Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

Summary

Total Revenue

% Growth

Adjusted EBITDA (Unburdened by SBC)

(-) Stock-Based Compensation

Adjusted EBITDA (Burdened by SBC)

% Margin

(-) D&A

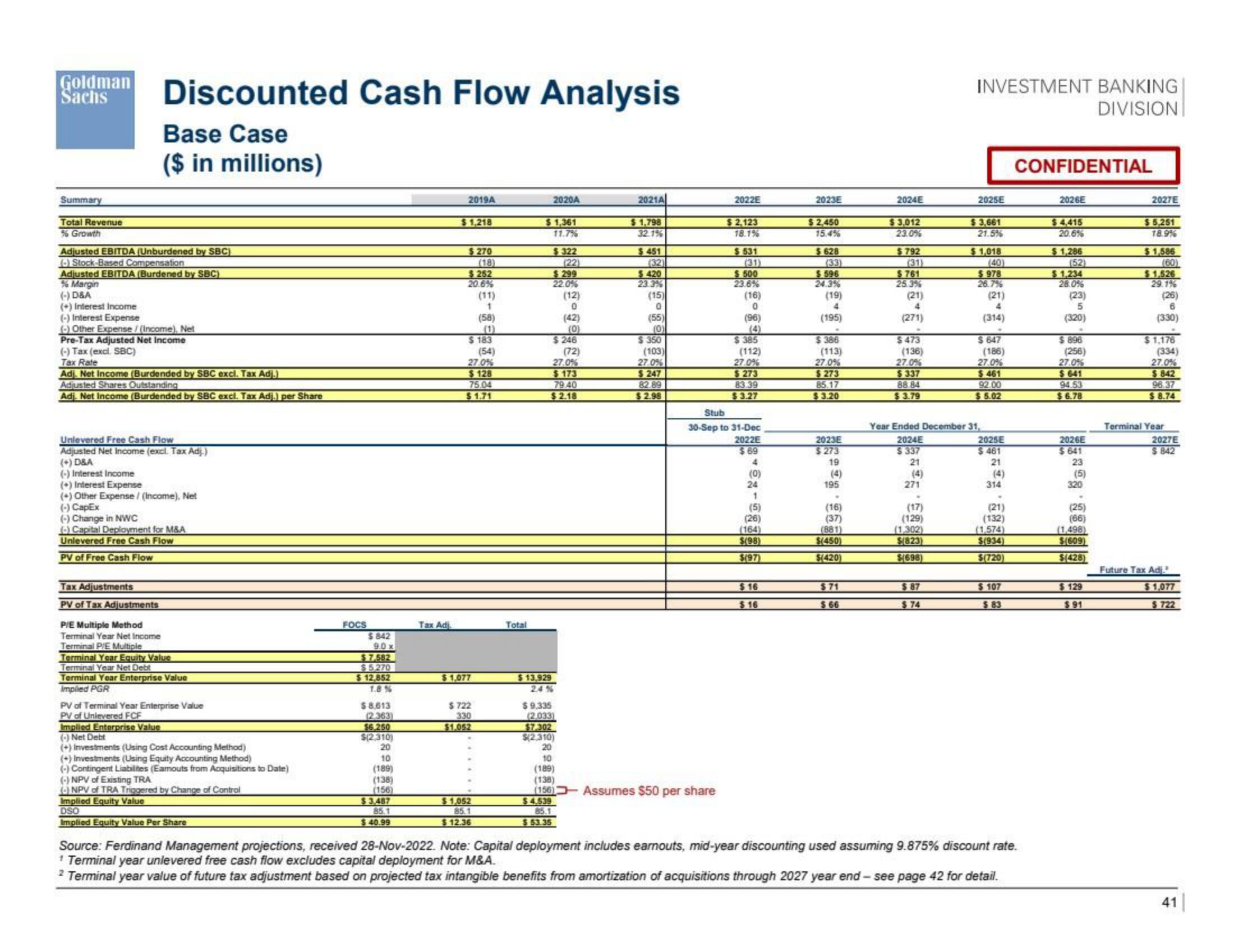

Discounted Cash Flow Analysis

Base Case

($ in millions)

(+) Interest Income

(-) Interest Expense

(-) Other Expense / (Income), Net

Pre-Tax Adjusted Net Income

(-) Tax (excl. SBC)

Tax Rate

Adj. Net Income (Burdended by SBC excl. Tax Adj.)

Adjusted Shares Outstanding

Adj. Net Income (Burdended by SBC excl. Tax Adj.) per Share

Unlevered Free Cash Flow

Adjusted Net Income (excl. Tax Adj.)

(+) D&A

(-) Interest Income

(+) Interest Expense

(+) Other Expense / (Income). Net

(-) CapEx

(-) Change in NWC

(-) Capital Deployment for M&A

Unlevered Free Cash Flow

PV of Free Cash Flow

Tax Adjustments

PV of Tax Adjustments

P/E Multiple Method

Terminal Year Net Income

Terminal P/E Multiple

Terminal Year Equity Value

Terminal Year Net Debt

Terminal Year Enterprise Value

Implied PGR

PV of Terminal Year Enterprise Value

PV of Unlevered FCF

Implied Enterprise Value

(-) Net Debt

(+) Investments (Using Cost Accounting Method)

(+) Investments (Using Equity Accounting Method)

(-) Contingent Liabilites (Eamouts from Acquisitions to Date)

(-) NPV of Existing TRA

(NPV of TRA Triggered by Change of Control

Implied Equity Value

DSO

Implied Equity Value Per Share

FOCS

$842

9.0x

$7.582

$5,270

$12,852

1.8 %

$8,613

(2.363)

$6.250

$(2,310)

20

10

(189)

(138)

(156)

$3,487

85.1

$40.99

Tax Adi

2019A

$1,218

$ 270

(18)

$252

20.6%

$1,077

$ 183

(54)

27.0%

$128

75.04

$1.71

$722

330

$1.052

(11)

1

$1,052

85.1

$ 12.36

(58)

(1)

Total

2020A

$1,361

11.7%

$322

(22)

$299

22.0%

$13.929

2.4%

(12)

0

(42)

(0)

$246

$9,335

(2.033)

27.0%

$173

79.40

$2.18

(72)

2021A

$1,798

32.1%

$451

(32)

$420

23.3%

(15)

0

(55)

(0)

$350

(103)

27.0%

$247

82.89

$2.98

2022E

$7.302

$(2.310)

20

10

(189)

(138)

(156) Assumes $50 per share

$4.539

85.1

$63.35

$2,123

18.1%

$531

$500

23.6%

(16)

0

(96)

$385

(112)

27.0%

$273

83.39

$3.27

Stub

30-Sep to 31-Dec

2022E

$69

4

(0)

24

1

(5)

(26)

(164)

$(98)

$(97)

$16

$16

2023E

$2,450

15.4%

$628

(33)

$596

24.3%

(19)

4

(195)

$ 386

(113)

27.0%

$273

85.17

$3.20

2023E

$273

19

(4)

195

(16)

(37)

(881)

$(450)

$(420)

$71

$66

2024E

$3,012

23.0%

$792

$761

25.3%

(21)

4

(271)

$ 473

(136)

27.0%

$337

88.84

$3.79

(4)

271

(17)

(129)

(1,302)

$(823)

$(698)

INVESTMENT BANKING

DIVISION

Year Ended December 31,

2024E

$ 337

21

$87

$74

2025E

$3,661

21.5%

$1,018

(40)

$978

26.7%

(21)

4

(314)

$ 647

(186)

27.0%

$461

92.00

$5.02

2025E

$461

21

314

(21)

(132)

(1.574)

$(934)

$(720)

$ 107

$83

CONFIDENTIAL

Source: Ferdinand Management projections, received 28-Nov-2022. Note: Capital deployment includes earnouts, mid-year discounting used assuming 9.875% discount rate.

1 Terminal year unlevered free cash flow excludes capital deployment for M&A.

2 Terminal year value of future tax adjustment based on projected tax intangible benefits from amortization of acquisitions through 2027 year end-see page 42 for detail.

2026E

$4,415

20.6%

$1,286

(52)

$1,234

28.0%

(23)

5

(320)

$ 896

(256)

27.0%

$641

94.53

$6.78

2026E

$641

23

(5)

320

.

(25)

(66)

(1,498)

$(609)

$(428)

$129

$91

2027E

$5,251

18.9%

$1,586

(60)

$1,526

29.1%

(26)

6

(330)

$1,176

(334)

27.0%

$842

96.37

$8.74

Terminal Year

2027E

$842

Future Tax Adj.

$1,077

$722

41View entire presentation