Trian Partners Activist Presentation Deck

Long Track Record of Value Creation in the Consumer Sector

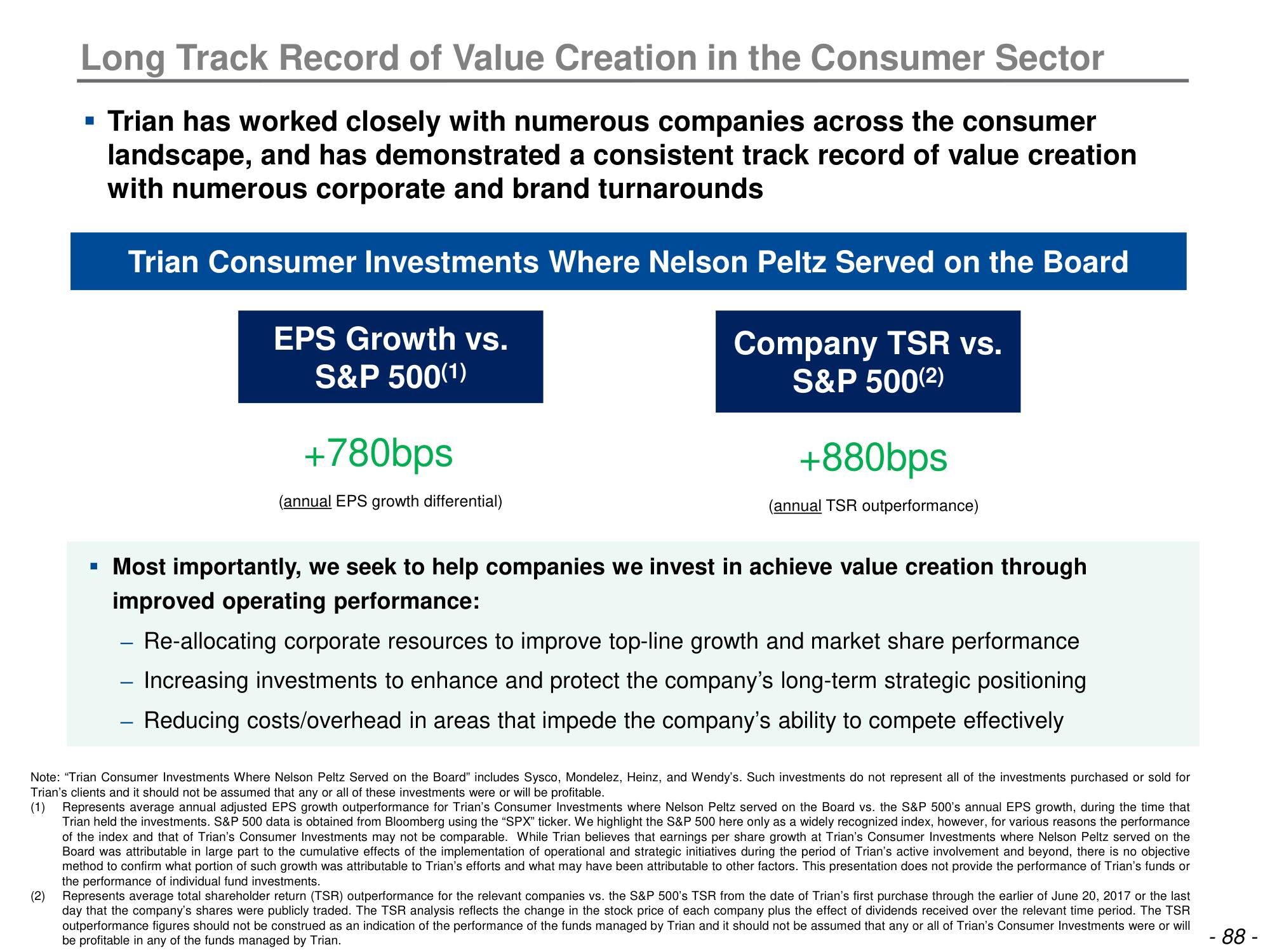

▪ Trian has worked closely with numerous companies across the consumer

landscape, and has demonstrated a consistent track record of value creation

with numerous corporate and brand turnarounds

(2)

Trian Consumer Investments Where Nelson Peltz Served on the Board

-

EPS Growth vs.

S&P 500(1)

-

+780bps

(annual EPS growth differential)

Company TSR vs.

S&P 500(2)

+880bps

▪ Most importantly, we seek to help companies we invest in achieve value creation through

improved operating performance:

(annual TSR outperformance)

Re-allocating corporate resources to improve top-line growth and market share performance

Increasing investments to enhance and protect the company's long-term strategic positioning

Reducing costs/overhead in areas that impede the company's ability to compete effectively

Note: "Trian Consumer Investments Where Nelson Peltz Served on the Board" includes Sysco, Mondelez, Heinz, and Wendy's. Such investments do not represent all of the investments purchased or sold for

Trian's clients and it should not be assumed that any or all of these investments were or will be profitable.

(1) Represents average annual adjusted EPS growth outperformance for Trian's Consumer Investments where Nelson Peltz served on the Board vs. the S&P 500's annual EPS growth, during the time that

Trian held the investments. S&P 500 data is obtained from Bloomberg using the "SPX" ticker. We highlight the S&P 500 here only as a widely recognized index, however, for various reasons the performance

of the index and that of Trian's Consumer Investments may not be comparable. While Trian believes that earnings per share growth at Trian's Consumer Investments where Nelson Peltz served on the

Board was attributable in large part to the cumulative effects of the implementation of operational and strategic initiatives during the period of Trian's active involvement and beyond, there is no objective

method to confirm what portion of such growth was attributable to Trian's efforts and what may have been attributable to other factors. This presentation does not provide the performance of Trian's funds or

the performance of individual fund investments.

Represents average total shareholder return (TSR) outperformance for the relevant companies vs. the S&P 500's TSR from the date of Trian's first purchase through the earlier of June 20, 2017 or the last

day that the company's shares were publicly traded. The TSR analysis reflects the change in the stock price of each company plus the effect of dividends received over the relevant time period. The TSR

outperformance figures should not be construed as an indication of the performance of the funds managed by Trian and it should not be assumed that any or all of Trian's Consumer Investments were or will

be profitable in any of the funds managed by Trian.

- 88 -View entire presentation