Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

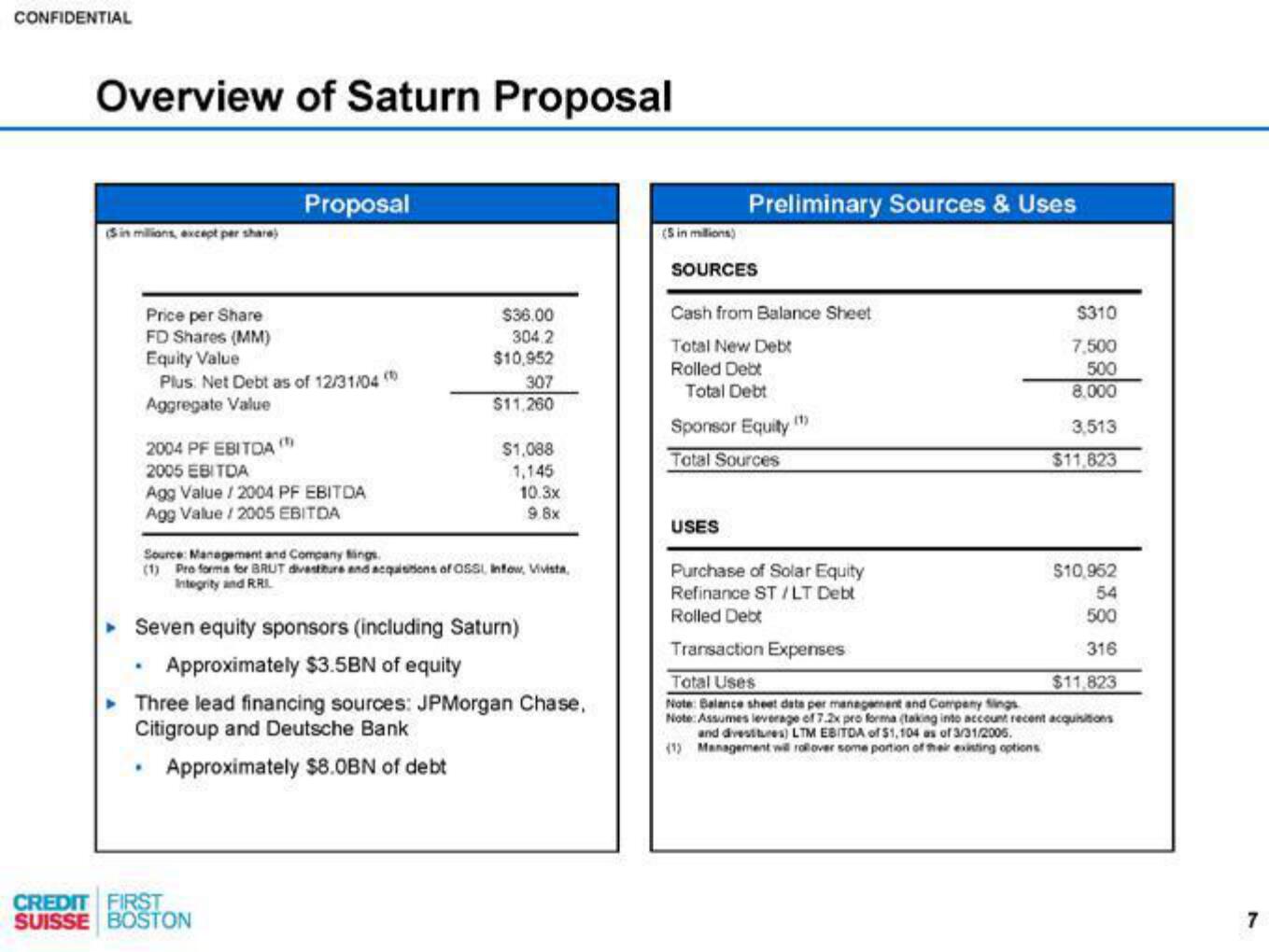

Overview of Saturn Proposal

(Sin millions, except per share)

Price per Share

FD Shares (MM)

Equity Value

Plus Net Debt as of 12/31/04 (

Aggregate Value

Proposal

2004 PF EBITDA

2005 EBITDA

Agg Value / 2004 PF EBITDA

Agg Value / 2005 EBITDA

.

.

$36.00

304.2

$10,952

307

$11,260

Source: Management and Company fings.

(1) Pro forma for BRUT divestiture and acquisitions of OSSI, Infow, Vivista,

Integrity and RRI

$1,088

1,145

▸ Seven equity sponsors (including Saturn)

Approximately $3.5BN of equity

CREDIT FIRST

SUISSE BOSTON

10.3x

9.8x

Three lead financing sources: JPMorgan Chase,

Citigroup and Deutsche Bank

Approximately $8.0BN of debt

(Sin millions)

Preliminary Sources & Uses

SOURCES

Cash from Balance Sheet

Total New Debt

Rolled Debt

Total Debt

Sponsor Equity (¹)

Total Sources

USES

$310

7,500

500

8.000

3,513

$11,823

Purchase of Solar Equity

Refinance ST/LT Debt

Rolled Debt

Transaction Expenses

Total Uses

Note: Balance sheet data per management and Company Sings

Note: Assumes leverage of 7.2x pro forma (taking into account recent acquisitions

and divestitures) LTM EBITDA of $1,104 as of 3/31/2006.

(1) Management will rollover some portion of their existing options

$10,952

54

500

316

$11,823

7View entire presentation