EVBox SPAC Presentation Deck

Sources & Uses / Pro-Forma Valuation

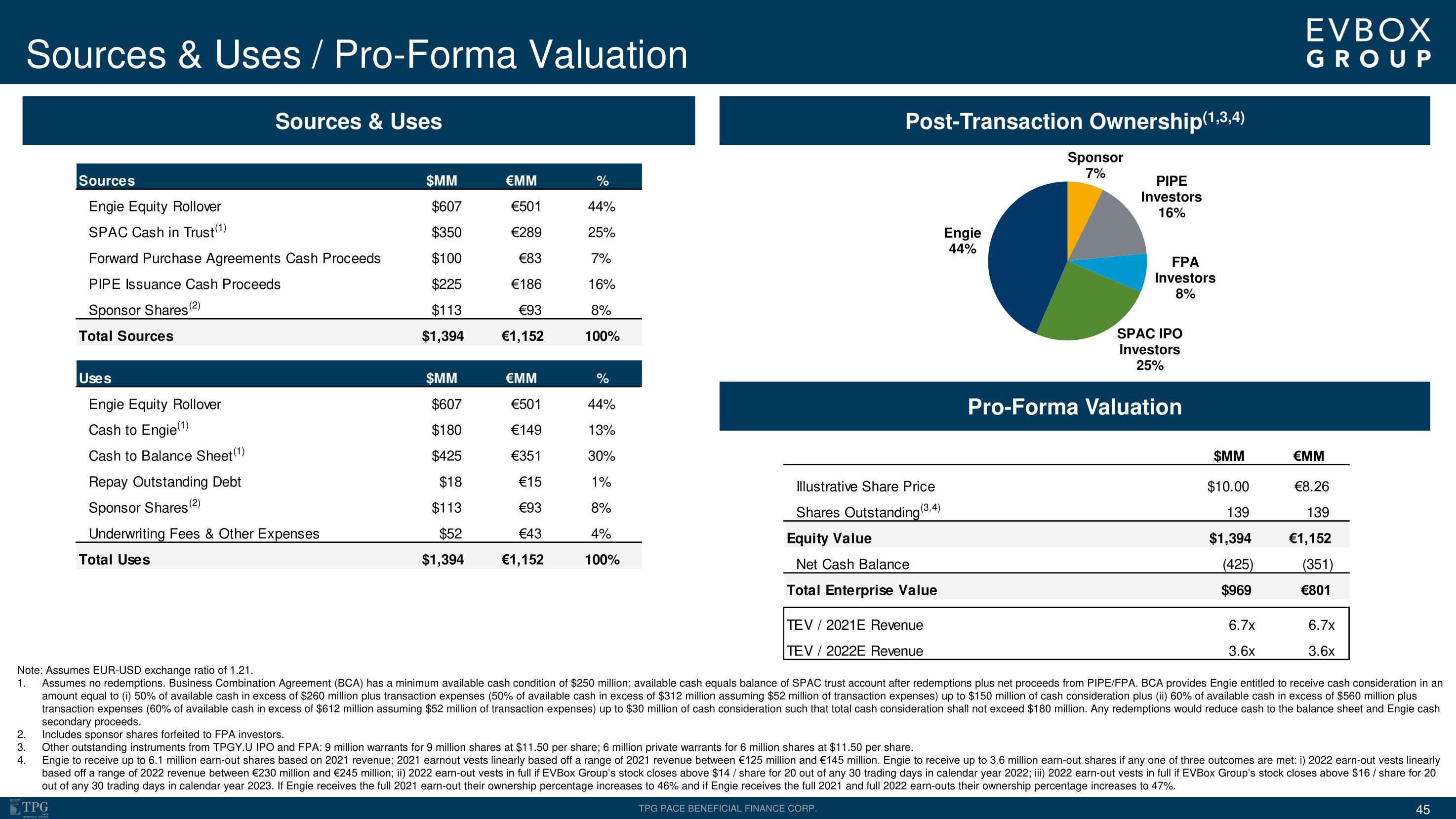

2.

3.

4.

Sources

Engie Equity Rollover

SPAC Cash in Trust(¹)

Forward Purchase Agreements Cash Proceeds

PIPE Issuance Cash Proceeds

Sponsor Shares (²)

Total Sources

Uses

Engie Equity Rollover

Cash to Engie (¹)

Cash to Balance Sheet(¹)

Sources & Uses

Repay Outstanding Debt

Sponsor Shares (2)

Underwriting Fees & Other Expenses

Total Uses

$MM

$607

$350

$100

$225

$113

$1,394

$MM

$607

$180

$425

$18

$113

$52

$1,394

€MM

€501

€289

€83

€186

€93

€1,152

€MM

€501

€149

€351

€15

€93

€43

€1,152

%

44%

25%

7%

16%

8%

100%

%

44%

13%

30%

1%

8%

4%

100%

Post-Transaction Ownership(1,3,4)

PIPE

Investors

16%

Illustrative Share Price

Shares Outstanding(³,4)

Equity Value

Net Cash Balance

Total Enterprise Value

TEV / 2021E Revenue

TEV / 2022E Revenue

Engie

44%

Sponsor

7%

FPA

Investors

8%

SPAC IPO

Investors

25%

Pro-Forma Valuation

$MM

$10.00

139

$1,394

(425)

$969

6.7x

3.6x

EVBOX

GROUP

€MM

€8.26

139

€1,152

(351)

€801

6.7x

3.6x

Note: Assumes EUR-USD exchange ratio of 1.21.

1. Assumes no redemptions. Business Combination Agreement (BCA) has a minimum available cash condition of $250 million; available cash equals balance of SPAC trust account after redemptions plus net proceeds from PIPE/FPA. BCA provides Engie entitled to receive cash consideration in an

amount equal to (i) 50% of available cash in excess of $260 million plus transaction expenses (50% of available cash in excess of $312 million assuming $52 million of transaction expenses) up to $150 million of cash consideration plus (ii) 60% of available cash in excess of $560 million plus

transaction expenses (60% of available cash in excess of $612 million assuming $52 million of transaction expenses) up to $30 million of cash consideration such that total cash consideration shall not exceed $180 million. Any redemptions would reduce cash to the balance sheet and Engie cash

secondary proceeds.

Includes sponsor shares forfeited to FPA investors.

Other outstanding instruments from TPGY.U IPO and FPA: 9 million warrants for 9 million shares at $11.50 per share; 6 million private warrants for 6 million shares at $11.50 per share.

Engie to receive up to 6.1 million earn-out shares based on 2021 revenue; 2021 earnout vests linearly based off a range of 2021 revenue between €125 million and €145 million. Engie to receive up to 3.6 million earn-out shares if any one of three outcomes are met: i) 2022 earn-out vests linearly

based off a range of 2022 revenue between €230 million and €245 million; ii) 2022 earn-out vests in full if EVBox Group's stock closes above $14/ share for 20 out of any 30 trading days in calendar year 2022; iii) 2022 earn-out vests in full if EVBox Group's stock closes above $16/ share for 20

out of any 30 trading days in calendar year 2023. If Engie receives the full 2021 earn-out their ownership percentage increases to 46% and if Engie receives the full 2021 and full 2022 earn-outs their ownership percentage increases to 47%.

TPG

TPG PACE BENEFICIAL FINANCE CORP.

BENEFICIAL FACE

45View entire presentation