Momentus SPAC Presentation Deck

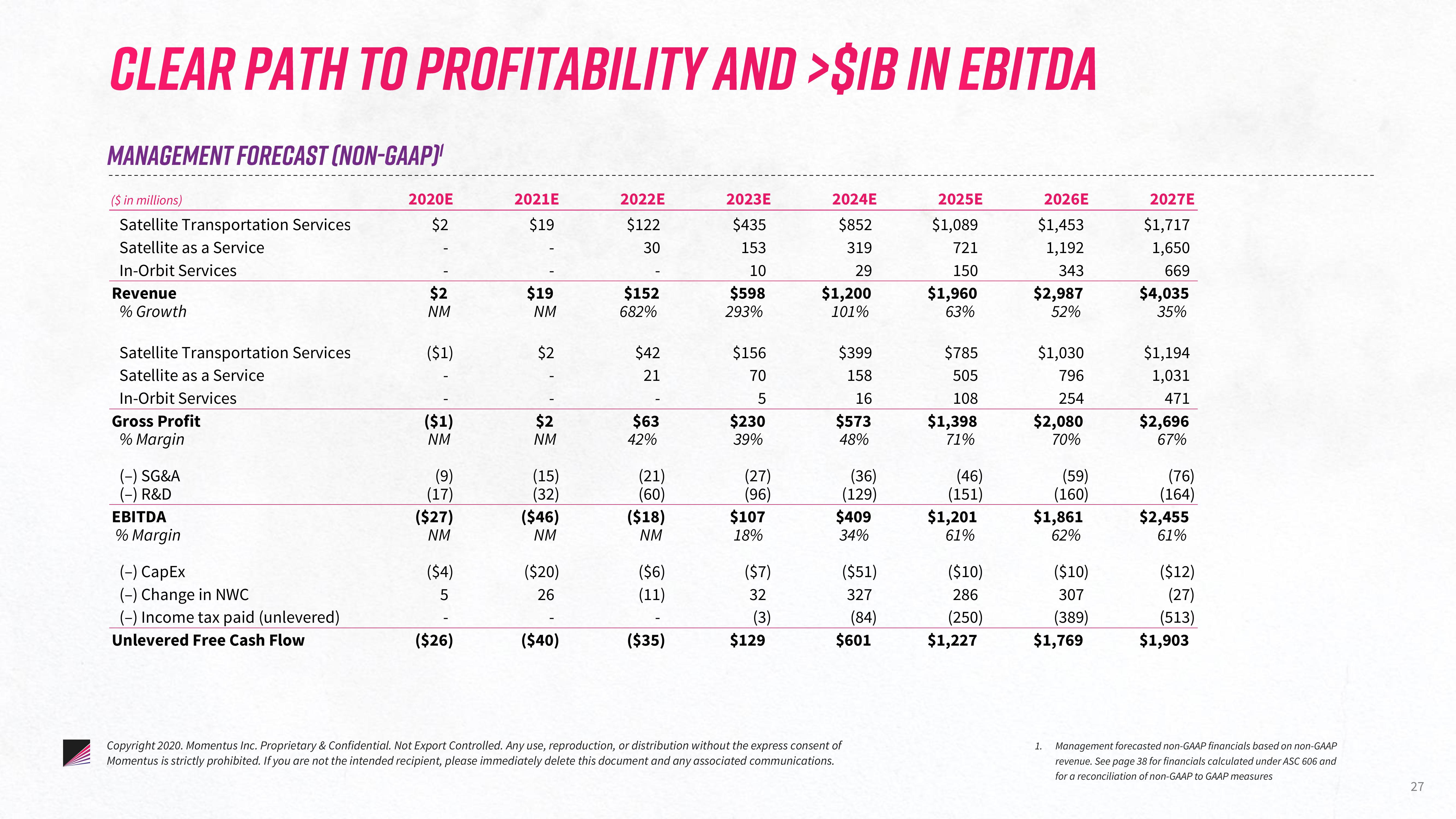

CLEAR PATH TO PROFITABILITY AND >$IB IN EBITDA

MANAGEMENT FORECAST (NON-GAAP)

($ in millions)

Satellite Transportation Services

Satellite as a Service

In-Orbit Services

Revenue

% Growth

Satellite Transportation Services

Satellite as a Service

In-Orbit Services

Gross Profit

% Margin

(-) SG&A

(-) R&D

EBITDA

% Margin

(-) CapEx

(-) Change in NWC

(-) Income tax paid (unlevered)

Unlevered Free Cash Flow

2020E

$2

$2

NM

($1)

($1)

NM

(9)

(17)

($27)

NM

($4)

5

($26)

2021E

$19

$19

NM

$2

$2

NM

(15)

(32)

($46)

NM

($20)

26

($40)

2022E

$122

30

$152

682%

$42

21

$63

42%

(21)

(60)

($18)

NM

($6)

(11)

($35)

2023E

$435

153

10

$598

293%

$156

70

5

$230

39%

(27)

(96)

$107

18%

($7)

32

(3)

$129

2024E

$852

319

29

$1,200

101%

$399

158

16

$573

48%

(36)

(129)

$409

34%

($51)

327

(84)

$601

Copyright 2020. Momentus Inc. Proprietary & Confidential. Not Export Controlled. Any use, reproduction, or distribution without the express consent of

Momentus is strictly prohibited. If you are not the intended recipient, please immediately delete this document and any associated communications.

2025E

$1,089

721

150

$1,960

63%

$785

505

108

$1,398

71%

(46)

(151)

$1,201

61%

($10)

286

(250)

$1,227

2026E

$1,453

1,192

343

$2,987

52%

$1,030

796

254

$2,080

70%

(59)

(160)

$1,861

62%

($10)

307

(389)

$1,769

2027E

$1,717

1,650

669

$4,035

35%

$1,194

1,031

471

$2,696

67%

(76)

(164)

$2,455

61%

($12)

(27)

(513)

$1,903

1. Management forecasted non-GAAP financials based on non-GAAP

revenue. See page 38 for financials calculated under ASC 606 and

for a reconciliation of non-GAAP to GAAP measures

27View entire presentation