Melrose Results Presentation Deck

Summary of results

Melrose

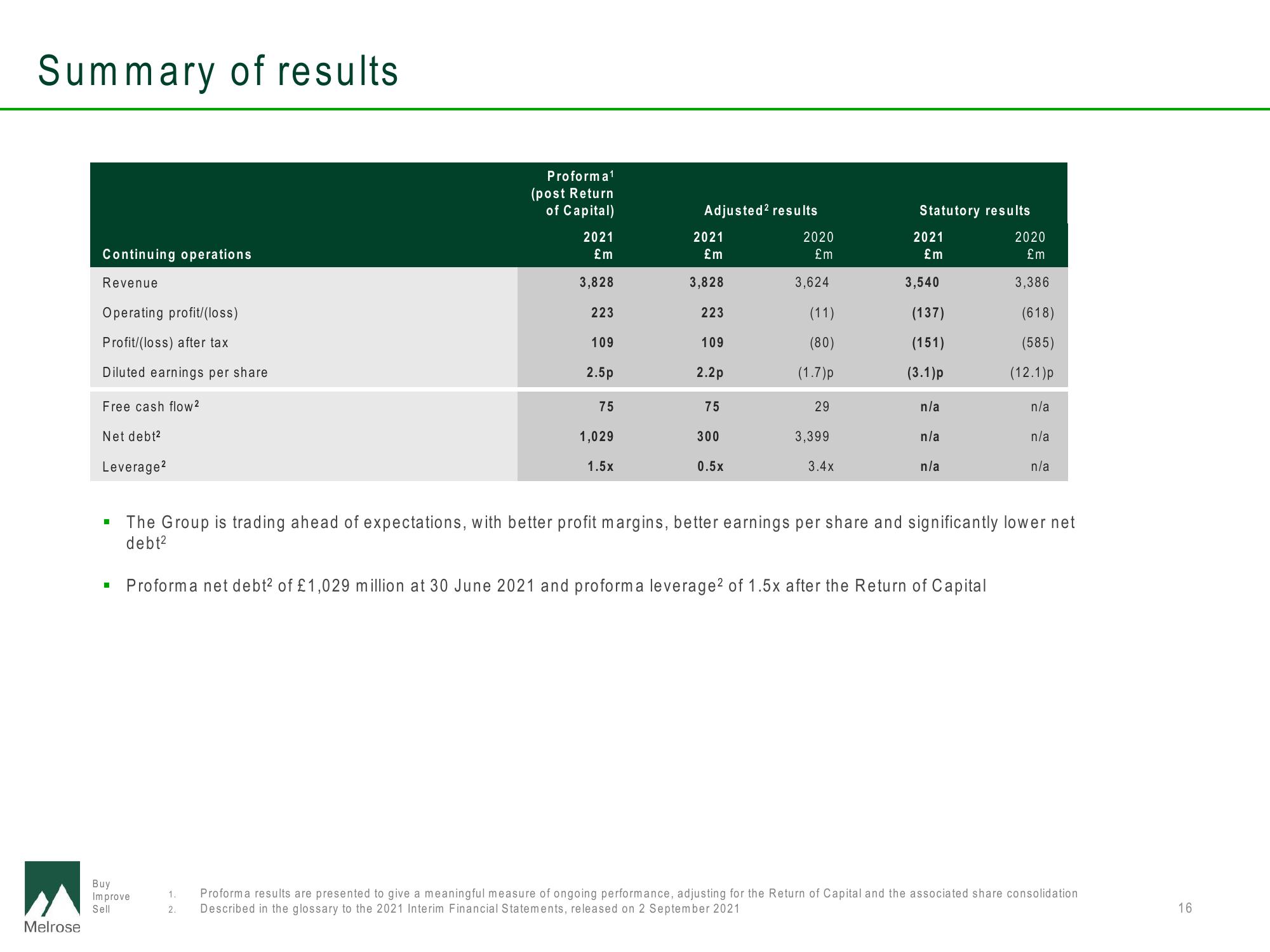

Continuing operations

Revenue

Operating profit/(loss)

Profit/(loss) after tax

Diluted earnings per share

Free cash flow²

Net debt²

Leverage ²

■

I

Proforma¹

(post Return

of Capital)

Buy

Improve

Sell

2021

£m

3,828

223

109

2.5p

75

1,029

1.5x

Adjusted ² results

2021

£m

3,828

223

109

2.2p

75

300

0.5x

2020

£m

3,624

(11)

(80)

(1.7)p

29

3,399

3.4x

Statutory results

2021

£m

3,540

(137)

(151)

(3.1) p

n/a

n/a

n/a

2020

£m

3,386

(618)

(585)

(12.1)p

n/a

n/a

n/a

The Group is trading ahead of expectations, with better profit margins, better earnings per share and significantly lower net

debt²

Proforma net debt² of £1,029 million at 30 June 2021 and proforma leverage2 of 1.5x after the Return of Capital

1.

Proforma results are presented to give a meaningful measure of ongoing performance, adjusting for the Return of Capital and the associated share consolidation

2. Described in the glossary to the 2021 Interim Financial Statements, released on 2 September 2021

16View entire presentation