TPG Results Presentation Deck

Other Operating Metrics

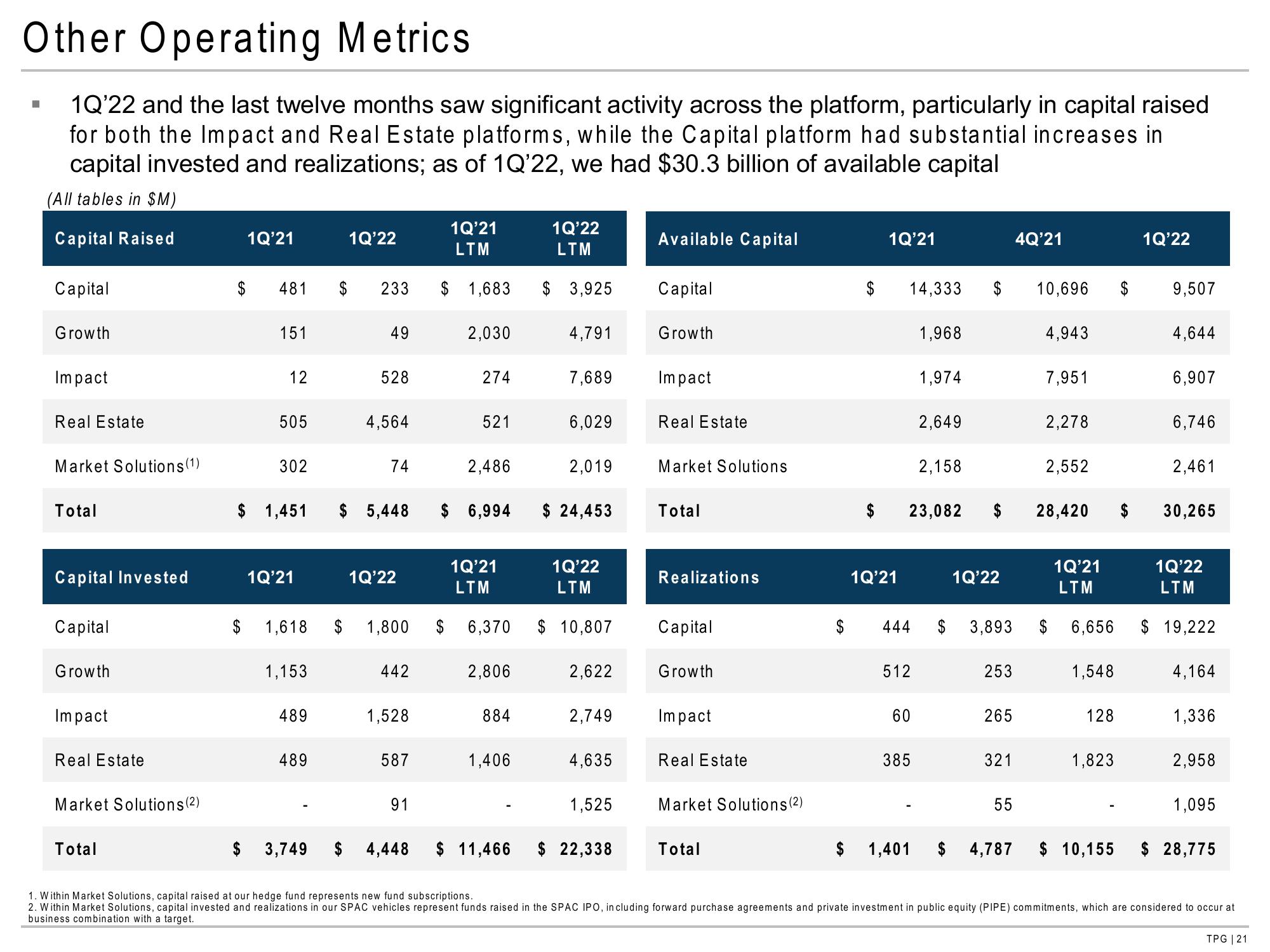

1Q'22 and the last twelve months saw significant activity across the platform, particularly in capital raised

for both the Impact and Real Estate platforms, while the Capital platform had substantial increases in

capital invested and realizations; as of 1Q'22, we had $30.3 billion of available capital

(All tables in $M)

Capital Raised

■

Capital

Growth

Impact

Real Estate

Market Solutions (1)

Total

Capital Invested

Capital

Growth

Impact

Real Estate

Market Solutions (2)

Total

$

1Q'21

481

151

12

505

302

1Q'21

1,618

1,153

489

489

1Q'22

$ 1,451 $ 5,448

$ 3,749

233

49

528

4,564

74

1Q'22

442

1,528

587

91

1Q'21

LTM

$ 1,683

$ 4,448

2,030

274

521

2,486

1Q'21

LTM

1Q'22

LTM

$ 1,800 $ 6,370 $ 10,807

2,806

1Q'22

LTM

$ 3,925

4,791

31

884

7,689

1,406

29

$ 6,994 $ 24,453

6,029

2,019

22

2,622

2,749

4,635

1,525

Available Capital

$ 11,466 $ 22,338

8

Capital

Gro

Growth

Impact

Re

Real Estate

Market Solutions

Total

Realizations

Capital

Gr

35 Rea

Growth

Impact

Real Estate

Market Solutions (2)

To

Total

$

1Q'21

14,333

1Q'21

444

$ 23,082

512

60

385

1,968

1,974

1,401

2,649

2,158

1Q'22

253

265

321

55

4Q'21

$ 4,787

10,696 $

4,943

$ 3,893 $

7,951

2,278

2,552

28,420

1Q'21

LTM

6,656

1,548

128

1,823

$ 10,155

1Q'22

9,507

4,644

6,907

6,746

2,461

30,265

1Q'22

LTM

$ 19,222

4,164

1,336

2,958

1,095

$ 28,775

1. Within Market Solutions, capital raised at our hedge fund represents new fund subscriptions.

2. Within Market Solutions, capital invested and realizations in our SPAC vehicles represent funds raised in the SPAC IPO, including forward purchase agreements and private investment in public equity (PIPE) commitments, which are considered to occur at

business combination with a target.

TPG | 21View entire presentation