Topps SPAC Presentation Deck

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(0)

7

Transaction Summary

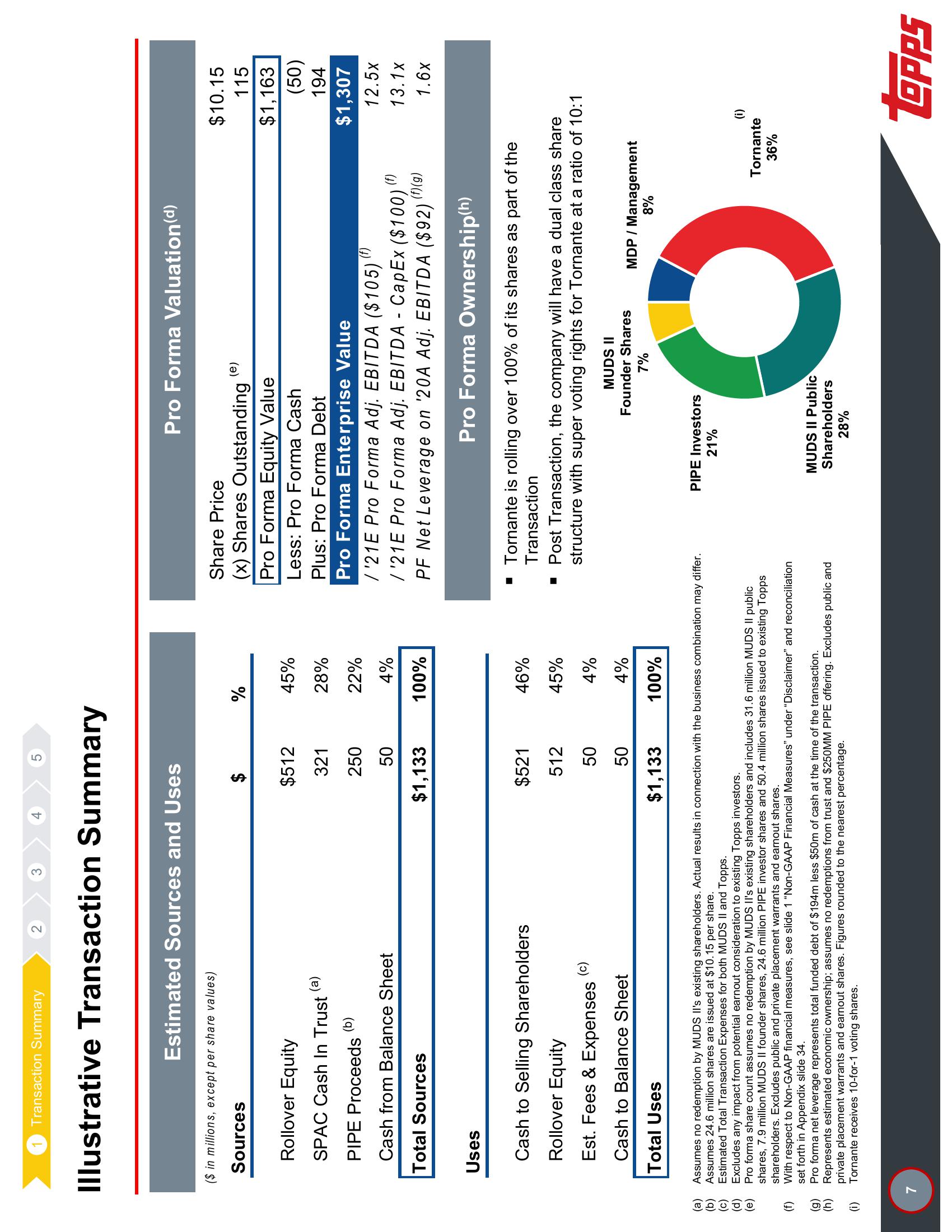

Illustrative Transaction Summary

($ in millions, except per share values)

Sources

Rollover Equity

SPAC Cash In Trust

(b)

Uses

Estimated Sources and Uses

2

(a)

PIPE Proceeds

Cash from Balance Sheet

Total Sources

4

Cash to Selling Shareholders

Rollover Equity

Est. Fees & Expenses

Cash to Balance Sheet

Total Uses

5

$512

321

250

50

$1,133

$521

512

50

50

$1,133

%

45%

28%

22%

4%

100%

46%

45%

4%

4%

100%

Share Price

(x) Shares Outstanding

Pro Forma Equity Value

Less: Pro Forma Cash

Plus: Pro Forma Debt

Pro Forma Enterprise Value

(f)

/ '21E Pro Forma Adj. EBITDA ($105)

/'21E Pro Forma Adj. EBITDA - CapEx ($100)

PF Net Leverage on '20A Adj. EBITDA ($92) (f)(9)

Pro Forma Ownership(h)

Pro Forma Valuation(d)

■ Tornante is rolling over 100% of its shares as part of the

Transaction

Assumes no redemption by MUDS II's existing shareholders. Actual results in connection with the business combination may differ.

Assumes 24.6 million shares are issued at $10.15 per share.

Estimated Total Transaction Expenses for both MUDS II and Topps.

Excludes any impact from potential earnout consideration to existing Topps investors.

Pro forma share count assumes no redemption by MUDS II's existing shareholders and includes 31.6 million MUDS II public

shares, 7.9 million MUDS II founder shares, 24.6 million PIPE investor shares and 50.4 million shares issued to existing Topps

shareholders. Excludes public and private placement warrants and earnout shares.

With respect to Non-GAAP financial measures, see slide 1 "Non-GAAP Financial Measures" under "Disclaimer" and reconciliation

set forth in Appendix slide 34.

Pro forma net leverage represents total funded debt of $194m less $50m of cash at the time of the transaction.

Represents estimated economic ownership; assumes no redemptions from trust and $250MM PIPE offering. Excludes public and

private placement warrants and earnout shares. Figures rounded to the nearest percentage.

Tornante receives 10-for-1 voting shares.

(e)

▪ Post Transaction, the company will have a dual class share

structure with super voting rights for Tornante at a ratio of 10:1

MUDS II

Founder Shares

7%

PIPE Investors

21%

MUDS II Public

Shareholders

28%

$10.15

115

$1,163

(50)

194

$1,307

MDP / Management

8%

(i)

12.5x

13.1x

1.6x

Tornante

36%

LOPPSView entire presentation