Paysafe Results Presentation Deck

Leverage summary

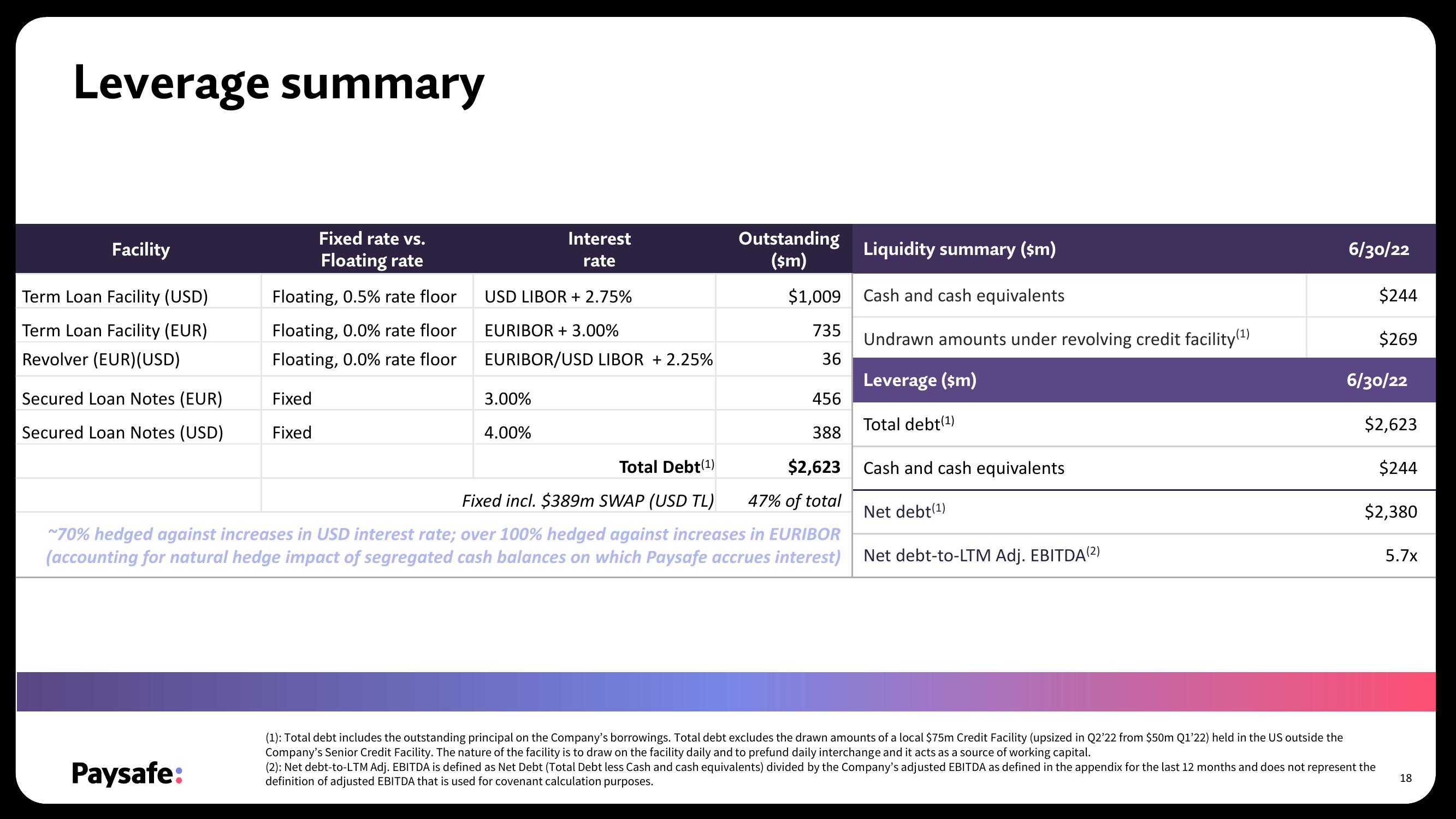

Facility

Term Loan Facility (USD)

Term Loan Facility (EUR)

Revolver (EUR) (USD)

Secured Loan Notes (EUR)

Secured Loan Notes (USD)

Paysafe:

Fixed rate vs.

Floating rate

Floating, 0.5% rate floor

Floating, 0.0% rate floor

Floating, 0.0% rate floor

Fixed

Fixed

Interest

rate

USD LIBOR + 2.75%

EURIBOR + 3.00%

EURIBOR/USD LIBOR +2.25%

3.00%

4.00%

Outstanding

($m)

$1,009

735

36

456

Total Debt(1)

Fixed incl. $389m SWAP (USD TL)

388

$2,623

47% of total

~70% hedged against increases in USD interest rate; over 100% hedged against increases in EURIBOR

(accounting for natural hedge impact of segregated cash balances on which Paysafe accrues interest)

Liquidity summary ($m)

Cash and cash equivalents

Undrawn amounts under revolving credit facility (¹)

Leverage ($m)

Total debt(¹)

Cash and cash equivalents

Net debt(¹)

Net debt-to-LTM Adj. EBITDA(2)

6/30/22

$244

$269

6/30/22

$2,623

$244

$2,380

(1): Total debt includes the outstanding principal on the Company's borrowings. Total debt excludes the drawn amounts of a local $75m Credit Facility (upsized in Q2'22 from $50m Q1'22) held in the US outside the

Company's Senior Credit Facility. The nature of the facility is to draw on the facility daily and to prefund daily interchange and it acts as a source of working capital.

(2): Net debt-to-LTM Adj. EBITDA is defined as Net Debt (Total Debt less Cash and cash equivalents) divided by the Company's adjusted EBITDA as defined in the appendix for the last 12 months and does not represent the

definition of adjusted EBITDA that is used for covenant calculation purposes.

5.7x

18View entire presentation