Eos Energy Investor Presentation Deck

Building Commercial Momentum

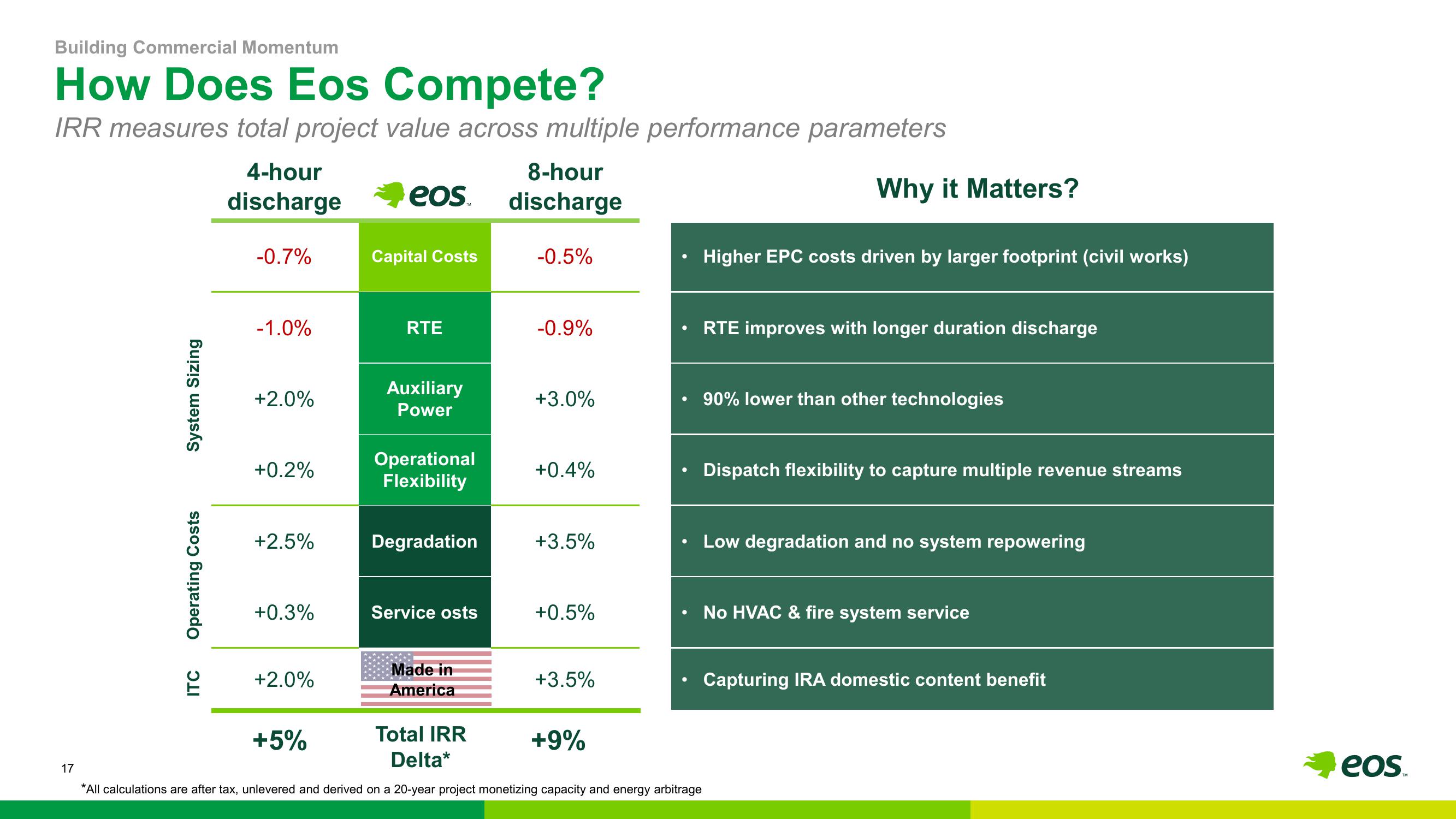

How Does Eos Compete?

IRR measures total project value across multiple performance parameters

17

System Sizing

Operating Costs

ITC

4-hour

discharge

-0.7%

-1.0%

+2.0%

+0.2%

+2.5%

+0.3%

+2.0%

eos.

+5%

Capital Costs

RTE

Auxiliary

Power

Operational

Flexibility

Degradation

Service osts

Made in

America

8-hour

discharge

-0.5%

-0.9%

+3.0%

+0.4%

+3.5%

+0.5%

+3.5%

●

+9%

●

●

Total IRR

Delta*

*All calculations are after tax, unlevered and derived on a 20-year project monetizing capacity and energy arbitrage

●

Why it Matters?

Higher EPC costs driven by larger footprint (civil works)

RTE improves with longer duration discharge

90% lower than other technologies

Dispatch flexibility to capture multiple revenue streams

Low degradation and no system repowering

No HVAC & fire system service

Capturing IRA domestic content benefit

eos.View entire presentation