Spirit Mergers and Acquisitions Presentation Deck

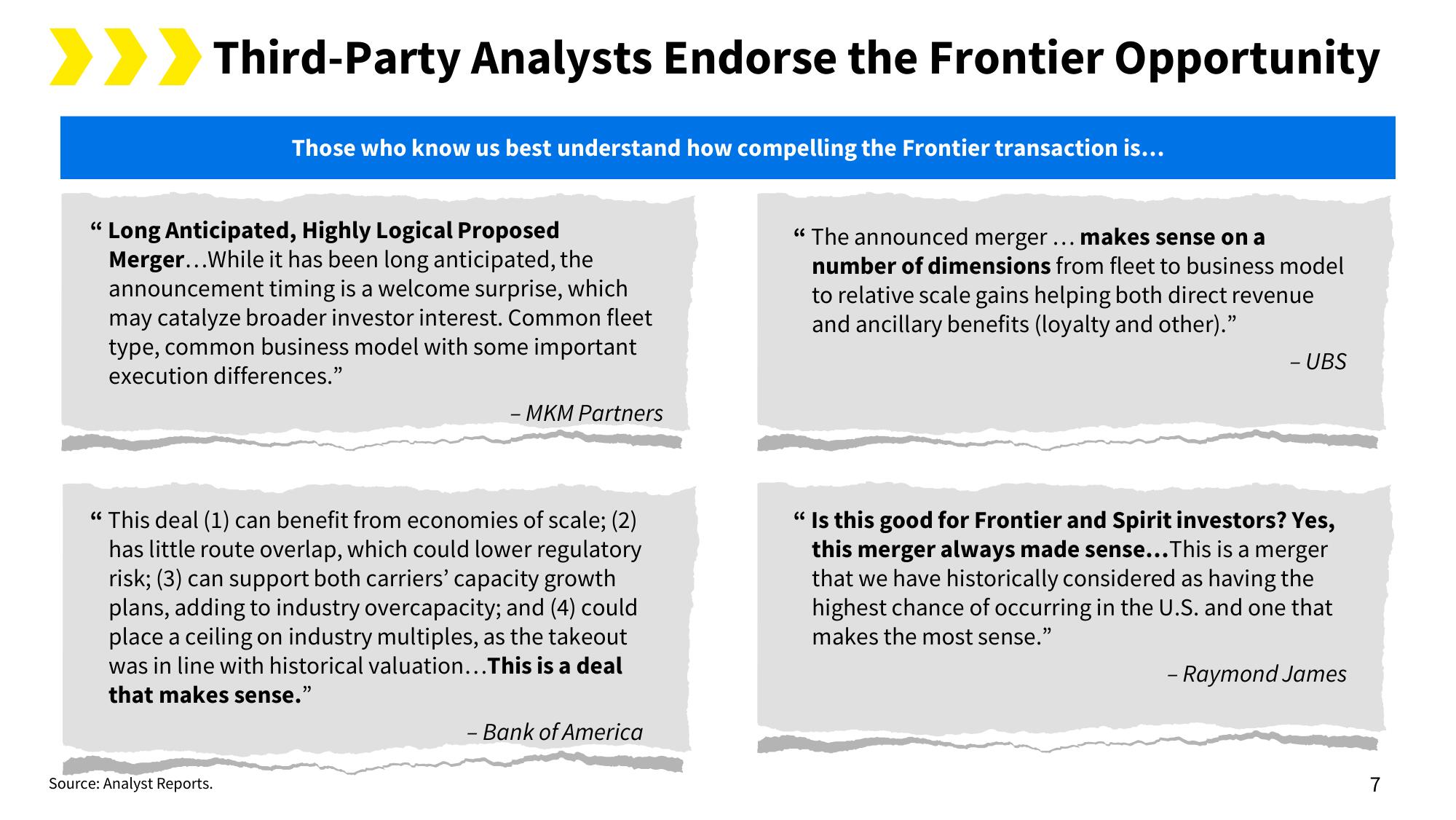

>>> Third-Party Analysts Endorse the Frontier Opportunity

66

Those who know us best understand how compelling the Frontier transaction is...

Long Anticipated, Highly Logical Proposed

Merger... While it has been long anticipated, the

announcement timing is a welcome surprise, which

may catalyze broader investor interest. Common fleet

type, common business model with some important

execution differences."

Source: Analyst Reports.

- MKM Partners

“ This deal (1) can benefit from economies of scale; (2)

has little route overlap, which could lower regulatory

risk; (3) can support both carriers' capacity growth

plans, adding to industry overcapacity; and (4) could

place a ceiling on industry multiples, as the takeout

was in line with historical valuation... This is a deal

that makes sense."

- Bank of America

"The announced merger ... makes sense on a

number of dimensions from fleet to business model

to relative scale gains helping both direct revenue

and ancillary benefits (loyalty and other)."

- UBS

"Is this good for Frontier and Spirit investors? Yes,

this merger always made sense... This is a merger

that we have historically considered as having the

highest chance of occurring in the U.S. and one that

makes the most sense."

- Raymond James

7View entire presentation