Trian Partners Activist Presentation Deck

Confidential-Not for Reproduction or Distribution

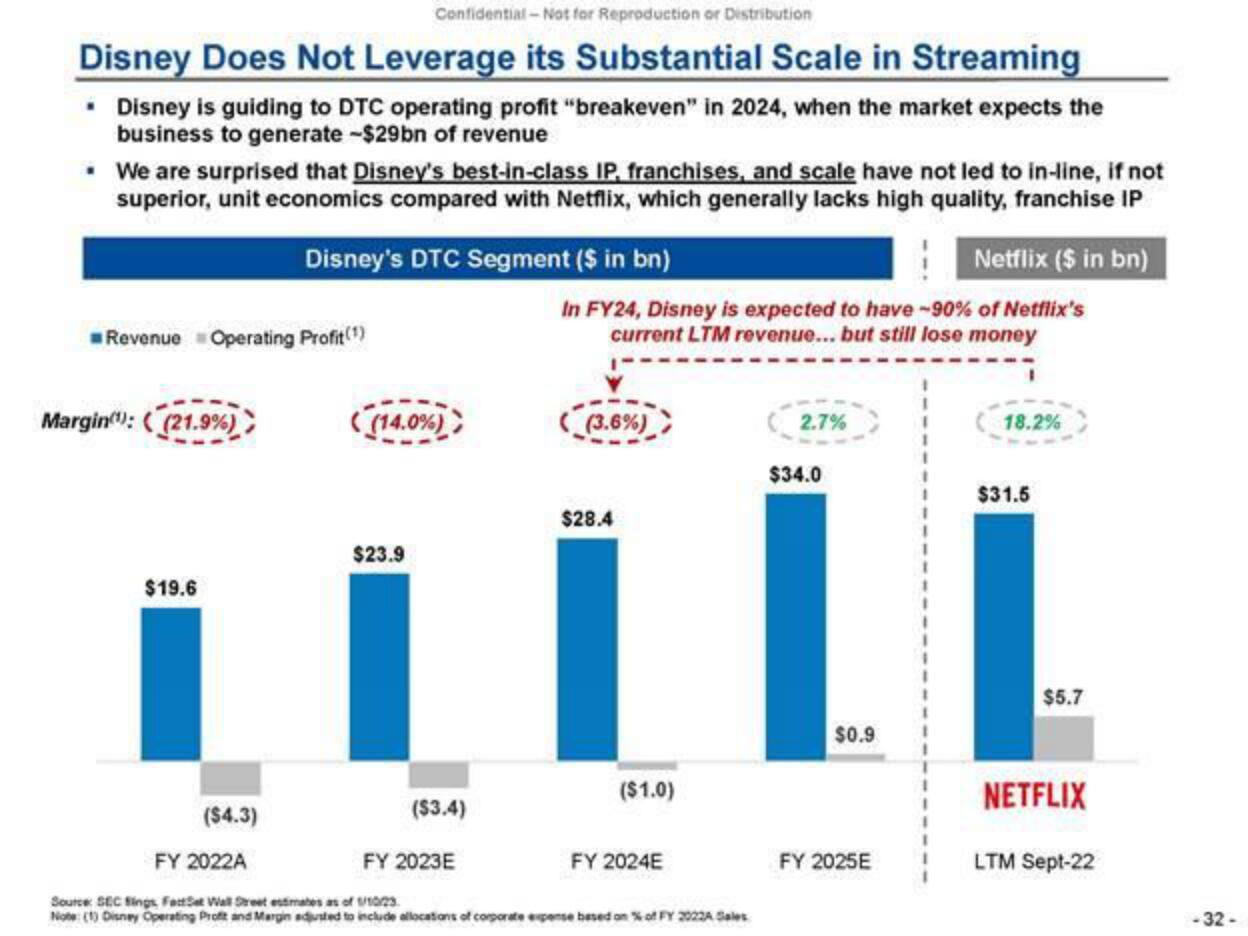

Disney Does Not Leverage its Substantial Scale in Streaming

• Disney is guiding to DTC operating profit "breakeven" in 2024, when the market expects the

business to generate -$29bn of revenue

• We are surprised that Disney's best-in-class IP, franchises, and scale have not led to in-line, if not

superior, unit economics compared with Netflix, which generally lacks high quality, franchise IP

Revenue Operating Profit (1)

Margin): ((21.9%)

$19.6

Disney's DTC Segment ($ in bn)

($4.3)

(14.0%)

$23.9

In FY24, Disney is expected to have ~90% of Netflix's

current LTM revenue... but still lose money

(3.6%)

$28.4

($1.0)

($3.4)

FY 2022A

FY 2023E

Source SEC Sings, FactSet Wall Street estimates as of 1/10/23

Note: (1) Disney Operating Profit and Margin adjusted to include allocations of corporate expense based on % of FY 2022A Sales

FY 2024E

2.7%

$34.0

$0.9

Netflix ($ in bn)

FY 2025E

18.2%

$31.5

$5.7

NETFLIX

LTM Sept-22

-32-View entire presentation