Hilltop Holdings Results Presentation Deck

Hilltop Holdings - Commercial Real Estate Portfolio

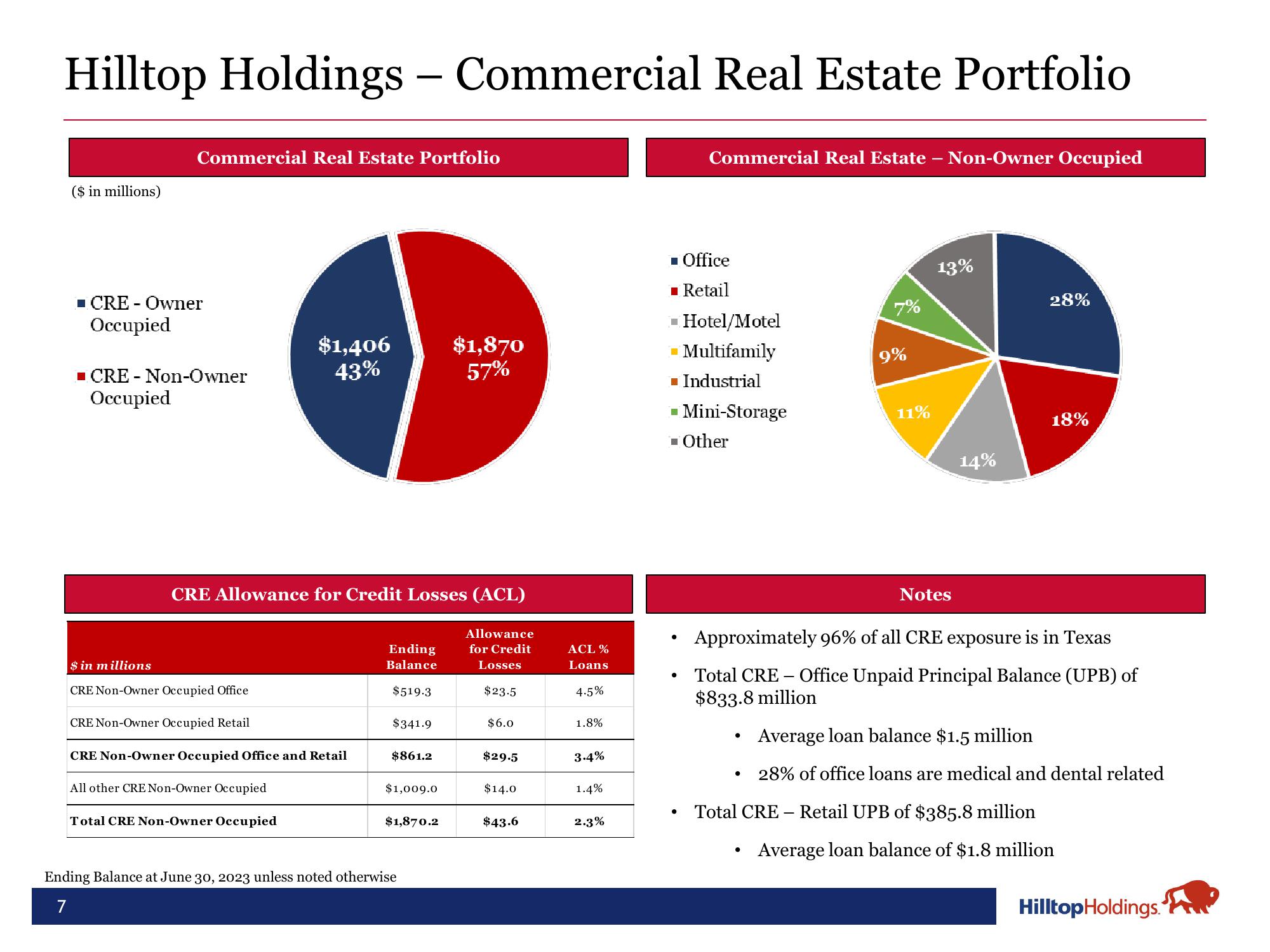

($ in millions)

Commercial Real Estate Portfolio

■CRE- Owner

Occupied

■CRE - Non-Owner

Occupied

$1,406

43%

CRE Allowance for Credit Losses (ACL)

Allowance

for Credit

Losses

$23.5

$ in millions

CRE Non-Owner Occupied Office

CRE Non-Owner Occupied Retail

CRE Non-Owner Occupied Office and Retail

All other CRE Non-Owner Occupied

Total CRE Non-Owner Occupied

Ending

Balance

$519.3

$341.9

$861.2

$1,009.0

$1,870.2

$1,870

57%

Ending Balance at June 30, 2023 unless noted otherwise

7

$6.0

$29.5

$14.0

$43.6

ACL %

Loans

4.5%

1.8%

3.4%

1.4%

2.3%

■ Office

■ Retail

■ Hotel/Motel

Multifamily

■ Industrial

Commercial Real Estate Non-Owner Occupied

■ Mini-Storage

■ Other

●

●

●

●

●

7%

9%

●

11%

13%

Notes

14%

Approximately 96% of all CRE exposure is in Texas

Total CRE - Office Unpaid Principal Balance (UPB) of

$833.8 million

28%

18%

Average loan balance $1.5 million

28% of office loans are medical and dental related

Total CRE- Retail UPB of $385.8 million

Average loan balance of $1.8 million

Hilltop Holdings.View entire presentation