Evercore Investment Banking Pitch Book

Why Evercore?

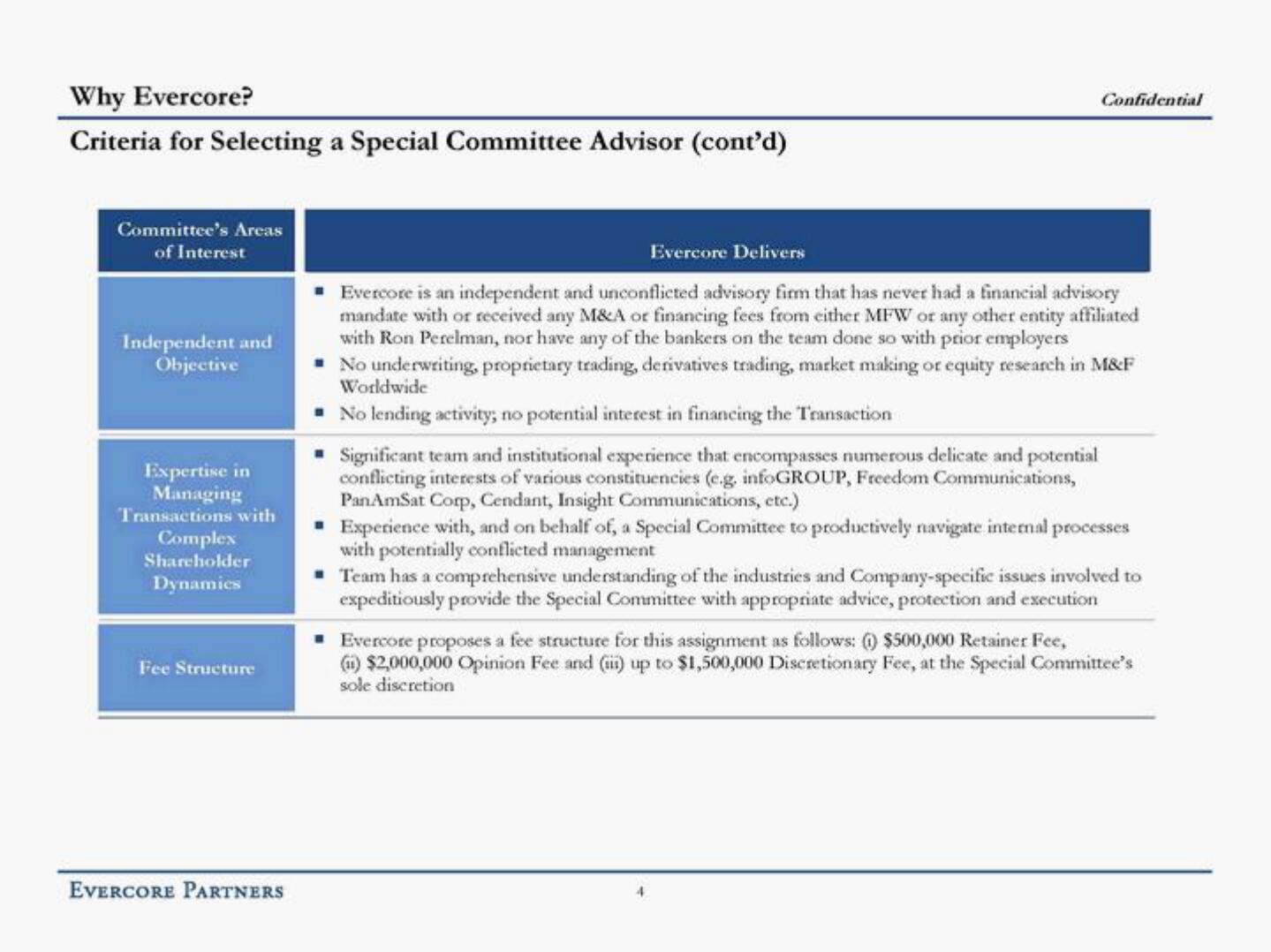

Criteria for Selecting a Special Committee Advisor (cont'd)

Committee's Areas

of Interest

Independent and

Objective

Expertise in

Managing

Transactions with

Complex

Shareholder

Dynamics

Fee Structure

EVERCORE PARTNERS

Confidential

Evercore Delivers

■ Evercore is an independent and unconflicted advisory firm that has never had a financial advisory

mandate with or received any M&A or financing fees from either MFW or any other entity affiliated

with Ron Perelman, nor have any of the bankers on the team done so with prior employers

No underwriting, proprietary trading, derivatives trading, market making or equity research in M&F

Worldwide

No lending activity; no potential interest in financing the Transaction

Significant team and institutional experience that encompasses numerous delicate and potential

conflicting interests of various constituencies (e.g. infoGROUP, Freedom Communications,

PanAmSat Corp, Cendant, Insight Communications, etc.)

■ Experience with, and on behalf of, a Special Committee to productively navigate internal processes

with potentially conflicted management

Team has a comprehensive understanding of the industries and Company-specific issues involved to

expeditiously provide the Special Committee with appropriate advice, protection and execution

Evercore proposes a fee structure for this assignment as follows: () $500,000 Retainer Fee,

(ii) $2,000,000 Opinion Fee and (iii) up to $1,500,000 Discretionary Fee, at the Special Committee's

sole discretionView entire presentation