Bausch+Lomb Results Presentation Deck

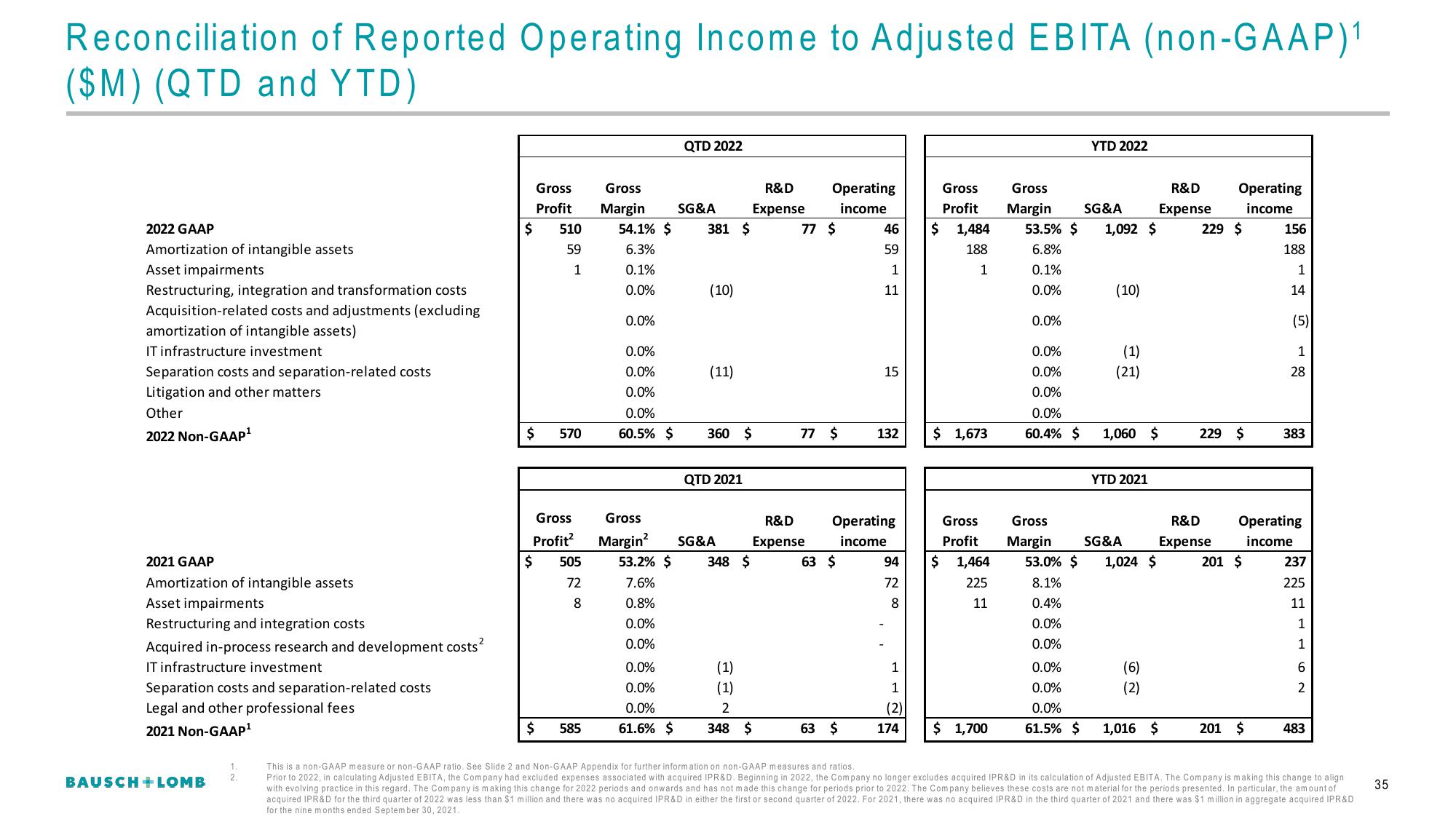

Reconciliation of Reported Operating Income to Adjusted EBITA (non-GAAP)1

($M) (QTD and YTD)

2022 GAAP

Amortization of intangible assets

Asset impairments

Restructuring, integration and transformation costs

Acquisition-related costs and adjustments (excluding

amortization of intangible assets)

IT infrastructure investment

Separation costs and separation-related costs

Litigation and other matters

Other

2022 Non-GAAP¹

2021 GAAP

Amortization of intangible assets

Asset impairments

Restructuring and integration costs

Acquired in-process research and development costs²

IT infrastructure investment

Separation costs and separation-related costs

Legal and other professional fees

2021 Non-GAAP¹

BAUSCH + LOMB

2.

$

Gross

Profit

510

59

1

$ 570

Gross

Profit²

$ 505

72

8

$ 585

Gross

Margin

54.1% $

6.3%

0.1%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

60.5% $

Gross

Margin²

53.2% $

7.6%

0.8%

0.0%

0.0%

0.0%

0.0%

0.0%

61.6% $

QTD 2022

SG&A

381 $

(10)

(11)

360 $

QTD 2021

SG&A

348 $

(1)

(1)

2

348 $

R&D

Expense

Operating

income

77 $

77 $

R&D

Expense

63 $

46

59

1

11

63 $

15

Operating

income

132

94

72

00

8

1

1

(2)

174

Gross

Profit

$ 1,484

188

1

$

1,673

Gross

Profit

1,464

225

11

$ 1,700

Gross

Margin SG&A

53.5% $ 1,092 $

6.8%

0.1%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

60.4% $

YTD 2022

0.0%

0.0%

0.0%

61.5% $

(10)

(1)

(21)

1,060 $

YTD 2021

(6)

(2)

Operating

R&D

Expense income

229 $

1,016 $

229 $

Gross

R&D Operating

Margin SG&A Expense income

53.0% $ 1,024 $ 201 $

8.1%

0.4%

0.0%

0.0%

156

188

1

14

201 $

(5)

1

28

383

237

225

11

1

1

6

2

483

This is a non-GAAP measure or non-GAAP ratio. See Slide 2 and Non-GAAP Appendix for further information on non-GAAP measures and ratios.

Prior to 2022, in calculating Adjusted EBITA, the Company had excluded expenses associated with acquired IPR&D. Beginning in 2022, the Company no longer excludes acquired IPR&D in its calculation of Adjusted EBITA. The Company is making this change to align.

with evolving practice in this regard. The Company is making this change for 2022 periods and onwards and has not made this change for periods prior to 2022. The Company believes these costs are not material for the periods presented. In particular, the amount of

acquired IPR&D for the third quarter of 2022 was less than $1 million and there was no acquired IPR&D in either the first or second quarter of 2022. For 2021, there was no acquired IPR&D in the third quarter of 2021 and there was $1 million in aggregate acquired IPR&D

for the nine months ended September 30, 2021.

35View entire presentation