Evercore Investment Banking Pitch Book

Why Evercore?

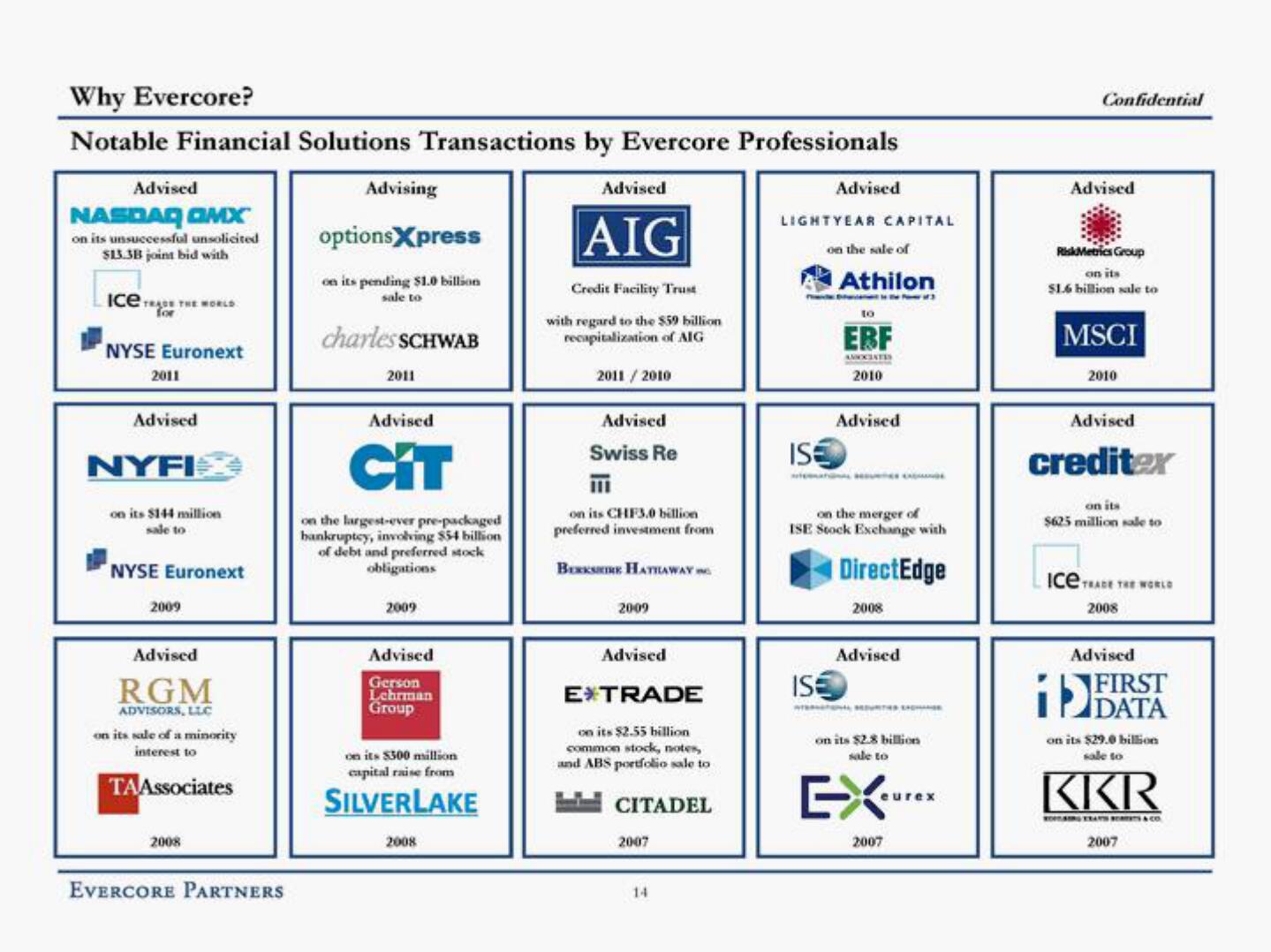

Notable Financial Solutions Transactions by Evercore Professionals

Advised

NASDAQ OMX

on its unsuccessful unsolicited

$13.3B joint bid with

Ice

TRAGE THE WORLD

for

NYSE Euronext

2011

Advised

NYFI

on its $144 million

sale to

NYSE Euronext

2009

Advised

RGM

ADVISORS, LLC

on its sale of a minority

interest to

TAAssociates

2008

EVERCORE PARTNERS

Advising

optionsXpress

on its pending $1.0 billion

sale to

charles SCHWAB

2011

Advised

CIT

on the largest-ever pre-packaged

bankruptcy, involving $54 billion

of debt and preferred stock

obligations

2009

Advised

Gerson

Lehrman

Group

on its $300 million

capi raise from

SILVERLAKE

2008

Advised

AIG

Credit Facility Trust

with regard to the $59 billion

recapitalization of AIG

2011/2010

Advised

Swiss Re

on its CHF3,0 billion

preferred investment from

BERKSHIRE HATHAWAY

2009

Advised

EXTRADE

on its $2.55 billion

common stock, notes,

and ABS portfolio sale to

CITADEL

2007

14

Advised

LIGHTYEAR CAPITAL

on the sale of

Athilon

ISE

10

ERF

AMOCIATES

2010

Advised

ISE

on the merger of

ISE Stock Exchange with

DirectEdge

2008

Advised

TURTLE

on its $2.8 billion

sale to

eurex

2007

Confidential

Advised

RiskMetrics Group

on its

$1.6 billion sale to

MSCI

2010

Advised

crediter

on its

$625 million sale to

Ice TRADE THE WORLD

2008

Advised

FIRST

on its $29.0 billion

sale to

KKR

ROPANG TRAS RATS & CO

2007View entire presentation