Greenlight Company Presentation

How Much Cash is There?

o We made some basic assumptions in

order to run through potential scenarios

of what Apple could do:

- Apple could repatriate and pay taxes

on current offshore cash of $94 billion

- We assume a $20 billion war chest

reserve to preserve flexibility

Greenlight Capital, Inc.

$ (billions)

Foreign Cash

Tax payment for repatriation

Net foreign cash

Total domestic cash

Reserves

Free domestic cash

Total Cash Available

94

(33)

61

43

(20)

23

84

19

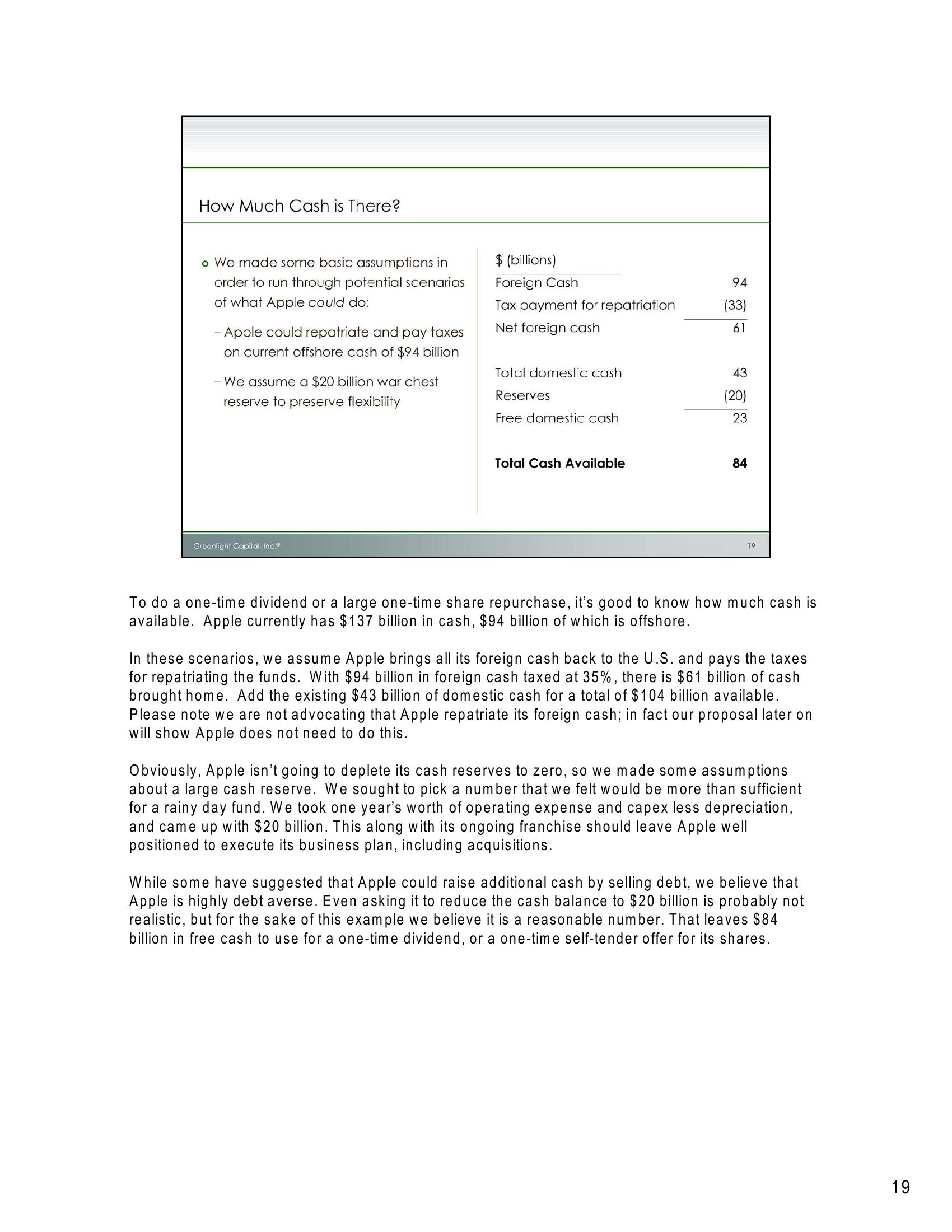

To do a one-time dividend or a large one-time share repurchase, it's good to know how much cash is

available. Apple currently has $137 billion in cash, $94 billion of which is offshore.

In these scenarios, we assume Apple brings all its foreign cash back to the U.S. and pays the taxes

for repatriating the funds. With $94 billion in foreign cash taxed at 35%, there is $61 billion of cash

brought home. Add the existing $43 billion of domestic cash for a total of $104 billion available.

Please note we are not advocating that Apple repatriate its foreign cash; in fact our proposal later on

will show Apple does not need to do this.

Obviously, Apple isn't going to deplete its cash reserves to zero, so we made some assumptions

about a large cash reserve. We sought to pick a number that we felt would be more than sufficient

for a rainy day fund. We took one year's worth of operating expense and capex less depreciation,

and came up with $20 billion. This along with its ongoing franchise should leave Apple well

positioned to execute its business plan, including acquisitions.

While some have suggested that Apple could raise additional cash by selling debt, we believe that

Apple is highly debt averse. Even asking it to reduce the cash balance to $20 billion is probably not

realistic, but for the sake of this example we believe it is a reasonable number. That leaves $84

billion in free cash to use for a one-time dividend, or a one-time self-tender offer for its shares.

19View entire presentation