Ocado Investor Day Presentation Deck

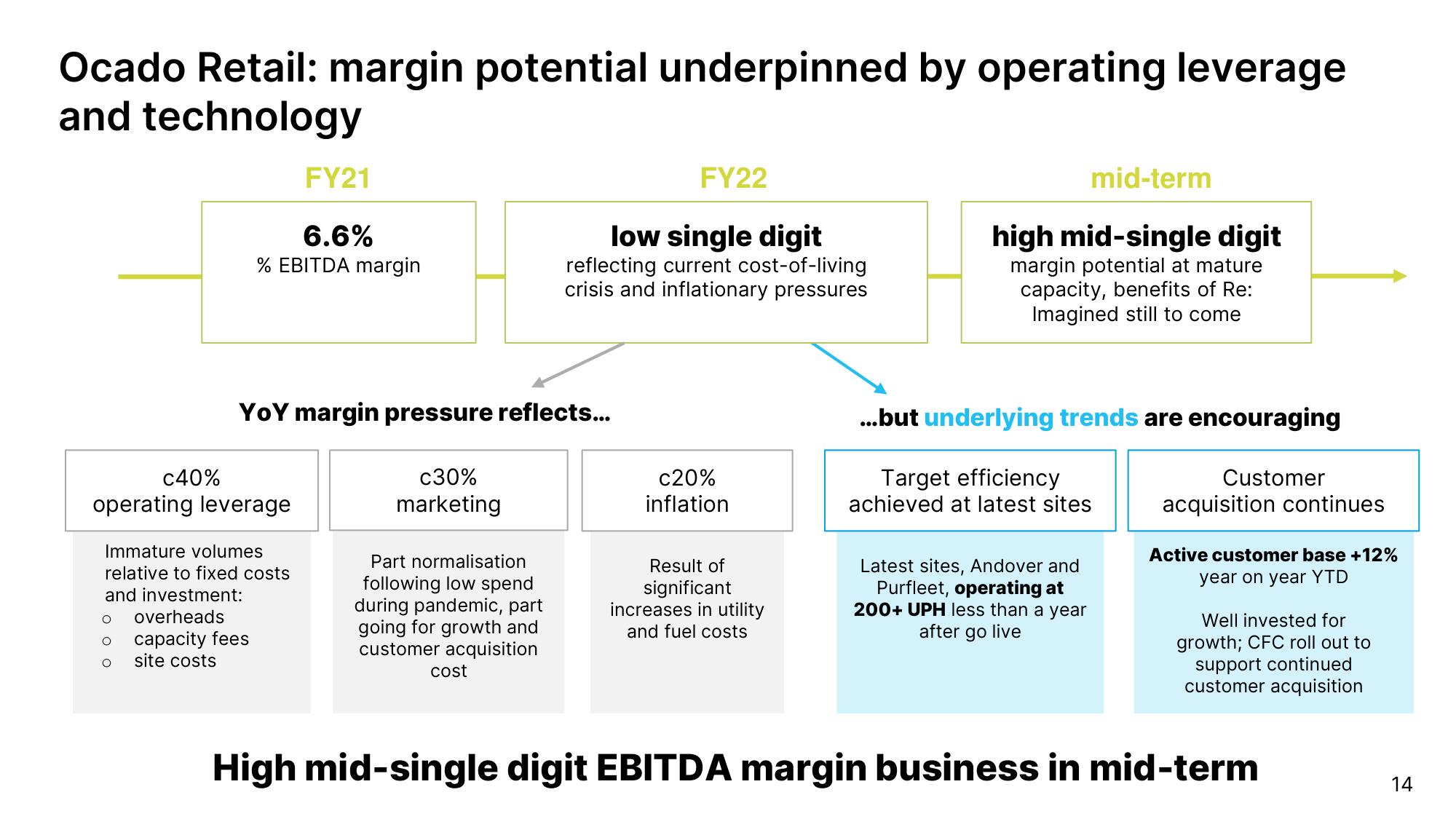

Ocado Retail: margin potential underpinned by operating leverage

and technology

O

c40%

O

operating leverage

Immature volumes

relative to fixed costs

and investment:

FY21

6.6%

% EBITDA margin

YoY margin pressure reflects...

c30%

marketing

overheads

capacity fees

site costs

Part normalisation

following low spend

during pandemic, part

going for growth and

customer acquisition

cost

FY22

low single digit

reflecting current cost-of-living

crisis and inflationary pressures

c20%

inflation

Result of

significant

increases in utility

and fuel costs

mid-term

high mid-single digit

margin potential at mature

capacity, benefits of Re:

Imagined still to come

...but underlying trends are encouraging

Target efficiency

achieved at latest sites

Latest sites, Andover and

Purfleet, operating at

200+ UPH less than a year

after go live

Customer

acquisition continues

Active customer base +12%

year on year YTD

Well invested for

growth; CFC roll out to

support continued

customer acquisition

High mid-single digit EBITDA margin business in mid-term

14View entire presentation