3Q20 Earnings Call Presentation

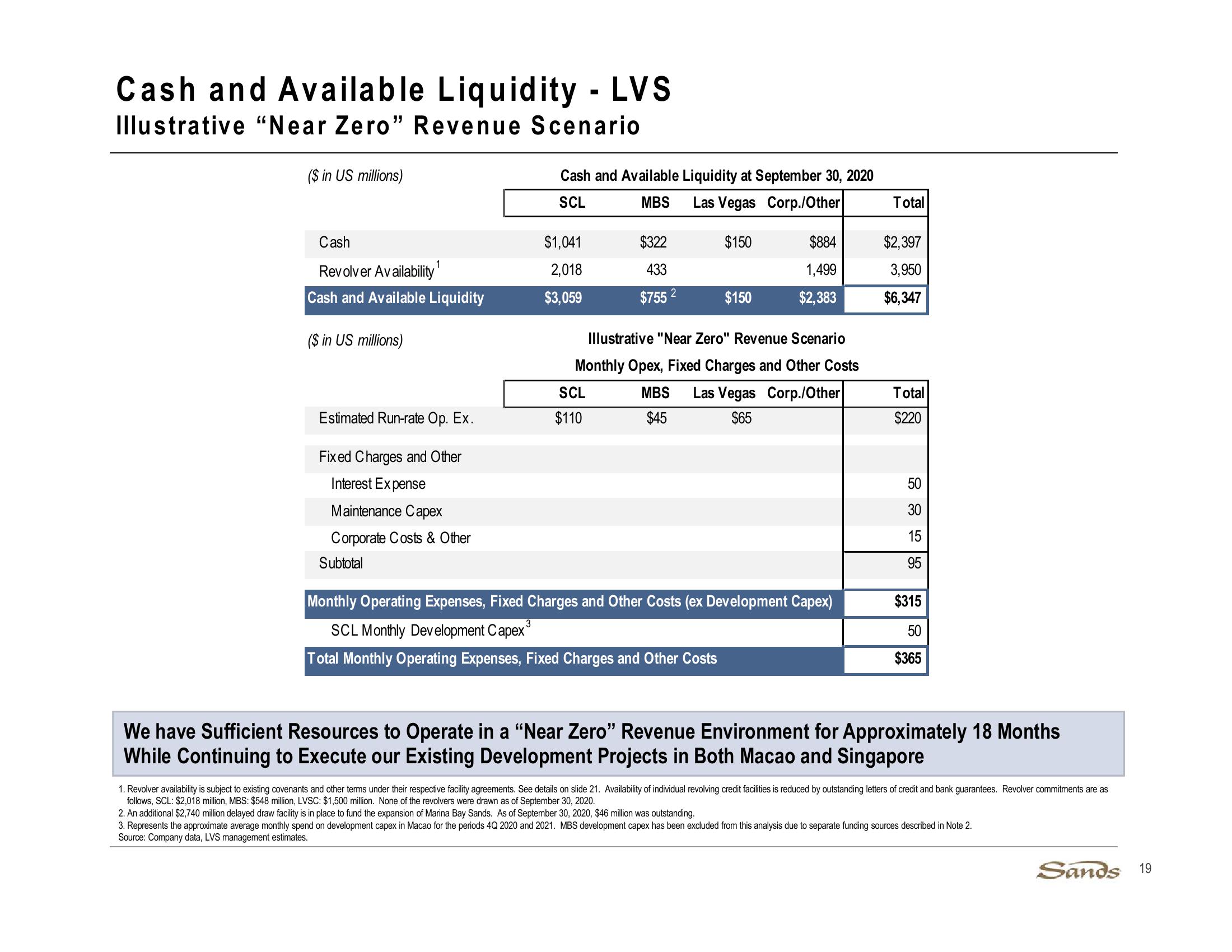

Cash and Available Liquidity - LVS

Illustrative "Near Zero" Revenue Scenario

($ in US millions)

Cash and Available Liquidity at September 30, 2020

SCL

MBS

Las Vegas Corp./Other|

Total

Cash

$1,041

$322

$150

$884

$2,397

Revolver Availability"

2,018

433

1,499

3,950

Cash and Available Liquidity

$3,059

$755

2

$150

$2,383

$6,347

($ in US millions)

Illustrative "Near Zero" Revenue Scenario

Monthly Opex, Fixed Charges and Other Costs

SCL

MBS

Estimated Run-rate Op. Ex.

$110

$45

Las Vegas Corp./Other

$65

Fixed Charges and Other

Interest Expense

Maintenance Capex

Corporate Costs & Other

Subtotal

Monthly Operating Expenses, Fixed Charges and Other Costs (ex Development Capex)

SCL Monthly Development Capex

3

Total Monthly Operating Expenses, Fixed Charges and Other Costs

Total

$220

530

15

56

95

$315

50

$365

We have Sufficient Resources to Operate in a "Near Zero" Revenue Environment for Approximately 18 Months

While Continuing to Execute our Existing Development Projects in Both Macao and Singapore

1. Revolver availability is subject to existing covenants and other terms under their respective facility agreements. See details on slide 21. Availability of individual revolving credit facilities is reduced by outstanding letters of credit and bank guarantees. Revolver commitments are as

follows, SCL: $2,018 million, MBS: $548 million, LVSC: $1,500 million. None of the revolvers were drawn as of September 30, 2020.

2. An additional $2,740 million delayed draw facility is in place to fund the expansion of Marina Bay Sands. As of September 30, 2020, $46 million was outstanding.

3. Represents the approximate average monthly spend on development capex in Macao for the periods 4Q 2020 and 2021. MBS development capex has been excluded from this analysis due to separate funding sources described in Note 2.

Source: Company data, LVS management estimates.

Sands 19View entire presentation