KKR Real Estate Finance Trust Investor Presentation Deck

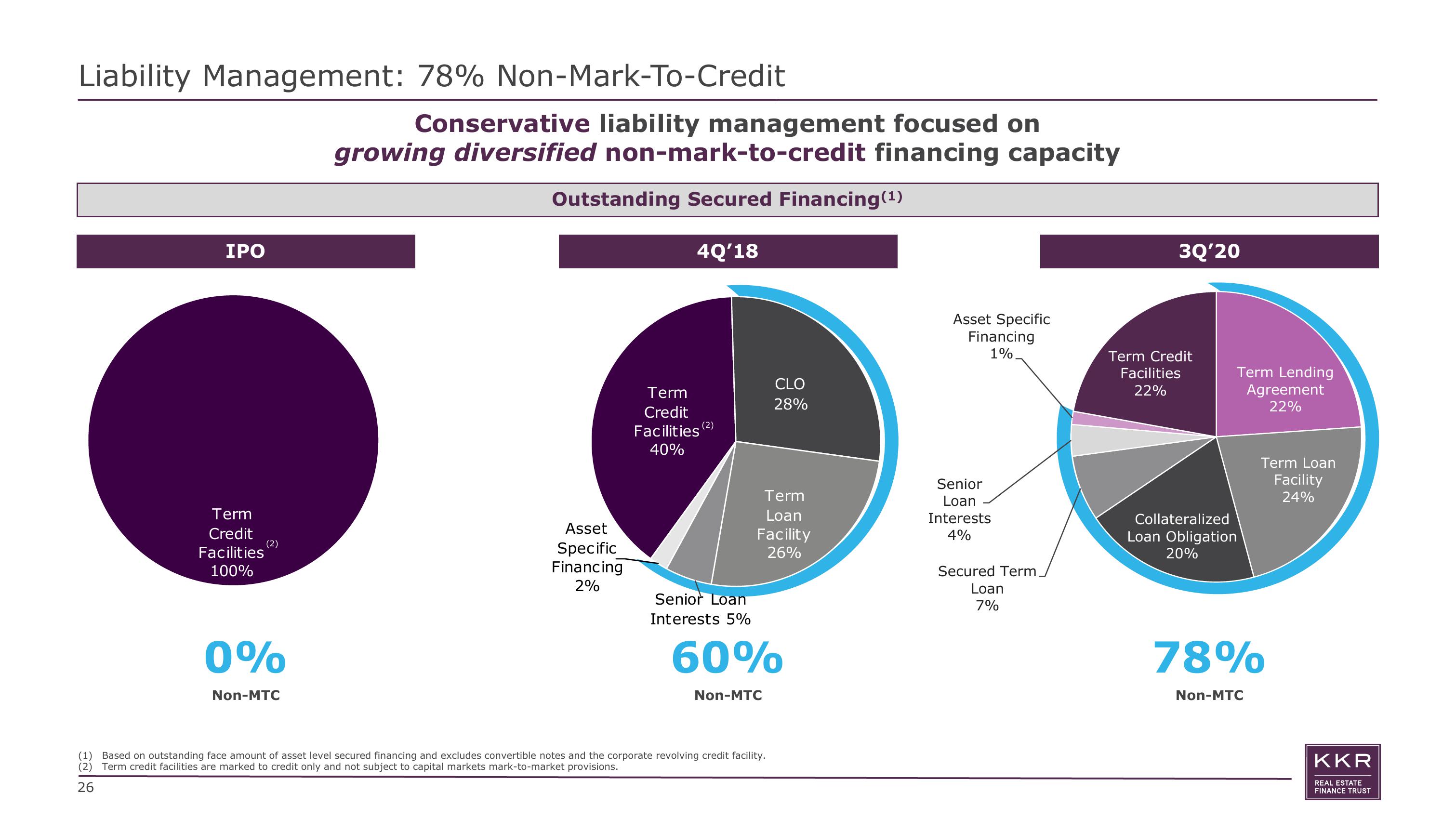

Liability Management: 78% Non-Mark-To-Credit

IPO

Term

Credit

Facilities

100%

(2)

0%

Non-MTC

Conservative liability management focused on

growing diversified non-mark-to-credit financing capacity

Outstanding Secured Financing(¹)

Asset

Specific

Financing

2%

4Q'18

Term

Credit

Facilities (2

(2)

40%

Senior Loan

Interests 5%

CLO

28%

Term

Loan

Facility

26%

60%

Non-MTC

(1) Based on outstanding face amount of asset level secured financing and excludes convertible notes and the corporate revolving credit facility.

(2) Term credit facilities are marked to credit only and not subject to capital markets mark-to-market provisions.

26

Asset Specific

Financing

1%.

Senior

Loan

Interests

4%

Secured Term.

Loan

7%

3Q'20

Term Credit

Facilities

22%

Collateralized

Loan Obligation

20%

Term Lending

Agreement

22%

78%

Non-MTC

Term Loan

Facility

24%

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation