Deutsche Bank Fixed Income Presentation Deck

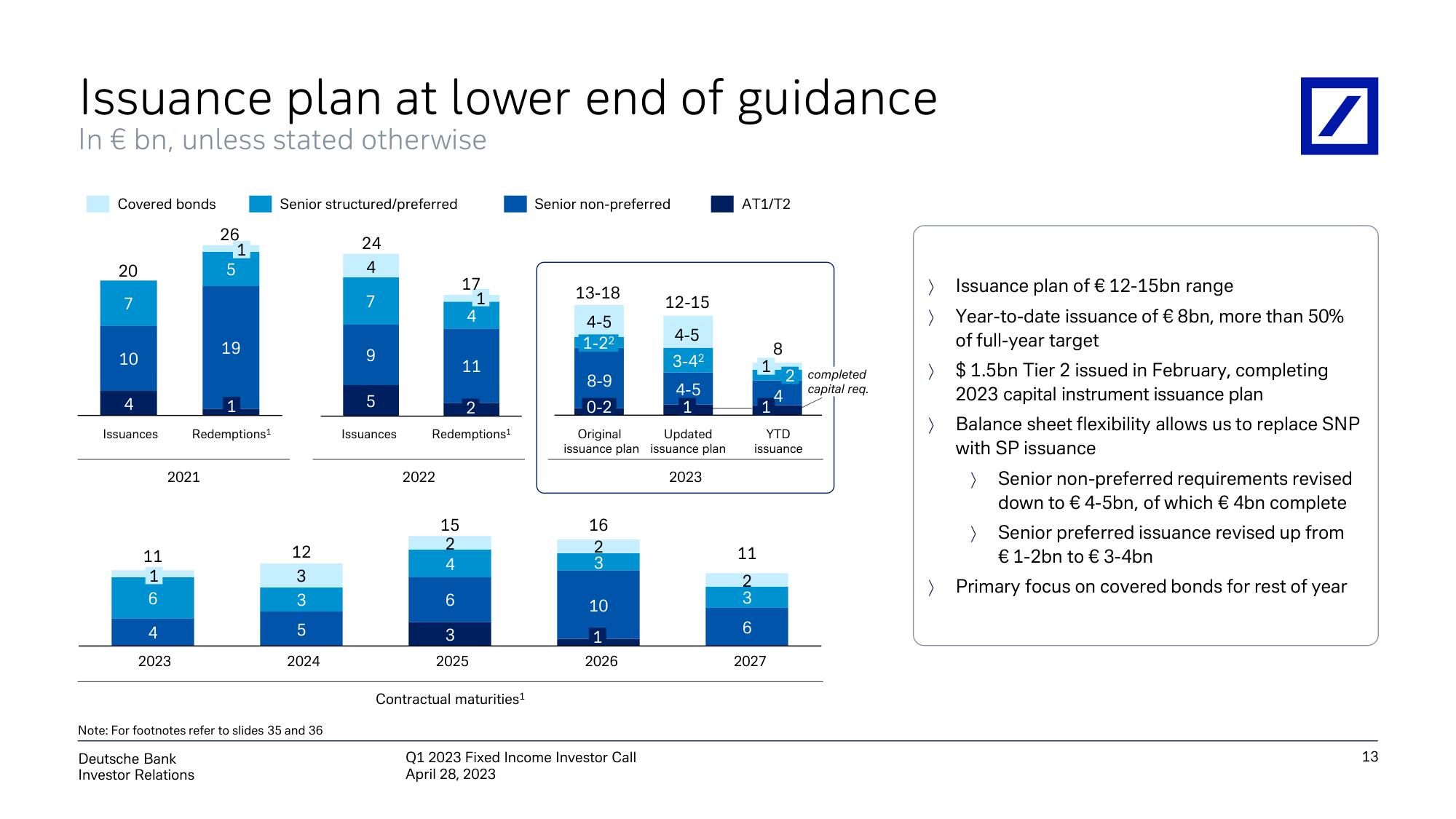

Issuance plan at lower end of guidance

In € bn, unless stated otherwise

Covered bonds

20

7

10

4

Issuances

11

1

6

2021

4

2023

26

1

5

1

Redemptions¹

19

Deutsche Bank

Investor Relations

Senior structured/preferred

or ww5

12

2024

Note: For footnotes refer to slides 35 and 36

24

4

7

9

5

Issuances

2022

15

2

4

17

6

2

Redemptions¹

1

4

11

3

2025

Contractual maturities¹

Senior non-preferred

13-18

4-5

1-2²

8-9

0-2

16

2

3

Original Updated

issuance plan issuance plan

2023

10

2026

12-15

4-5

3-4²

Q1 2023 Fixed Income Investor Call

April 28, 2023

4-5

1

AT1/T2

1

11

2

3

6

1

8

YTD

issuance

2027

4

completed

capital req.

/

> Issuance plan of € 12-15bn range

>

Year-to-date issuance of € 8bn, more than 50%

of full-year target

> $1.5bn Tier 2 issued in February, completing

2023 capital instrument issuance plan

>

Balance sheet flexibility allows us to replace SNP

with SP issuance

>

Senior non-preferred requirements revised

down to € 4-5bn, of which € 4bn complete

>

Senior preferred issuance revised up from

€ 1-2bn to € 3-4bn

> Primary focus on covered bonds for rest of

year

13View entire presentation