AppHarvest SPAC Presentation Deck

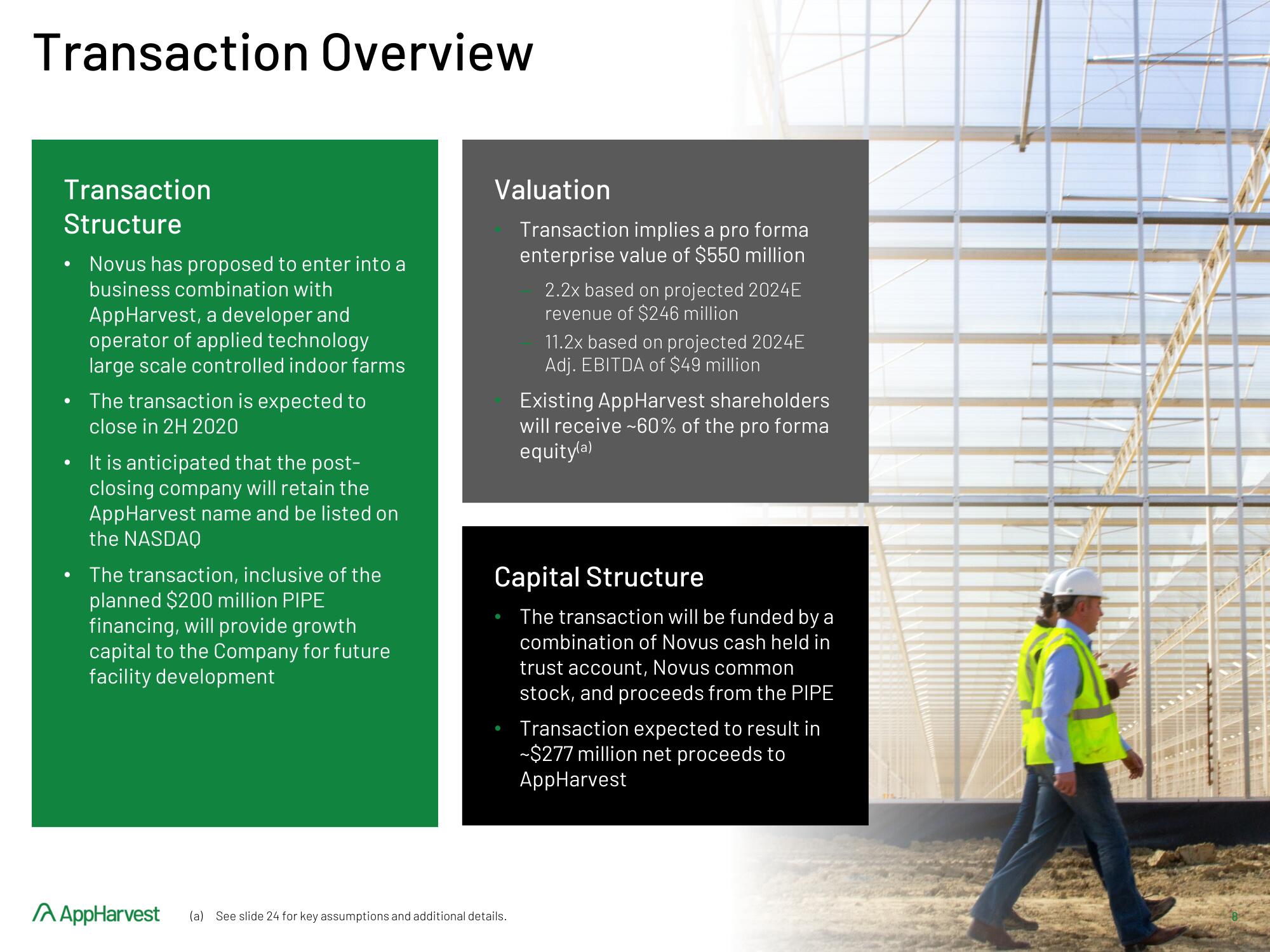

Transaction Overview

Transaction

Structure

●

●

Novus has proposed to enter into a

business combination with

AppHarvest, a developer and

operator of applied technology

large scale controlled indoor farms

The transaction is expected to

close in 2H 2020

It is anticipated that the post-

closing company will retain the

AppHarvest name and be listed on

the NASDAQ

The transaction, inclusive of the

planned $200 million PIPE

financing, will provide growth

capital to the Company for future

facility development

Valuation

Transaction implies a pro forma

enterprise value of $550 million

2.2x based on projected 2024E

revenue of $246 million

AAAppHarvest (a) See slide 24 for key assumptions and additional details.

11.2x based on projected 2024E

Adj. EBITDA of $49 million

Existing AppHarvest shareholders

will receive ~60% of the pro forma

equity(a)

Capital Structure

The transaction will be funded by a

combination of Novus cash held in

trust account, Novus common

stock, and proceeds from the PIPE

Transaction expected to result in

-$277 million net proceeds to

AppHarvest

CARE ETTView entire presentation