Tradeweb Investor Presentation Deck

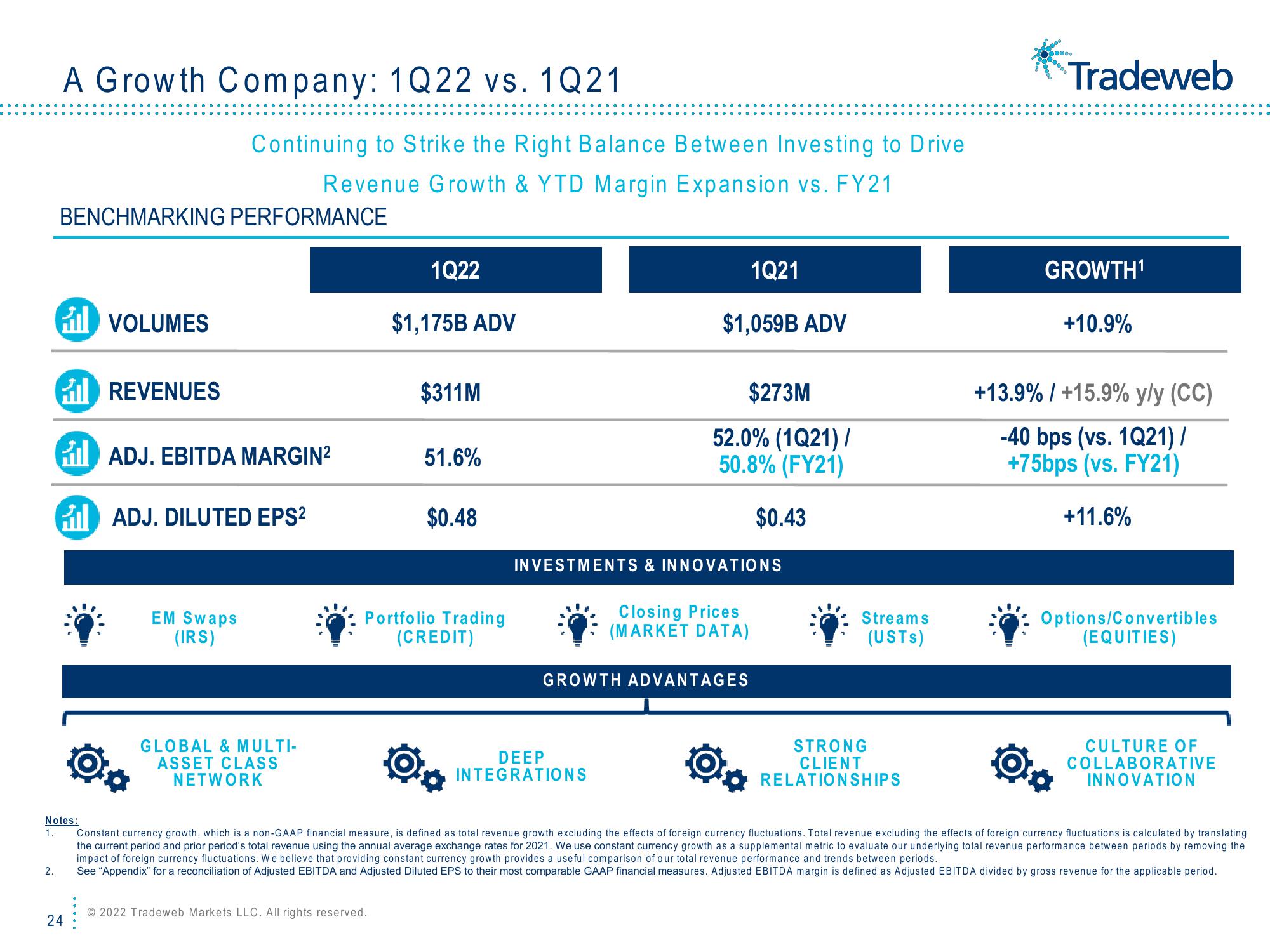

A Growth Company: 1Q22 vs. 1Q21

2.

BENCHMARKING PERFORMANCE

il VOLUMES

24

Notes:

1.

Continuing to Strike the Right Balance Between Investing to Drive

Revenue Growth & YTD Margin Expansion vs. FY21

il REVENUES

il ADJ. EBITDA MARGIN²

ADJ. DILUTED EPS²

EM Swaps

(IRS)

GLOBAL & MULTI-

ASSET CLASS

NETWORK

1Q22

$1,175B ADV

Ⓒ2022 Tradeweb Markets LLC. All rights reserved.

$311M

51.6%

$0.48

Portfolio Trading

(CREDIT)

1Q21

$1,059B ADV

$273M

52.0% (1Q21) /

50.8% (FY21)

DEEP

INTEGRATIONS

INVESTMENTS & INNOVATIONS

Closing Prices

(MARKET DATA)

GROWTH ADVANTAGES

$0.43

Streams

(USTS)

STRONG

CLIENT

RELATIONSHIPS

Tradeweb

GROWTH¹

+10.9%

+13.9% / +15.9% y/y (CC)

-40 bps (vs. 1Q21) /

+75bps (vs. FY21)

+11.6%

Options/Convertibles

(EQUITIES)

*

Constant currency growth, which is a non-GAAP financial measure, is defined as total revenue growth excluding the effects of foreign currency fluctuations. Total revenue excluding the effects of foreign currency fluctuations is calculated by translating

the current period and prior period's total revenue using the annual average exchange rates for 2021. We use constant currency growth as a supplemental metric to evaluate our underlying total revenue performance between periods by removing the

impact of foreign currency fluctuations. We believe that providing constant currency growth provides a useful comparison of our total revenue performance and trends between periods.

See "Appendix" for a reconciliation of Adjusted EBITDA and Adjusted Diluted EPS to their most comparable GAAP financial measures. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by gross revenue for the applicable period.

CULTURE OF

COLLABORATIVE

INNOVATIONView entire presentation