Marti Results Presentation Deck

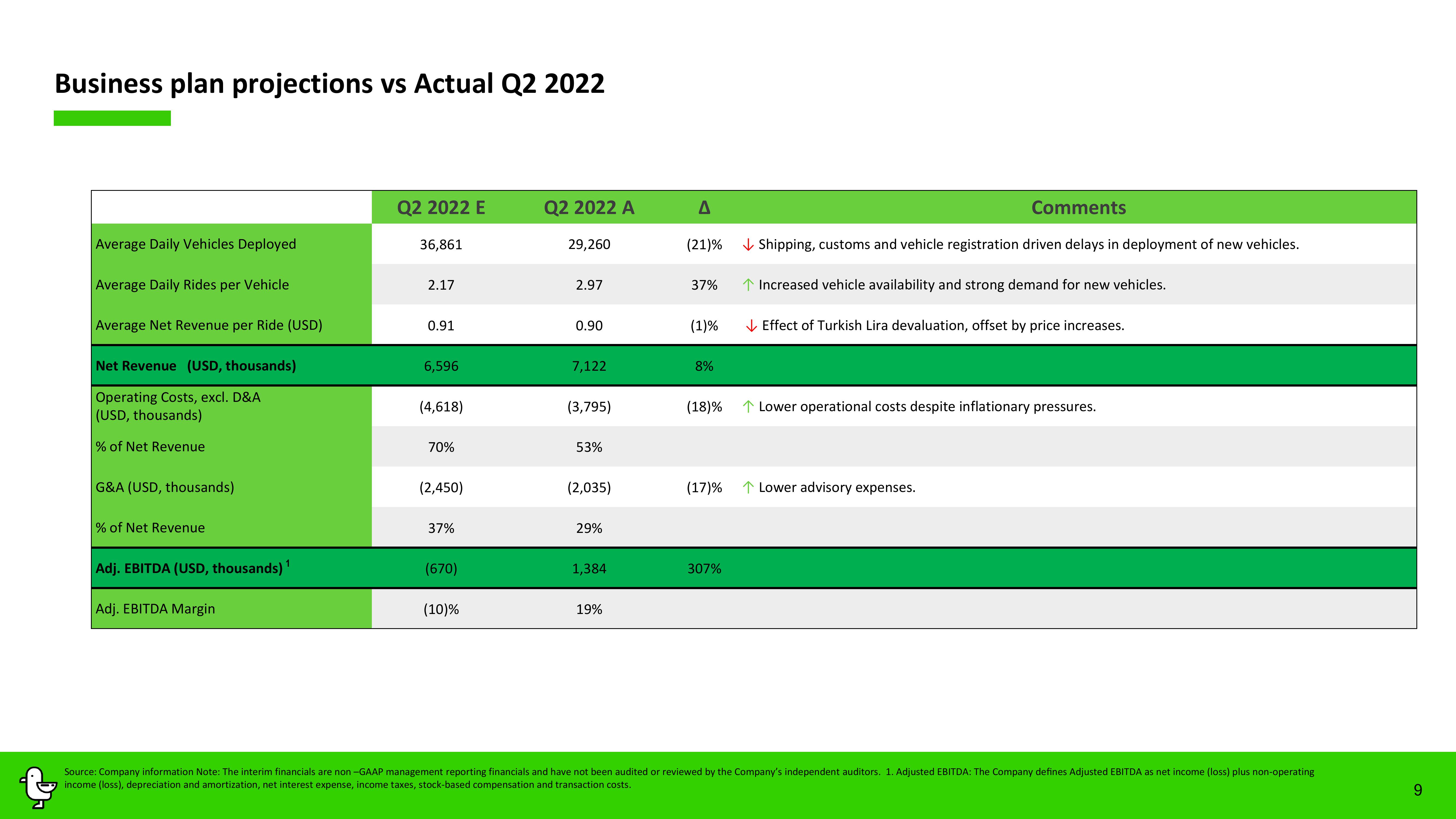

Business plan projections vs Actual Q2 2022

Average Daily Vehicles Deployed

Average Daily Rides per Vehicle

Average Net Revenue per Ride (USD)

Net Revenue (USD, thousands)

Operating Costs, excl. D&A

(USD, thousands)

% of Net Revenue

G&A (USD, thousands)

% of Net Revenue

Adj. EBITDA (USD, thousands)

Adj. EBITDA Margin

Q2 2022 E

36,861

2.17

0.91

6,596

(4,618)

70%

(2,450)

37%

(670)

(10)%

Q2 2022 A

29,260

2.97

0.90

7,122

(3,795)

53%

(2,035)

29%

1,384

19%

A

(21)%

37%

(1)%

8%

(18)%

(17)%

307%

Comments

Shipping, customs and vehicle registration driven delays in deployment of new vehicles.

↑ Increased vehicle availability and strong demand for new vehicles.

✓ Effect of Turkish Lira devaluation, offset by price increases.

↑ Lower operational costs despite inflationary pressures.

↑ Lower advisory expenses.

Source: Company information Note: The interim financials are non-GAAP management reporting financials and have not been audited or reviewed by the Company's independent auditors. 1. Adjusted EBITDA: The Company defines Adjusted EBITDA as net income (loss) plus non-operating

income (loss), depreciation and amortization, net interest expense, income taxes, stock-based compensation and transaction costs.

9View entire presentation