Ready Capital Investor Presentation Deck

SBC Lending and Acquisitions

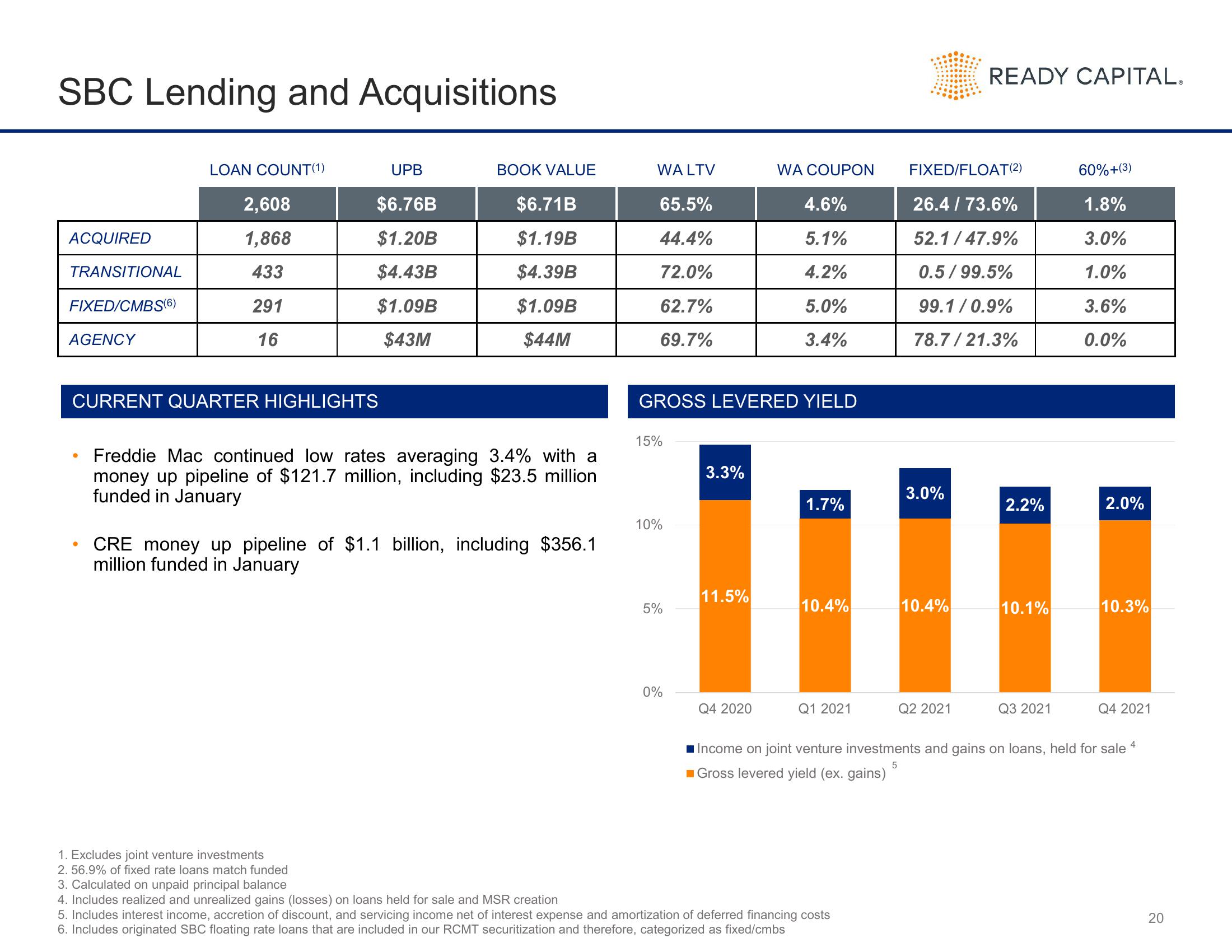

ACQUIRED

TRANSITIONAL

FIXED/CMBS(6)

AGENCY

LOAN COUNT(1)

2,608

1,868

433

291

16

UPB

$6.76B

$1.20B

$4.43B

$1.09B

$43M

CURRENT QUARTER HIGHLIGHTS

BOOK VALUE

1. Excludes joint venture investments

2. 56.9% of fixed rate loans match funded

$6.71B

$1.19B

$4.39B

$1.09B

$44M

Freddie Mac continued low rates averaging 3.4% with a

money up pipeline of $121.7 million, including $23.5 million

funded in January

CRE money up pipeline of $1.1 billion, including $356.1

million funded in January

WA LTV

65.5%

44.4%

72.0%

62.7%

69.7%

15%

GROSS LEVERED YIELD

10%

5%

0%

3.3%

11.5%

WA COUPON

Q4 2020

4.6%

5.1%

4.2%

5.0%

3.4%

1.7%

10.4%

Q1 2021

3. Calculated on unpaid principal balance

4. Includes realized and unrealized gains (losses) on loans held for sale and MSR creation

5. Includes interest income, accretion of discount, and servicing income net of interest expense and amortization of deferred financing costs

6. Includes originated SBC floating rate loans that are included in our RCMT securitization and therefore, categorized as fixed/cmbs

FIXED/FLOAT(2)

26.4 / 73.6%

52.1/47.9%

0.5/99.5%

99.1/0.9%

78.7/21.3%

3.0%

10.4%

READY CAPITAL.

Q2 2021

2.2%

10.1%

Q3 2021

60%+(3)

1.8%

3.0%

1.0%

3.6%

0.0%

2.0%

10.3%

Q4 2021

4

Income on joint venture investments and gains on loans, held for sale

Gross levered yield (ex. gains)

5

20View entire presentation