Deutsche Bank Fixed Income Presentation Deck

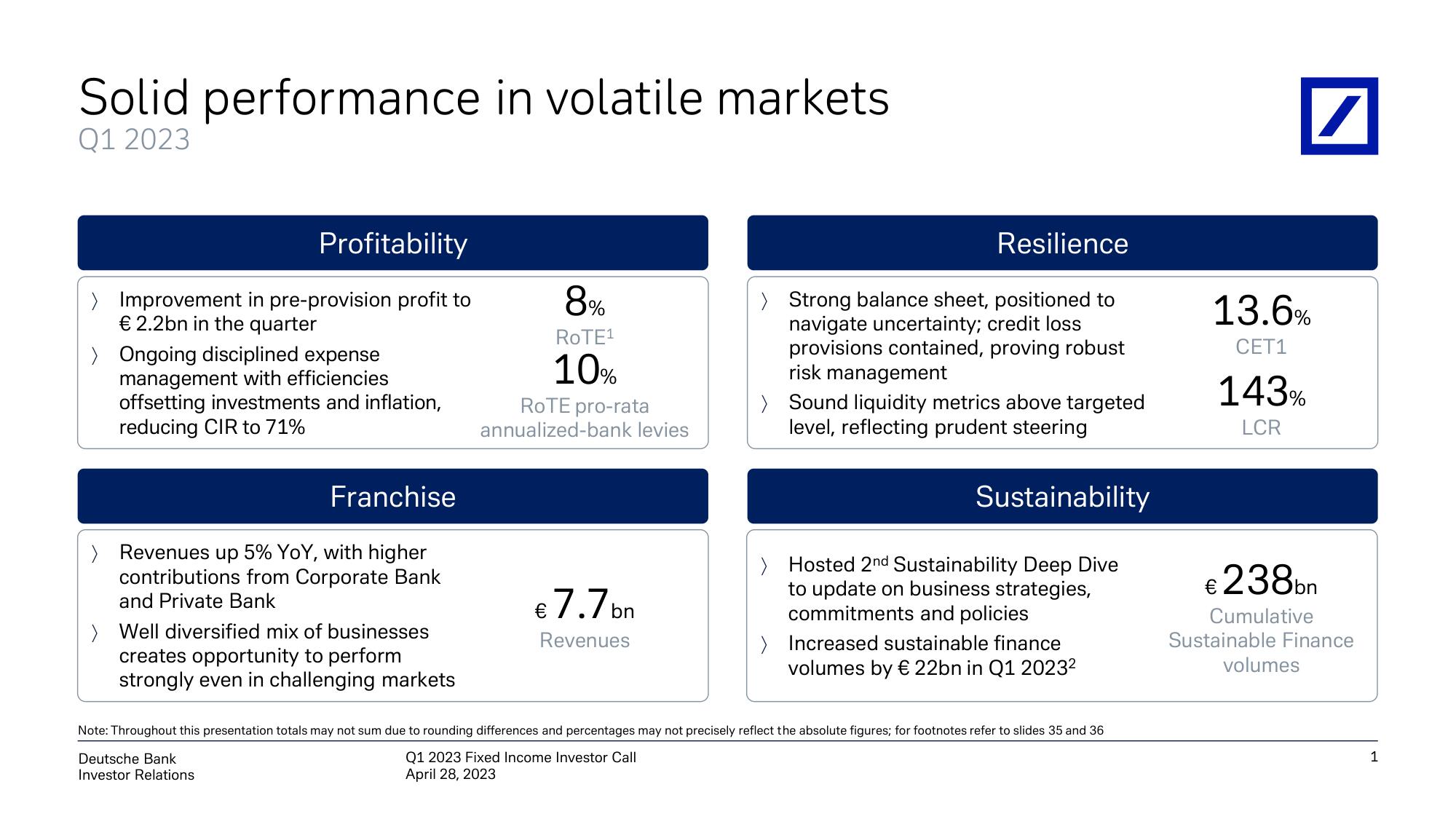

Solid performance in volatile markets

Q1 2023

Profitability

>

Improvement in pre-provision profit to

€ 2.2bn in the quarter

>

Ongoing disciplined expense

management with efficiencies

offsetting investments and inflation,

reducing CIR to 71%

Franchise

> Revenues up 5% YoY, with higher

contributions from Corporate Bank

and Private Bank

> Well diversified mix of businesses

creates opportunity to perform

strongly even in challenging markets

8%

RoTE¹

10%

Deutsche Bank

Investor Relations

ROTE pro-rata

annualized-bank levies

€ 7.7bn

Revenues

Resilience

> Strong balance sheet, positioned to

navigate uncertainty; credit loss

provisions contained, proving robust

risk management

> Sound liquidity metrics above targeted

level, reflecting prudent steering

Sustainability

> Hosted 2nd Sustainability Deep Dive

to update on business strategies,

commitments and policies

> Increased sustainable finance

volumes by € 22bn in Q1 2023²

Note: Throughout this presentation totals may not sum due to rounding differences and percentages may not precisely reflect the absolute figures; for footnotes refer to slides 35 and 36

Q1 2023 Fixed Income Investor Call

April 28, 2023

13.6%

CET1

143%

LCR

€ 238bn

Cumulative

Sustainable Finance

volumes

1View entire presentation