Allwyn Investor Conference Presentation Deck

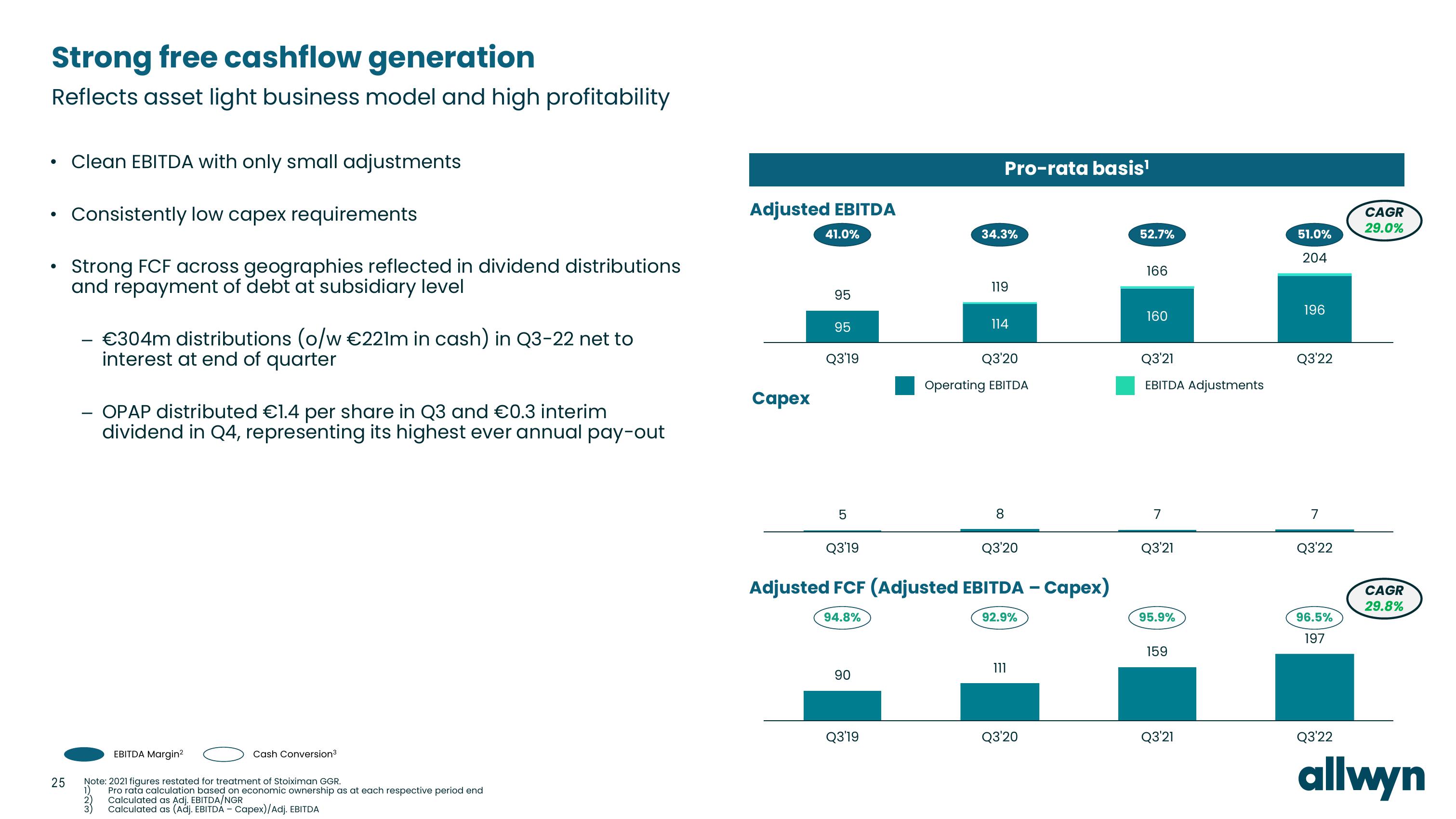

Strong free cashflow generation

Reflects asset light business model and high profitability

• Clean EBITDA with only small adjustments

Consistently low capex requirements

Strong FCF across geographies reflected in dividend distributions

and repayment of debt at subsidiary level

●

25

– €304m distributions (o/w €221m in cash) in Q3-22 net to

interest at end of quarter

OPAP distributed €1.4 per share in Q3 and €0.3 interim

dividend in Q4, representing its highest ever annual pay-out

EBITDA Margin²

Cash Conversion³

Note: 2021 figures restated for treatment of Stoiximan GGR.

1) Pro rata calculation based on economic ownership as at each respective period end

Calculated as Adj. EBITDA/NGR

Calculated as (Adj. EBITDA - Capex)/Adj. EBITDA

Adjusted EBITDA

Capex

41.0%

95

95

Q3'19

5

Q3'19

90

Pro-rata basis¹

Q3'19

34.3%

8

Q3'20

Adjusted FCF (Adjusted EBITDA - Capex)

94.8%

92.9%

119

114

Q3'20

Operating EBITDA

111

Q3'20

52.7%

166

160

Q3'21

EBITDA Adjustments

7

Q3'21

95.9%

159

Q3'21

51.0%

204

196

Q3'22

7

Q3'22

96.5%

197

Q3'22

CAGR

29.0%

CAGR

29.8%

allwynView entire presentation