Third Quarter 2022 Earnings Conference Call

Noninterest income

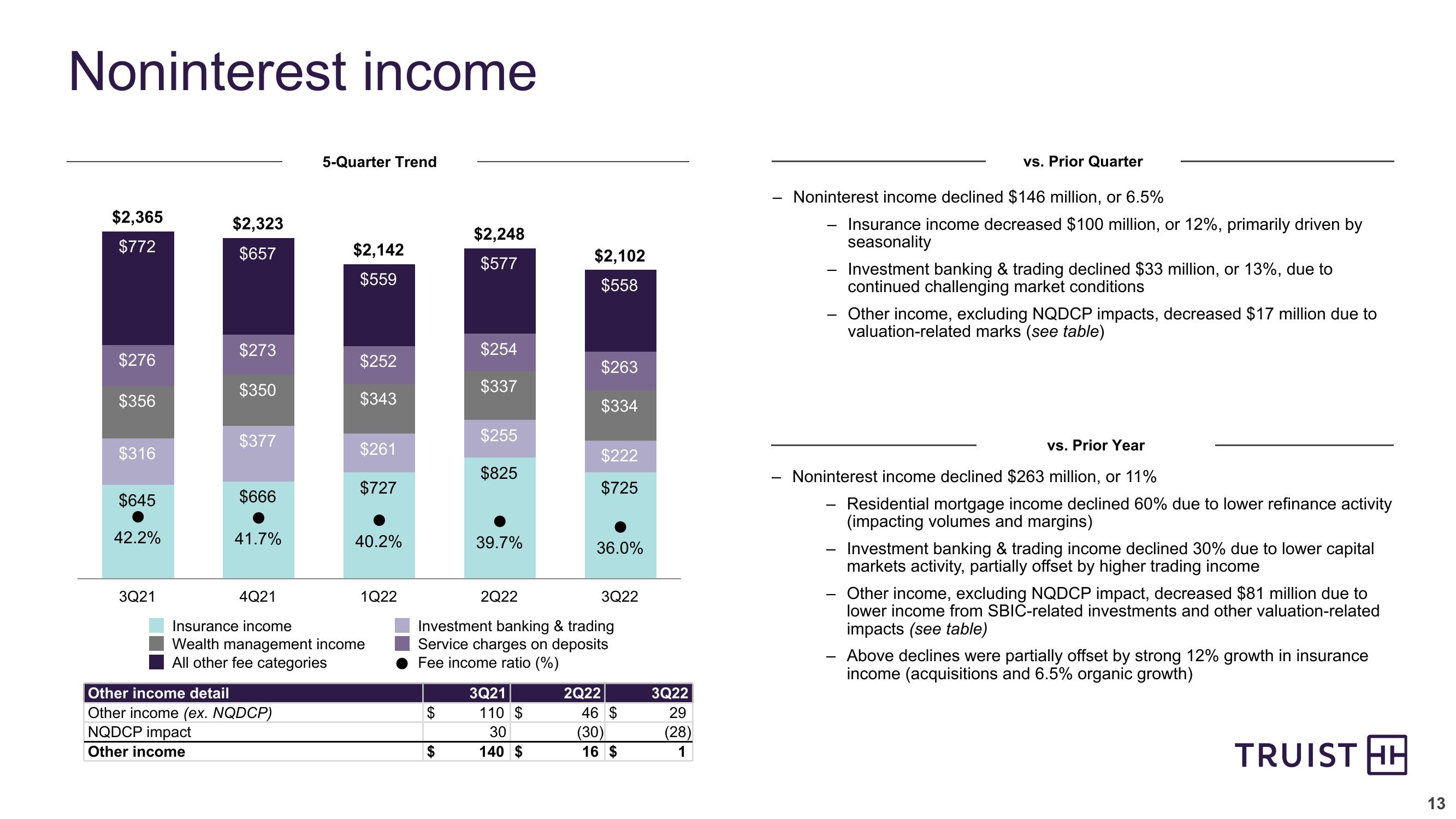

5-Quarter Trend

$2,365

$2,323

$2,248

$772

$657

$2,142

$577

$559

$2,102

$558

$273

$254

$276

$252

$263

$350

$337

$356

$343

$334

$377

$255

$316

$261

$222

$825

$727

$725

$645

$666

42.2%

41.7%

40.2%

39.7%

36.0%

3Q21

4Q21

Insurance income

Wealth management income

All other fee categories

Other income detail

Other income (ex. NQDCP)

NQDCP impact

Other income

1Q22

2Q22

3Q22

Investment banking & trading

Service charges on deposits

Fee income ratio (%)

3Q21

110 $

30

2Q22

46 $

3Q22

29

(30)

(28)

140 $

16 $

vs. Prior Quarter

Noninterest income declined $146 million, or 6.5%

-

Insurance income decreased $100 million, or 12%, primarily driven by

seasonality

- Investment banking & trading declined $33 million, or 13%, due to

continued challenging market conditions

Other income, excluding NQDCP impacts, decreased $17 million due to

valuation-related marks (see table)

vs. Prior Year

Noninterest income declined $263 million, or 11%

-

Residential mortgage income declined 60% due to lower refinance activity

(impacting volumes and margins)

- Investment banking & trading income declined 30% due to lower capital

markets activity, partially offset by higher trading income

Other income, excluding NQDCP impact, decreased $81 million due to

lower income from SBIC-related investments and other valuation-related

impacts (see table)

Above declines were partially offset by strong 12% growth in insurance

income (acquisitions and 6.5% organic growth)

TRUIST HH

13View entire presentation