Snap Inc Results Presentation Deck

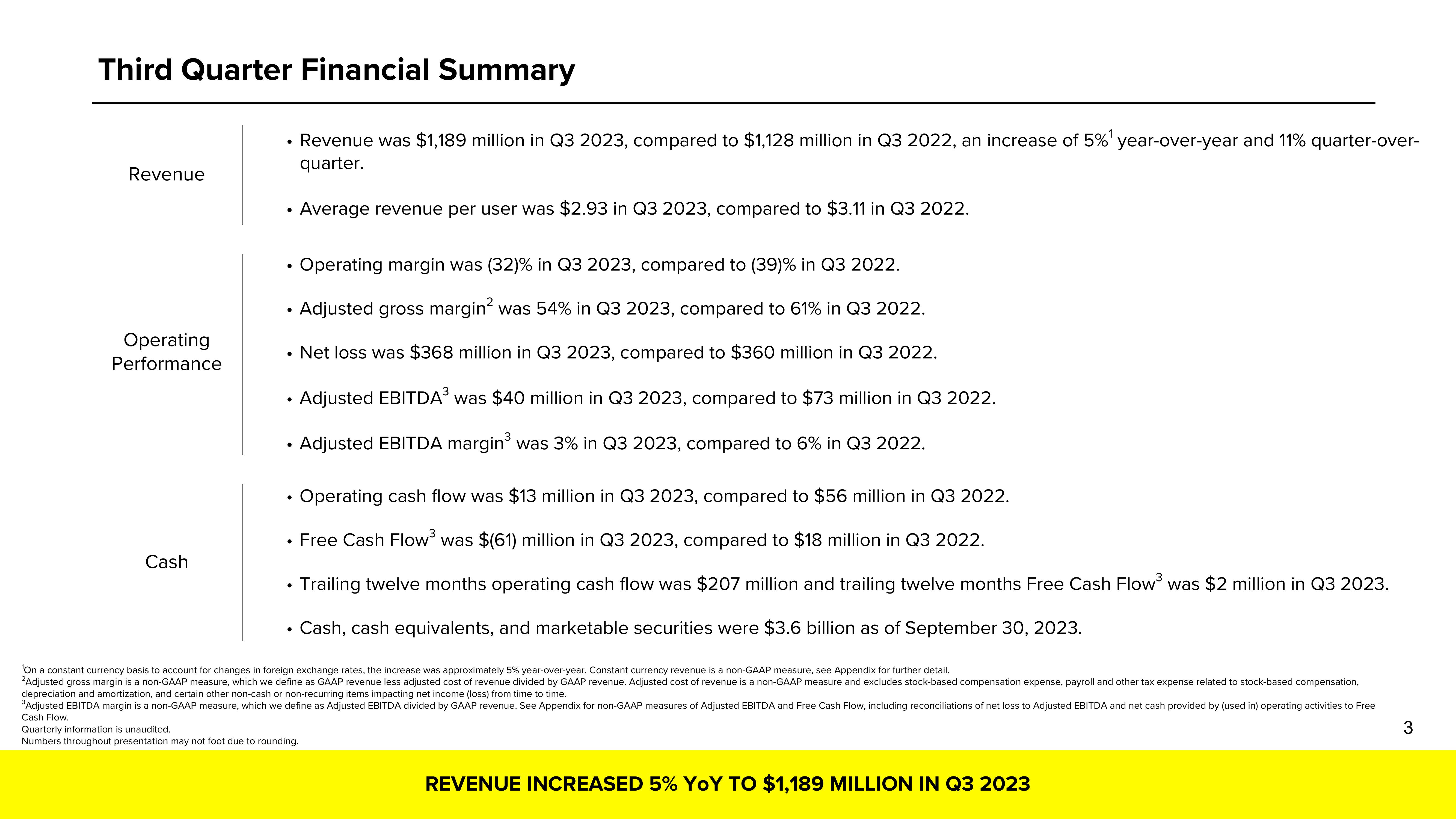

Third Quarter Financial Summary

Revenue

Operating

Performance

Cash

●

●

Operating margin was (32) % in Q3 2023, compared to (39) % in Q3 2022.

• Adjusted gross margin² was 54% in Q3 2023, compared to 61% in Q3 2022.

• Net loss was $368 million in Q3 2023, compared to $360 million in Q3 2022.

Adjusted EBITDA³ was $40 million in Q3 2023, compared to $73 million in Q3 2022.

• Adjusted EBITDA margin³ was 3% in Q3 2023, compared to 6% in Q3 2022.

●

●

Revenue was $1,189 million in Q3 2023, compared to $1,128 million in Q3 2022, an increase of 5% ¹ year-over-year and 11% quarter-over-

quarter.

Average revenue per user was $2.93 in Q3 2023, compared to $3.11 in Q3 2022.

●

Operating cash flow was $13 million in Q3 2023, compared to $56 million in Q3 2022.

Free Cash Flow³ was $(61) million in Q3 2023, compared to $18 million in Q3 2022.

Trailing twelve months operating cash flow was $207 million and trailing twelve months Free Cash Flow³ was $2 million in Q3 2023.

Cash, cash equivalents, and marketable securities were $3.6 billion as of September 30, 2023.

'On a constant currency basis to account for changes in foreign exchange rates, the increase was approximately 5% year-over-year. Constant currency revenue is a non-GAAP measure, see Appendix for further detail.

²Adjusted gross margin is a non-GAAP measure, which we define as GAAP revenue less adjusted cost of revenue divided by GAAP revenue. Adjusted cost of revenue is a non-GAAP measure and excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation,

depreciation and amortization, and certain other non-cash or non-recurring items impacting net income (loss) from time to time.

³Adjusted EBITDA margin is a non-GAAP measure, which we define as Adjusted EBITDA divided by GAAP revenue. See Appendix for non-GAAP measures of Adjusted EBITDA and Free Cash Flow, including reconciliations of net loss to Adjusted EBITDA and net cash provided by (used in) operating activities to Free

Cash Flow.

Quarterly information is unaudited.

Numbers throughout presentation may not foot due to rounding.

REVENUE INCREASED 5% YoY TO $1,189 MILLION IN Q3 2023

3View entire presentation