Bird Investor Presentation Deck

Material improvement in profitability profile in H2 2022

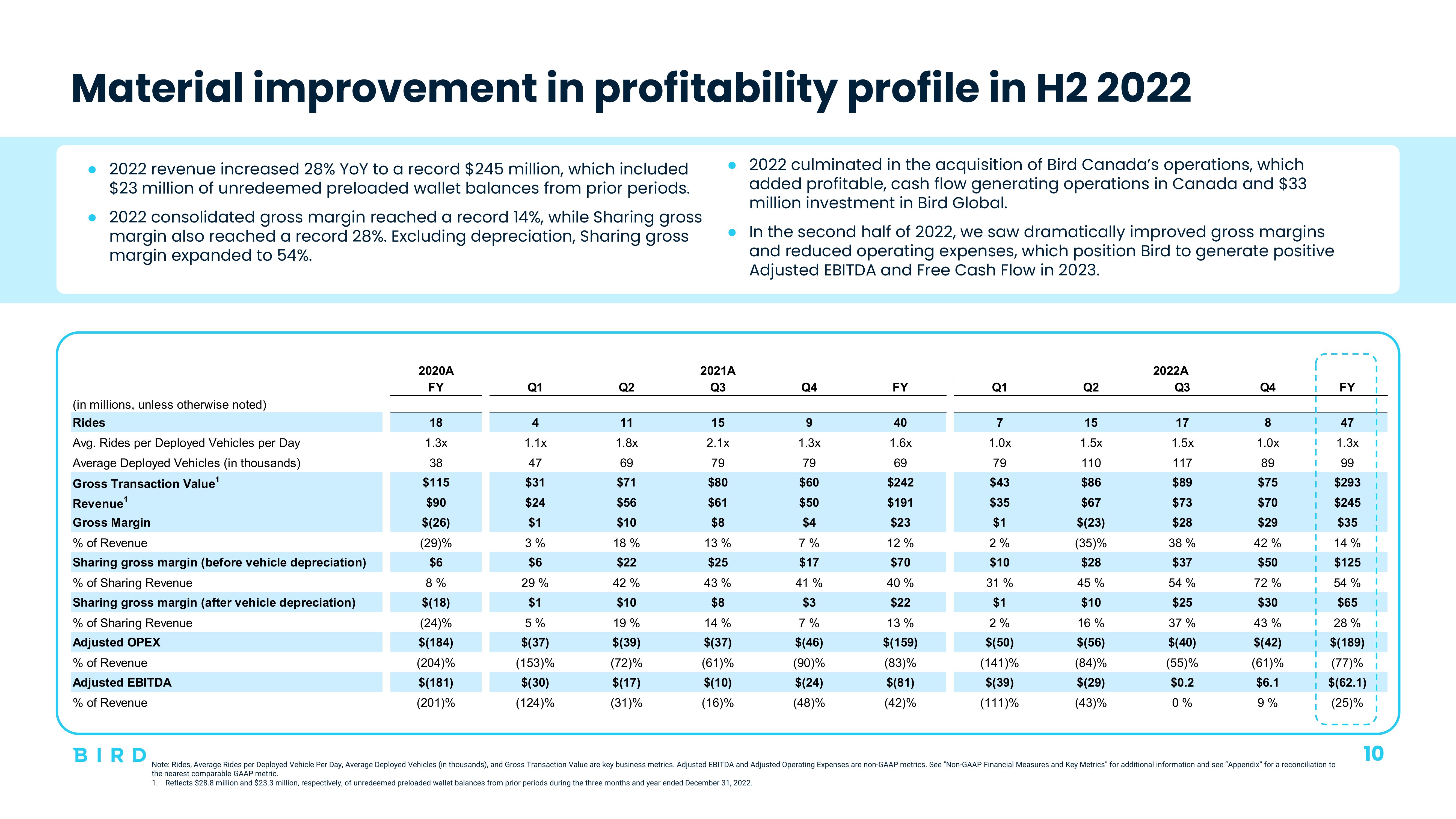

• 2022 revenue increased 28% YoY to a record $245 million, which included

$23 million of unredeemed preloaded wallet balances from prior periods.

• 2022 consolidated gross margin reached a record 14%, while Sharing gross

margin also reached a record 28%. Excluding depreciation, Sharing gross

margin expanded to 54%.

(in millions, unless otherwise noted)

Rides

Avg. Rides per Deployed Vehicles per Day

Average Deployed Vehicles (in thousands)

Gross Transaction Value¹

Revenue¹

Gross Margin

% of Revenue

Sharing gross margin (before vehicle depreciation)

% of Sharing Revenue

Sharing gross margin (after vehicle depreciation)

% of Sharing Revenue

Adjusted OPEX

% of Revenue

Adjusted EBITDA

% of Revenue

BIRD

2020A

FY

18

1.3x

38

$115

$90

$(26)

(29)%

$6

8%

$(18)

(24)%

$(184)

(204)%

$(181)

(201)%

Q1

4

1.1x

47

$31

$24

$1

3%

$6

29%

$1

5%

$(37)

(153)%

$(30)

(124)%

Q2

11

1.8x

69

$71

$56

$10

18 %

$22

42%

$10

19 %

$(39)

(72)%

$(17)

(31)%

• 2022 culminated in the acquisition of Bird Canada's operations, which

added profitable, cash flow generating operations in Canada and $33

million investment in Bird Global.

. In the second half of 2022, we saw dramatically improved gross margins

and reduced operating expenses, which position Bird to generate positive

Adjusted EBITDA and Free Cash Flow in 2023.

2021A

Q3

15

2.1x

79

$80

$61

$8

13%

$25

43%

$8

14%

$(37)

(61)%

$(10)

(16)%

Q4

9

1.3x

79

$60

$50

$4

7%

$17

41%

$3

7%

$(46)

(90)%

$(24)

(48)%

FY

40

1.6x

69

$242

$191

$23

12%

$70

40%

$22

13 %

$(159)

(83)%

$(81)

(42)%

Q1

7

1.0x

79

$43

$35

$1

2%

$10

31%

$1

2%

$(50)

(141)%

$(39)

(111)%

Q2

15

1.5x

110

$86

$67

$(23)

(35)%

$28

45 %

$10

16 %

$(56)

(84)%

$(29)

(43)%

2022A

Q3

17

1.5x

117

$89

$73

$28

38 %

$37

54%

$25

37%

$(40)

(55)%

$0.2

0%

Q4

8

1.0x

89

$75

$70

$29

42%

$50

72%

$30

43 %

$(42)

(61)%

$6.1

9%

1

1

FY

47

1.3x

99

$293

$245

$35

14%

$125

54%

$65

28%

$(189)

(77)%

$(62.1)

(25)%

Note: Rides, Average Rides per Deployed Vehicle Per Day, Average Deployed Vehicles (in thousands), and Gross Transaction Value are key business metrics. Adjusted EBITDA and Adjusted Operating Expenses are non-GAAP metrics. See "Non-GAAP Financial Measures and Key Metrics" for additional information and see "Appendix" for a reconciliation to

the nearest comparable GAAP metric.

1. Reflects $28.8 million and $23.3 million, respectively, of unredeemed preloaded wallet balances from prior periods during the three months and year ended December 31, 2022.

10View entire presentation