Bausch+Lomb Results Presentation Deck

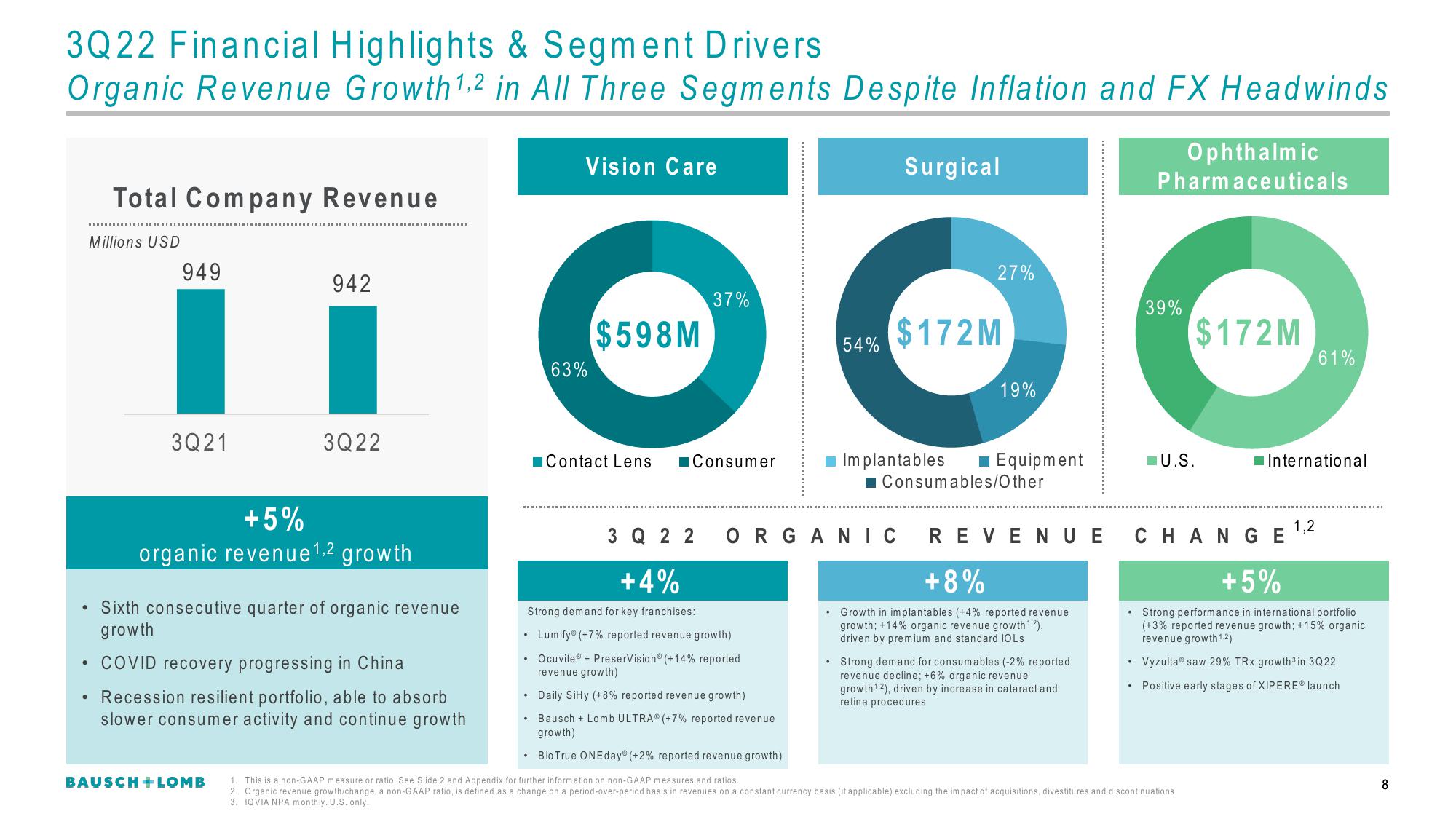

3Q22 Financial Highlights & Segment Drivers

Organic Revenue Growth ¹.2 in All Three Segments Despite Inflation and FX Headwinds

●

Total Company Revenue

Millions USD

•

949

3Q21

942

3Q22

+5%

organic revenue ¹,2 growth

Sixth consecutive quarter of organic revenue

growth

• COVID recovery progressing in China

Recession resilient portfolio, able to absorb

slower consumer activity and continue growth

BAUSCH + LOMB

Vision Care

.

63%

$598M

37%

Contact Lens ■Consumer

Surgical

27%

54% $172M

19%

■ Implantables ■ Equipment

Consumables/Other

3 Q 22

+4%

Strong demand for key franchises:

Lumify (+7% reported revenue growth)

Ocuvite® + PreserVision (+14% reported

revenue growth)

Daily SiHy (+8% reported revenue growth)

Bausch+Lomb ULTRA® (+7% reported revenue

growth)

• Bio True ONEday (+2% reported revenue growth)

1. This is a non-GAAP measure or ratio. See Slide 2 and Appendix for further information on non-GAAP measures and ratios.

2. Organic revenue growth/change, a non-GAAP ratio, is defined as a change on a period-over-period basis in revenues on a constant currency basis (if applicable) excluding the impact of acquisitions, divestitures and discontinuations.

3. IQVIA NPA monthly. U.S. only.

ORGANIC REVENUE

+8%

Growth in implantables (+4% reported revenue

growth; +14% organic revenue growth ¹.2),

driven by premium and standard IOLS

• Strong demand for consumables (-2% reported

revenue decline; +6% organic revenue

growth ¹.2), driven by increase in cataract and

retina procedures

.

Ophthalmic

Pharmaceuticals

.

39%

$172M

U.S.

International

CHANGE

61%

1,2

+5%

Strong performance in international portfolio

(+3% reported revenue growth; +15% organic

revenue growth 1.2)

Vyzulta® saw 29% TRx growth ³ in 3Q22

Positive early stages of XIPERE® launch

8View entire presentation