Inovalon Results Presentation Deck

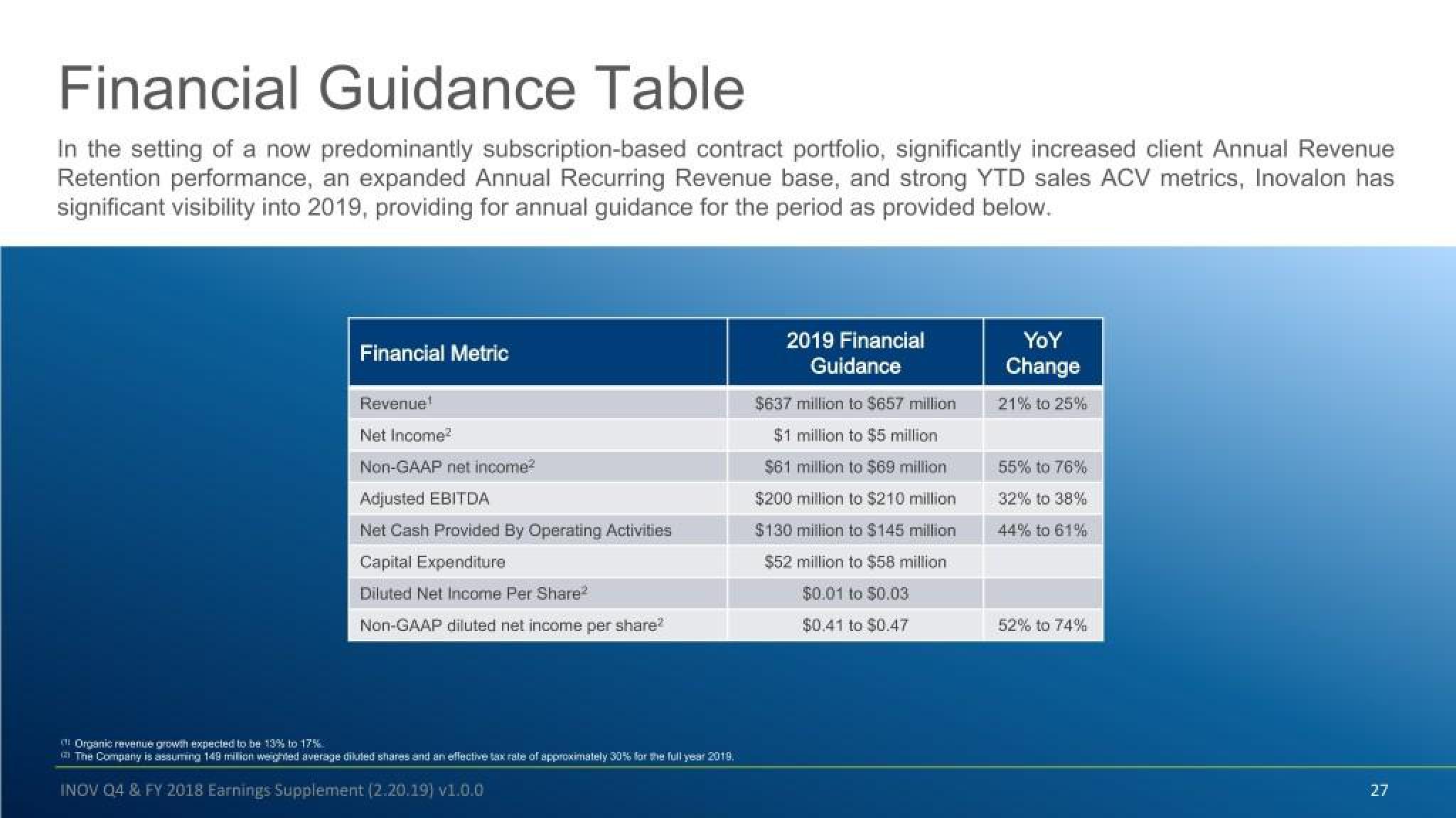

Financial Guidance Table

In the setting of a now predominantly subscription-based contract portfolio, significantly increased client Annual Revenue

Retention performance, an expanded Annual Recurring Revenue base, and strong YTD sales ACV metrics, Inovalon has

significant visibility into 2019, providing for annual guidance for the period as provided below.

Financial Metric

Revenue

Net Income²

Non-GAAP net income²

Adjusted EBITDA

Net Cash Provided By Operating Activities

Capital Expenditure

Diluted Net Income Per Share²

Non-GAAP diluted net income per share²

Organic revenue growth expected to be 13% to 17%

The Company is assuming 149 million weighted average diluted shares and an effective tax rate of approximately 30% for the full year 2019.

INOV Q4 & FY 2018 Earnings Supplement (2.20.19) v1.0.0

2019 Financial

Guidance

$637 million to $657 million

$1 million to $5 million

$61 million to $69 million

$200 million to $210 million

$130 million to $145 million

$52 million to $58 million

$0.01 to $0.03

$0.41 to $0.47

YOY

Change

21% to 25%

55% to 76%

32% to 38%

44% to 61%

52% to 74%

27View entire presentation