Q3’19 Earnings Supplemental Presentation

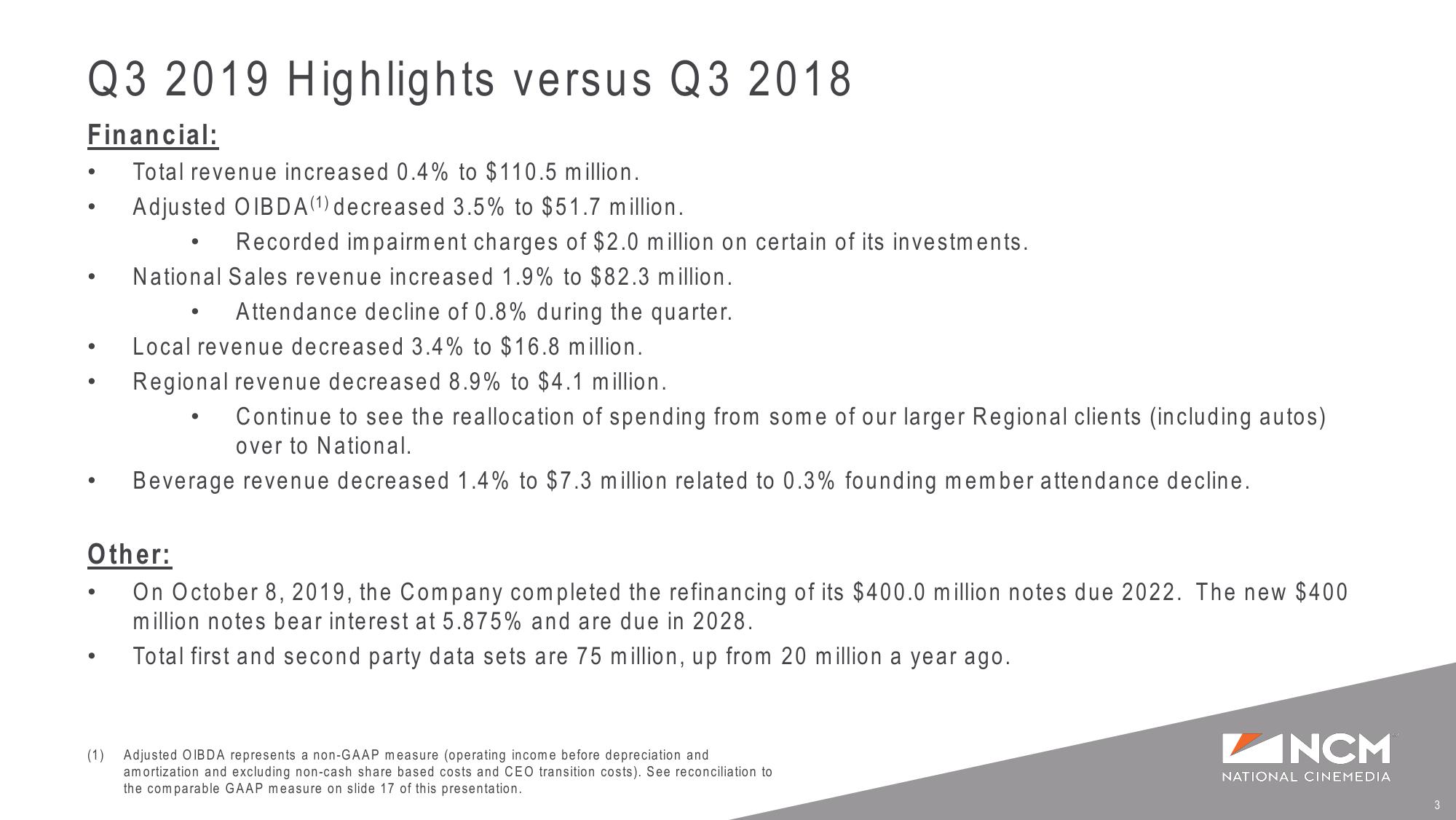

Q3 2019 Highlights versus Q3 2018

Financial:

Total revenue increased 0.4% to $110.5 million.

Adjusted OIBDA (1) decreased 3.5% to $51.7 million.

●

●

Recorded impairment charges of $2.0 million on certain of its investments.

National Sales revenue increased 1.9% to $82.3 million.

Attendance decline of 0.8% during the quarter.

Local revenue decreased 3.4% to $16.8 million.

Regional revenue decreased 8.9% to $4.1 million.

Continue to see the reallocation of spending from some of our larger Regional clients (including autos)

over to National.

Beverage revenue decreased 1.4% to $7.3 million related to 0.3% founding member attendance decline.

Other:

On October 8, 2019, the Company completed the refinancing of its $400.0 million notes due 2022. The new $400

million notes bear interest at 5.875% and are due in 2028.

Total first and second party data sets are 75 million, up from 20 million a year ago.

(1) Adjusted OIBDA represents a non-GAAP measure (operating income before depreciation and

amortization and excluding non-cash share based costs and CEO transition costs). See reconciliation to

the comparable GAAP measure on slide 17 of this presentation.

NCM

NATIONAL CINEMEDIA

3View entire presentation