Bridge Investment Group Results Presentation Deck

Appendix

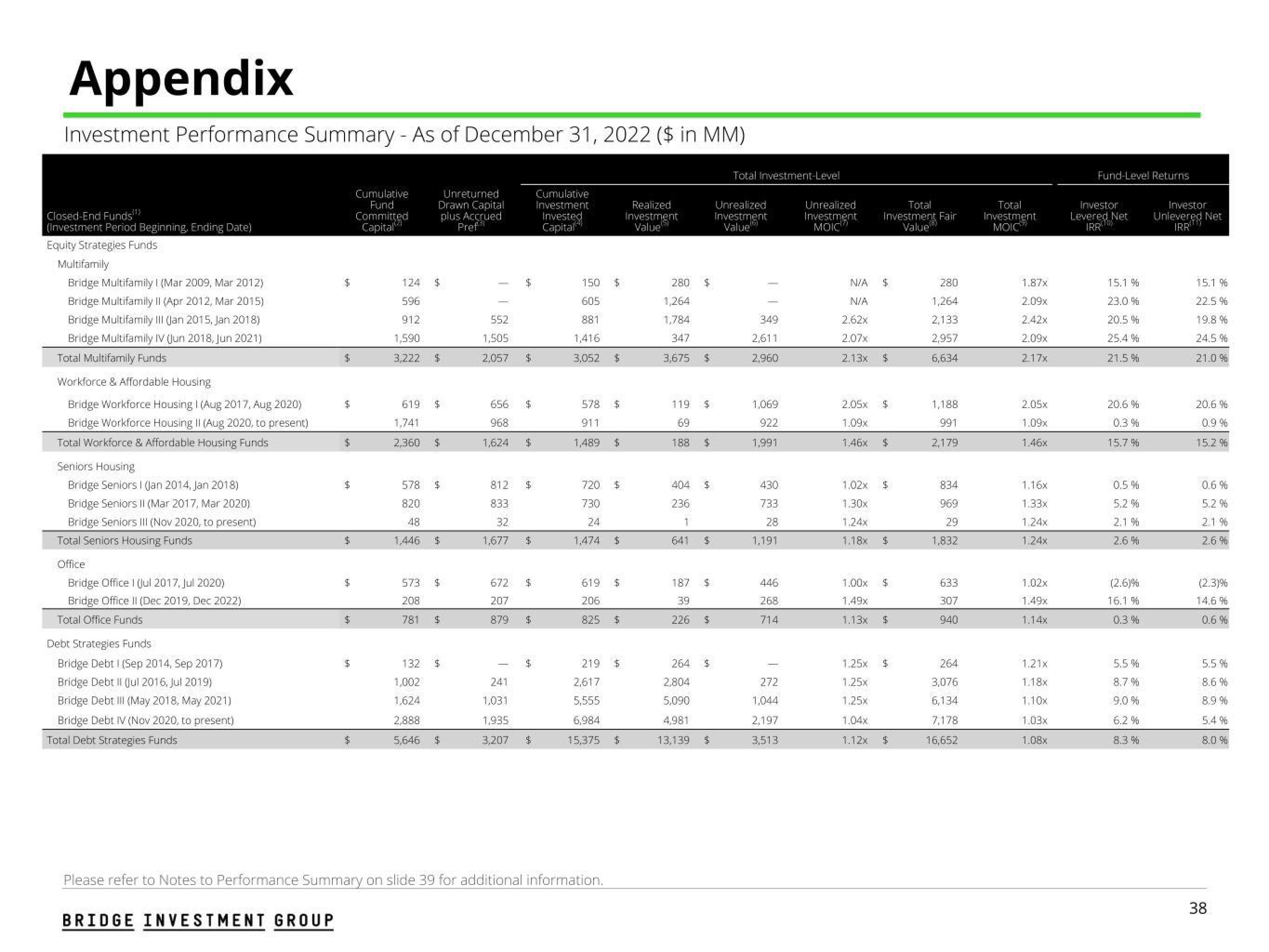

Investment Performance Summary - As of December 31, 2022 ($ in MM)

Closed-End Funds!!)

(Investment Period Beginning, Ending Date)

Equity Strategies Funds

Multifamily

Bridge Multifamily I (Mar 2009, Mar 2012)

Bridge Multifamily II (Apr 2012, Mar 2015)

Bridge Multifamily III (Jan 2015, Jan 2018)

Bridge Multifamily IV (Jun 2018, Jun 2021)

Total Multifamily Funds

Workforce & Affordable Housing

Bridge Workforce Housing I (Aug 2017, Aug 2020)

Bridge Workforce Housing II (Aug 2020, to present)

Total Workforce & Affordable Housing Funds

Seniors Housing

Bridge Seniors I (Jan 2014, Jan 2018)

Bridge Seniors II (Mar 2017, Mar 2020)

Bridge Seniors III (Nov 2020, to present)

Total Seniors Housing Funds

Office

Bridge Office I (Jul 2017, Jul 2020)

Bridge Office II (Dec 2019, Dec 2022)

Total Office Funds

Debt Strategies Funds

Bridge Debt 1 (Sep 2014, Sep 2017)

Bridge Debt II (Jul 2016, Jul 2019)

Bridge Debt III (May 2018, May 2021)

Bridge Debt IV (Nov 2020, to present)

Total Debt Strategies Funds

$

$

$

$

$

$

$

Cumulative

Fund

Committed

Capital

Unreturned

Drawn Capital

plus Accrued

Pref

124 $

596

912

1,590

3,222 $

619

1,741

2,360 $

$

578 $

820

48

1,446 $

573 $

208

781 $

132 $

1,002

1,624

2,888

5,646 $

552

1,505

2,057 $

656 $

968

1,624 $

812

833

32

1,677

$

$

672 $

207

879

$

$

241

1,031

1,935

3,207 $

Cumulative

Investment

Invested

Capital

150 $

605

881

1,416

3,052 $

578 $

911

1,489 $

720 $

730

24

1,474

619

206

825

2,617

5,555

6,984

15,375

$

Please refer to Notes to Performance Summary on slide 39 for additional information.

BRIDGE INVESTMENT GROUP

$

219 $

$

$

Realized

Investment

Value

280 $

1,264

1,784

347

3,675 $

119

69

188

64

$

404 $

236

1

641 $

187 $

39

226

$

264 $

2,804

5,090

4,981

13,139 $

Total Investment-Level

Unrealized

Investment

Value

349

2,611

2,960

1,069

922

1,991

430

733

28

1,191

446

268

714

272

1,044

2,197

3,513

Unrealized

Investment

MOIC

N/A

N/A

2.62x

2.07x

2.13x

Total

Investment Fair

Value

$

$

2.05x $

1.09x

1.46x $

1.02X $

1.30x

1,24x

1.18x $

1.00x $

1.49x

1.13x

$

1.25x $

1.25x

1.25X

1.04x

1.12x $

280

1,264

2,133

2,957

6,634

1,188

991

2,179

834

969

29

1,832

633

307

940

264

3,076

6,134

7,178

16,652

Total

Investment

MOIC

1.87x

2.09x

2.42x

2.09x

2.17x

2.05x

1.09x

1.46x

1.16x

1.33x

1,24x

1.24x

1.02x

1.49x

1.14x

1.21x

1.18x

1.10x

1.03x

1.08x

Fund-Level Returns

Investor

Levered Net

IRR(¹0)

15.1 %

23.0 %

20.5%

25.4 %

21.5%

20.6 %

0.3%

15.7%

0.5%

5.2 %

2.1%

2.6%

(2.6)%

16.1%

0.3%

5.5%

8.7%

9.0 %

6.2 %

8.3 %

Investor

Unlevered

IRR

Net

15.1 %

22.5%

19.8 %

24.5%

21.0%

20.6 %

0.9 %

15.2 %

0.6 %

5.2 %

2.1%

2.6 %

(2.3)%

14,6 %

0.6%

5.5%

8.6 %

8.9 %

5.4 %

8.0 %

38View entire presentation