Deutsche Bank Results Presentation Deck

Corporate Bank

In € m, unless stated otherwise

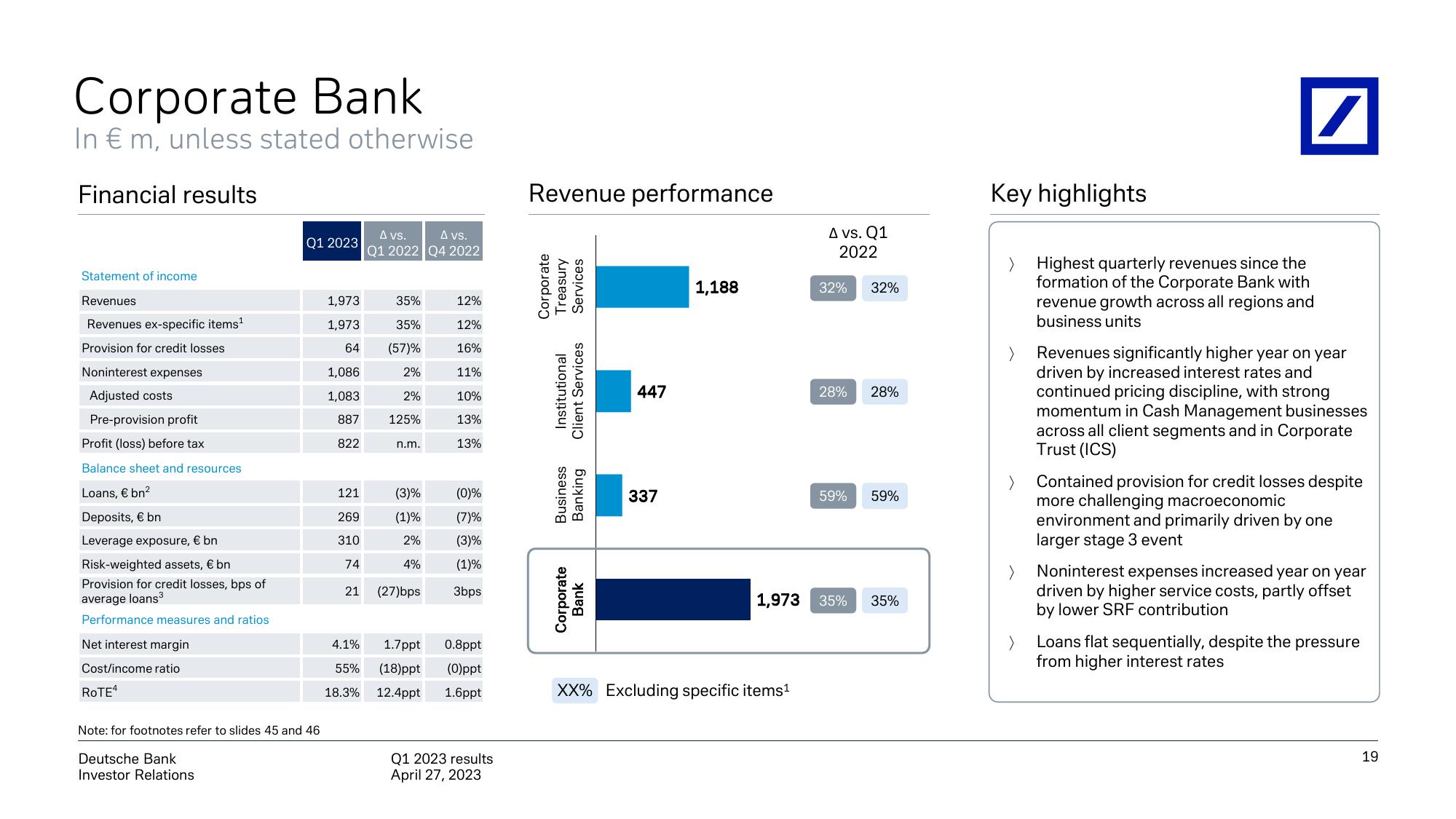

Financial results

Statement of income.

Revenues

Revenues ex-specific items¹

Provision for credit losses

Noninterest expenses

Adjusted costs

Pre-provision profit

Profit (loss) before tax

Balance sheet and resources

Loans, € bn²

Deposits, € bn

Leverage exposure, € bn

Risk-weighted assets, € bn

Provision for credit losses, bps of

average loans³

Performance measures and ratios

Net interest margin

Cost/income ratio

ROTE4

Q1 2023

Note: for footnotes refer to slides 45 and 46

Deutsche Bank

Investor Relations

1,973

1,973

64

1,086

1,083

887

822

121

269

310

74

21

4.1%

55%

18.3%

A vs.

A vs.

Q1 2022 Q4 2022

35%

35%

(57)%

2%

2%

125%

n.m.

(3)%

(1)%

2%

(0)%

(7)%

(3)%

(1)%

(27)bps 3bps

12%

12%

16%

11%

10%

13%

13%

4%

1.7ppt 0.8ppt

(18)ppt

(0)ppt

12.4ppt 1.6ppt

Q1 2023 results

April 27, 2023

Revenue performance

Corporate

Treasury

Services

Client Services

Institutional

Business

Banking

Corporate

Bank

447

337

1,188

A vs. Q1

2022

XX% Excluding specific items¹

32% 32%

28% 28%

59% 59%

1,973 35%

35%

Key highlights

/

Highest quarterly revenues since the

formation of the Corporate Bank with

revenue growth across all regions and

business units

Revenues significantly higher year on year

driven by increased interest rates and

continued pricing discipline, with strong

momentum in Cash Management businesses

across all client segments and in Corporate

Trust (ICS)

Contained provision for credit losses despite

more challenging macroeconomic

environment and primarily driven by one

larger stage 3 event

Noninterest expenses increased year on year

driven by higher service costs, partly offset

by lower SRF contribution

Loans flat sequentially, despite the pressure

from higher interest rates

19View entire presentation