UBS Results Presentation Deck

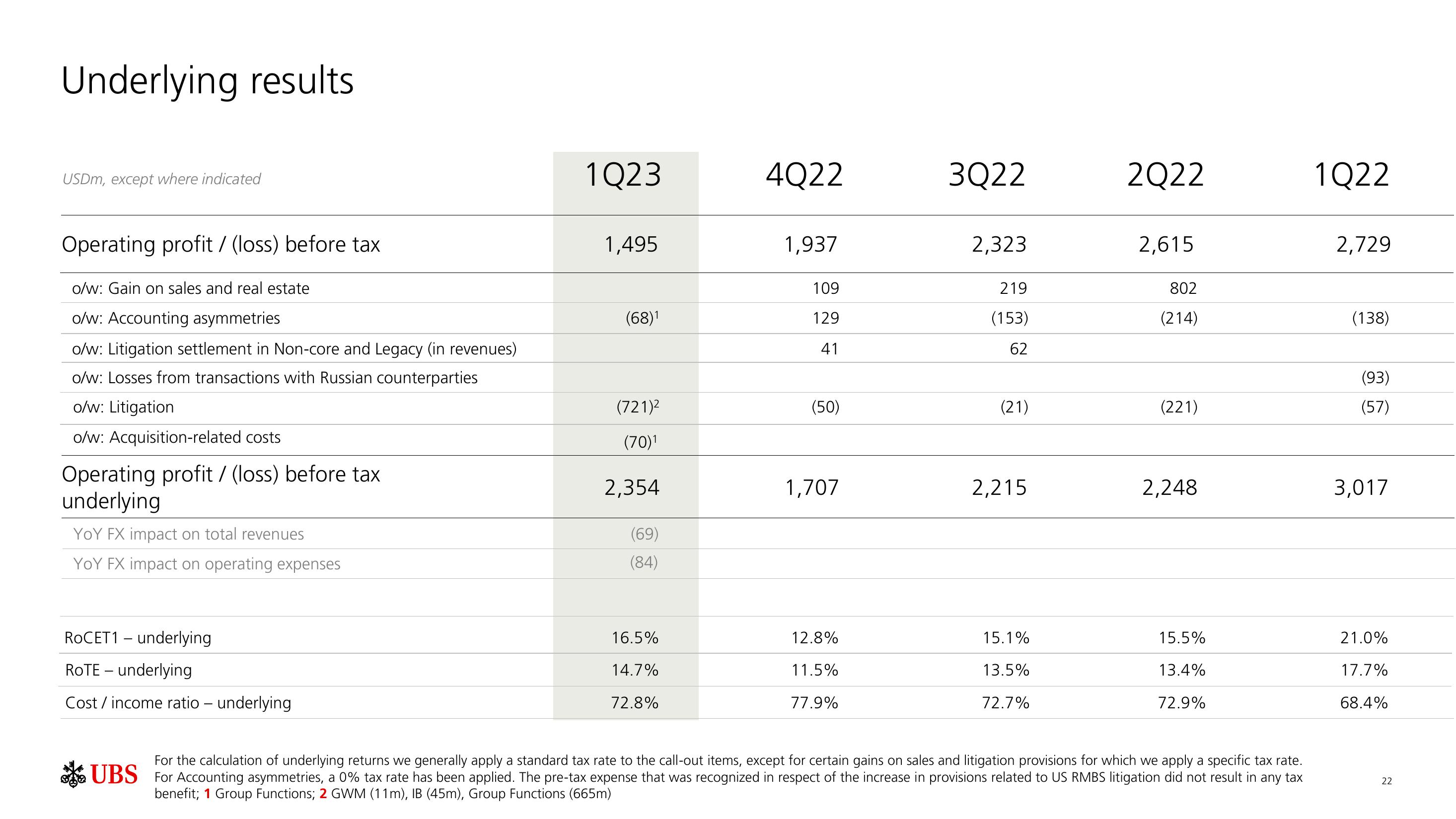

Underlying results

USDm, except where indicated

Operating profit/ (loss) before tax

o/w: Gain on sales and real estate

o/w: Accounting asymmetries

o/w: Litigation settlement in Non-core and Legacy (in revenues)

o/w: Losses from transactions with Russian counterparties

o/w: Litigation

o/w: Acquisition-related costs

Operating profit/ (loss) before tax

underlying

YOY FX impact on total revenues

YOY FX impact on operating expenses

ROCET1 underlying

ROTE underlying

Cost/ income ratio- underlying

1Q23

1,495

(68)1

(721)²

(70)¹

2,354

(69)

(84)

16.5%

14.7%

72.8%

4Q22

1,937

109

129

41

(50)

1,707

12.8%

11.5%

77.9%

3Q22

2,323

219

(153)

62

(21)

2,215

15.1%

13.5%

72.7%

2Q22

2,615

802

(214)

(221)

2,248

15.5%

13.4%

72.9%

For the calculation of underlying returns we generally apply a standard tax rate to the call-out items, except for certain gains on sales and litigation provisions for which we apply a specific tax rate.

UBS For Accounting asymmetries, a 0% tax rate has been applied. The pre-tax expense that was recognized in respect of the increase in provisions related to US RMBS litigation did not result in any tax

benefit; 1 Group Functions; 2 GWM (11m), IB (45m), Group Functions (665m)

1Q22

2,729

(138)

(93)

(57)

3,017

21.0%

17.7%

68.4%

22View entire presentation