Baird Investment Banking Pitch Book

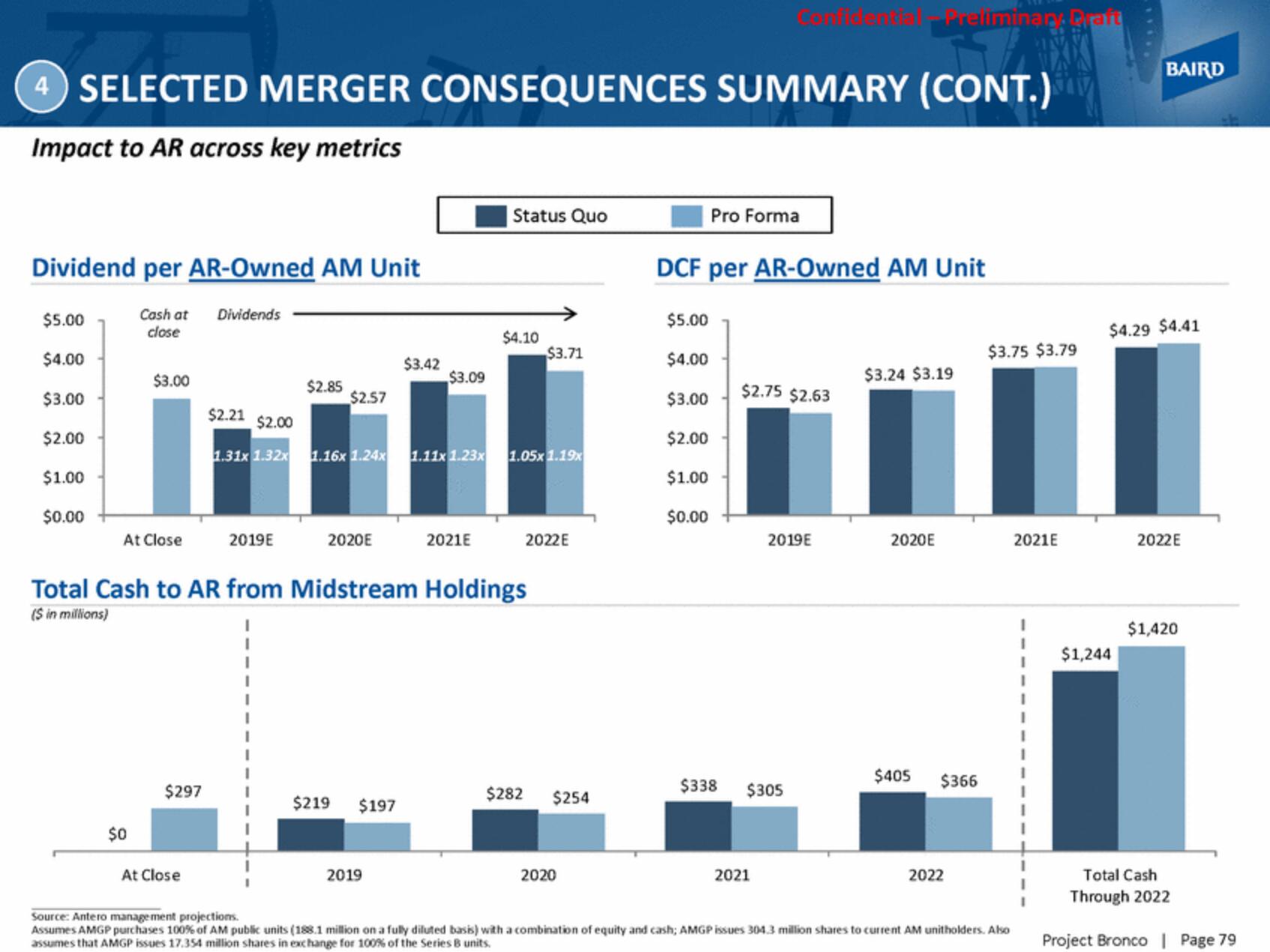

4 SELECTED MERGER CONSEQUENCES SUMMARY (CONT.)

Impact to AR across key metrics

Dividend per AR-Owned AM Unit

Cash at Dividends

close

$5.00

$4.00

$3.00

$2.00

$1.00

$0.00

$3.00

At Close

$0

$297

At Close

$2.85

2019E

$2.57

2020E

$219

$3.42

$2.21 $2.00

1.31x 1.32x 1.16x 1.24x 1.11x1.23x 1.05x 1.19x

$197

$3.09

Total Cash to AR from Midstream Holdings

($ in millions)

2019

Status Quo

2021E

$4.10

$3.71

$282

2022E

$254

2020

$5.00

Pro Forma

DCF per AR-Owned AM Unit

$4.00

$3.00

$2.00

$1.00

$0.00

$338

$2.75 $2.63

2019E

$305

2021

Telliminan. Draft

$3.24 $3.19

2020E

$405

$366

2022

$3.75 $3.79

Source: Antero management projections.

Assumes AMGP purchases 100% of AM public units (188.1 million on a fully diluted basis) with a combination of equity and cash; AMGP issues 304.3 million shares to current AM unitholders. Also

assumes that AMGP issues 17.354 million shares in exchange for 100% of the Series B units.

2021E

BAIRD

$4.29 $4.41

$1,244

2022E

$1,420

Total Cash

Through 2022

Project Bronco | Page 79View entire presentation