Ready Capital Investor Presentation Deck

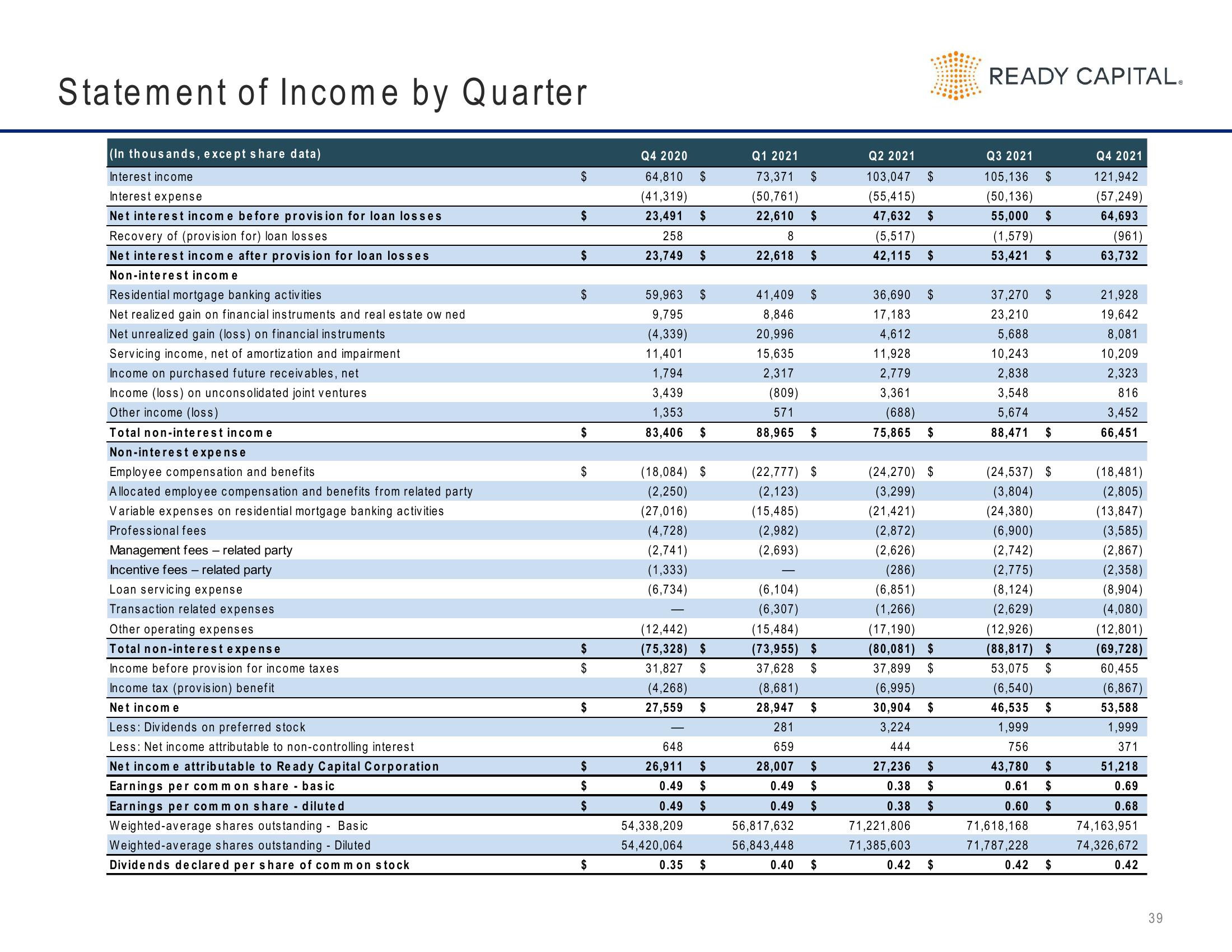

Statement of Income by Quarter

(In thousands, except share data)

Interest income

Interest expense

Net interest income before provision for loan losses

Recovery of (provision for) loan losses

Net interest income after provision for loan losses

Non-interest income

Residential mortgage banking activities

Net realized gain on financial instruments and real estate ow ned

Net unrealized gain (loss) on financial instruments

Servicing income, net of amortization and impairment

Income on purchased future receivables, net

Income (loss) on unconsolidated joint ventures

Other income (loss)

Total non-interest income

Non-interest expense

Employee compensation and benefits

Allocated employee compensation and benefits from related party

Variable expenses on residential mortgage banking activities

Professional fees

Management fees - related party

Incentive fees - related party

Loan servicing expense

Transaction related expenses

Other operating expenses

Total non-interest expense

Income before provision for income taxes

Income tax (provision) benefit

Net income

Less: Dividends on preferred stock

Less: Net income attributable to non-controlling interest

Net income attributable to Ready Capital Corporation

Earnings per common share basic

Earnings per common share - diluted

Weighted-average shares outstanding Basic

Weighted-average shares outstanding - Diluted

Dividends declared per share of common stock

$

$

$

$

$

$

$

$

$

$

$

$

$

Q4 2020

64,810

(41,319)

23,491

258

23,749 $

59,963

9,795

(4,339)

11,401

1,794

3,439

1,353

83,406

$

(27,016)

(4,728)

(2,741)

(1,333)

(6,734)

$

$

$

(18,084) $

(2,250)

(12,442)

(75,328) $

31,827 $

(4,268)

27,559

$

648

26,911 $

0.49 $

0.49 $

54,338,209

54,420,064

0.35 $

Q1 2021

73,371

(50,761)

22,610 $

8

22,618 $

41,409

8,846

20,996

15,635

2,317

$

$

(809)

571

88,965 $

(22,777) $

(2,123)

(15,485)

(2,982)

(2,693)

(6,104)

(6,307)

(15,484)

(73,955) $

37,628 $

(8,681)

28,947

281

659

28,007 $

0.49 $

0.49 $

$

56,817,632

56,843,448

0.40 $

Q2 2021

103,047

(55,415)

47,632

(5,517)

42,115

36,690

17,183

4,612

11,928

2,779

3,361

$

$

$

$

(688)

75,865 $

(24,270) $

(3,299)

(21,421)

(2,872)

(2,626)

(286)

(6,851)

(1,266)

(17,190)

(80,081) $

37,899 $

(6,995)

30,904 $

3,224

444

27,236 $

0.38 $

0.38 $

71,221,806

71,385,603

0.42 $

READY CAPITAL.

Q3 2021

105,136

(50,136)

55,000 $

(1,579)

53,421

$

$

$

37,270

23,210

5,688

10,243

2,838

3,548

5,674

88,471 $

(24,537) $

(3,804)

(24,380)

(6,900)

(2,742)

(2,775)

(8,124)

(2,629)

(12,926)

(88,817) $

53,075 $

(6,540)

46,535 $

1,999

756

43,780 $

0.61 $

0.60 $

71,618,168

71,787,228

0.42 $

Q4 2021

121,942

(57,249)

64,693

(961)

63,732

21,928

19,642

8,081

10,209

2,323

816

3,452

66,451

(18,481)

(2,805)

(13,847)

(3,585)

(2,867)

(2,358)

(8,904)

(4,080)

(12,801)

(69,728)

60,455

(6,867)

53,588

1,999

371

51,218

0.69

0.68

74,163,951

74,326,672

0.42

39View entire presentation