BlackRock Global Long/Short Credit Absolute Return Credit

GLSC Seeks to Isolate Credit Risk

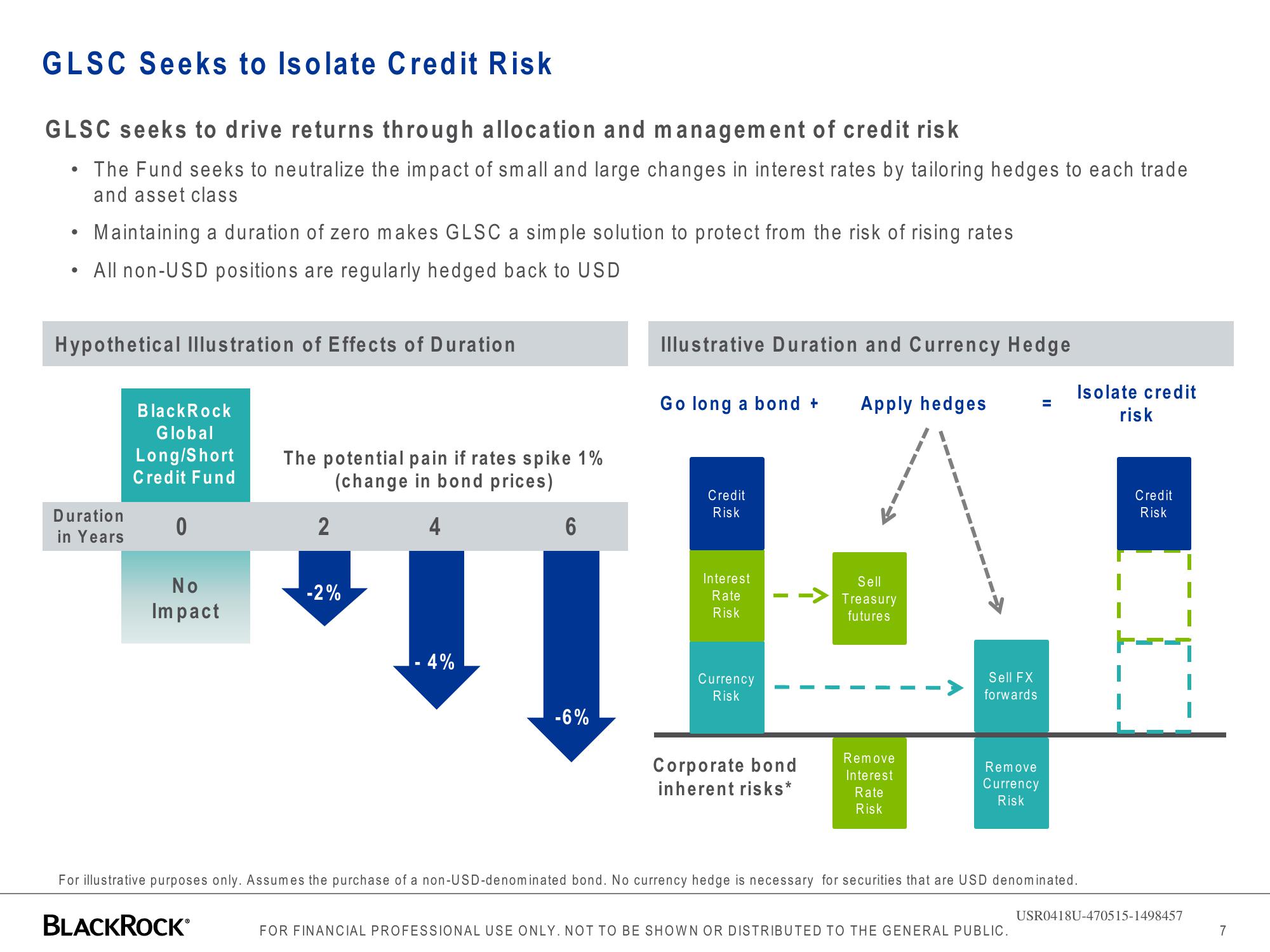

GLSC seeks to drive returns through allocation and management of credit risk

The Fund seeks to neutralize the impact of small and large changes in interest rates by tailoring hedges to each trade

and asset class

●

Maintaining a duration of zero makes GLSC a simple solution to protect from the risk of rising rates

All non-USD positions are regularly hedged back to USD

Hypothetical Illustration of Effects of Duration

Duration

in Years

BlackRock

Global

Long/Short

Credit Fund

0

No

Impact

The potential pain if rates spike 1%

(change in bond prices)

2

-2%

- 4%

6

-6%

Illustrative Duration and Currency Hedge

Go long a bond +

Credit

Risk

Interest

Rate

Risk

Currency

Risk

Apply hedges

Sell

--> Treasury

futures

Corporate bond

inherent risks*

Remove

Interest

Rate

Risk

Sell FX

forwards

Remove

Currency

Risk

=

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT TO BE SHOWN OR DISTRIBUTED TO THE GENERAL PUBLIC.

Isolate credit

risk

For illustrative purposes only. Assumes the purchase of a non-USD-denominated bond. No currency hedge is necessary for securities that are USD denominated.

BLACKROCK*

Credit

Risk

USR0418U-470515-1498457

7View entire presentation