SoftBank Results Presentation Deck

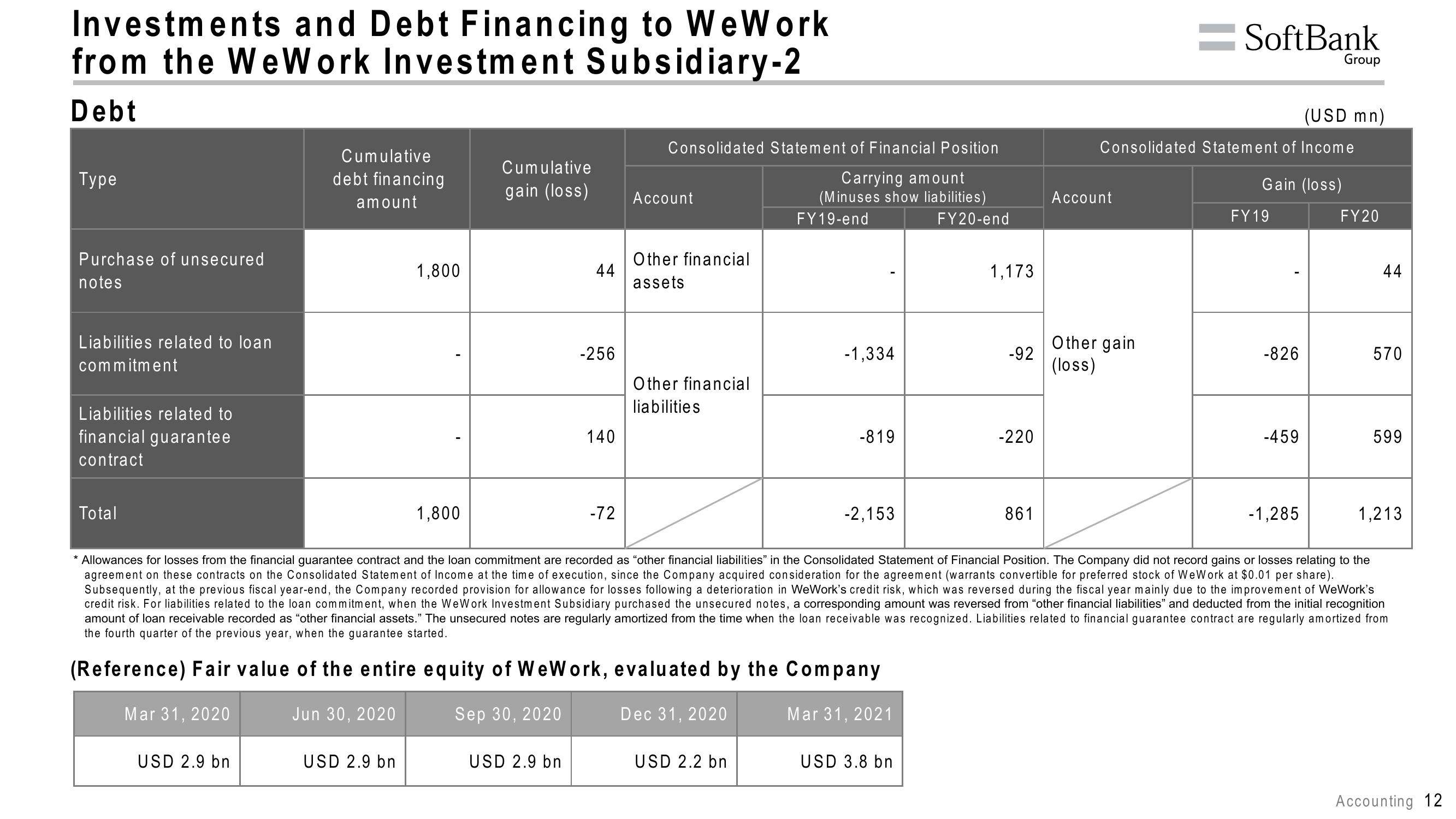

Investments and Debt Financing to WeWork

from the WeWork Investment Subsidiary-2

Debt

Type

Purchase of unsecured

notes

Liabilities related to loan

commitment

Liabilities related to

financial guarantee

contract

Total

Cumulative

debt financing

amount

USD 2.9 bn

1,800

USD 2.9 bn

1,800

Cumulative

gain (loss)

44

-256

USD 2.9 bn

140

-72

Consolidated Statement of Financial Position

Carrying amount

(Minuses show liabilities)

FY19-end

Account

Other financial

assets

Other financial

liabilities

-1,334

Dec 31, 2020

-819

equity of WeWork, evaluated by the Company

Sep 30, 2020

Mar 31, 2021

USD 2.2 bn

-2,153

FY20-end

USD 3.8 bn

1,173

-92

-220

861

Account

SoftBank

Other gain

(loss)

Consolidated Statement of Income

Gain (loss)

FY19

-826

-459

Group

-1,285

(USD mn)

* Allowances for losses from the financial guarantee contract and the loan commitment are recorded as "other financial liabilities" in the Consolidated Statement of Financial Position. The Company did not record gains or losses relating to the

agreement on these contracts on the Consolidated Statement of Income at the time of execution, since the Company acquired consideration for the agreement (warrants convertible for preferred stock of WeWork at $0.01 per share).

Subsequently, at the previous fiscal year-end, the Company recorded provision for allowance for losses following a deterioration in WeWork's credit risk, which was reversed during the fiscal year mainly due to the improvement of WeWork's

credit risk. For liabilities related to the loan commitment, when the WeWork Investment Subsidiary purchased the unsecured notes, a corresponding amount was reversed from "other financial liabilities" and deducted from the initial recognition

amount of loan receivable recorded as "other financial assets." The unsecured notes are regularly amortized from the time when the loan receivable was recognized. Liabilities related to financial guarantee contract are regularly amortized from

the fourth quarter of the previous year, when the guarantee started.

(Reference) Fair value of the entire

Mar 31, 2020

Jun 30, 2020

FY20

44

570

599

1,213

Accounting 12View entire presentation