Comcast Results Presentation Deck

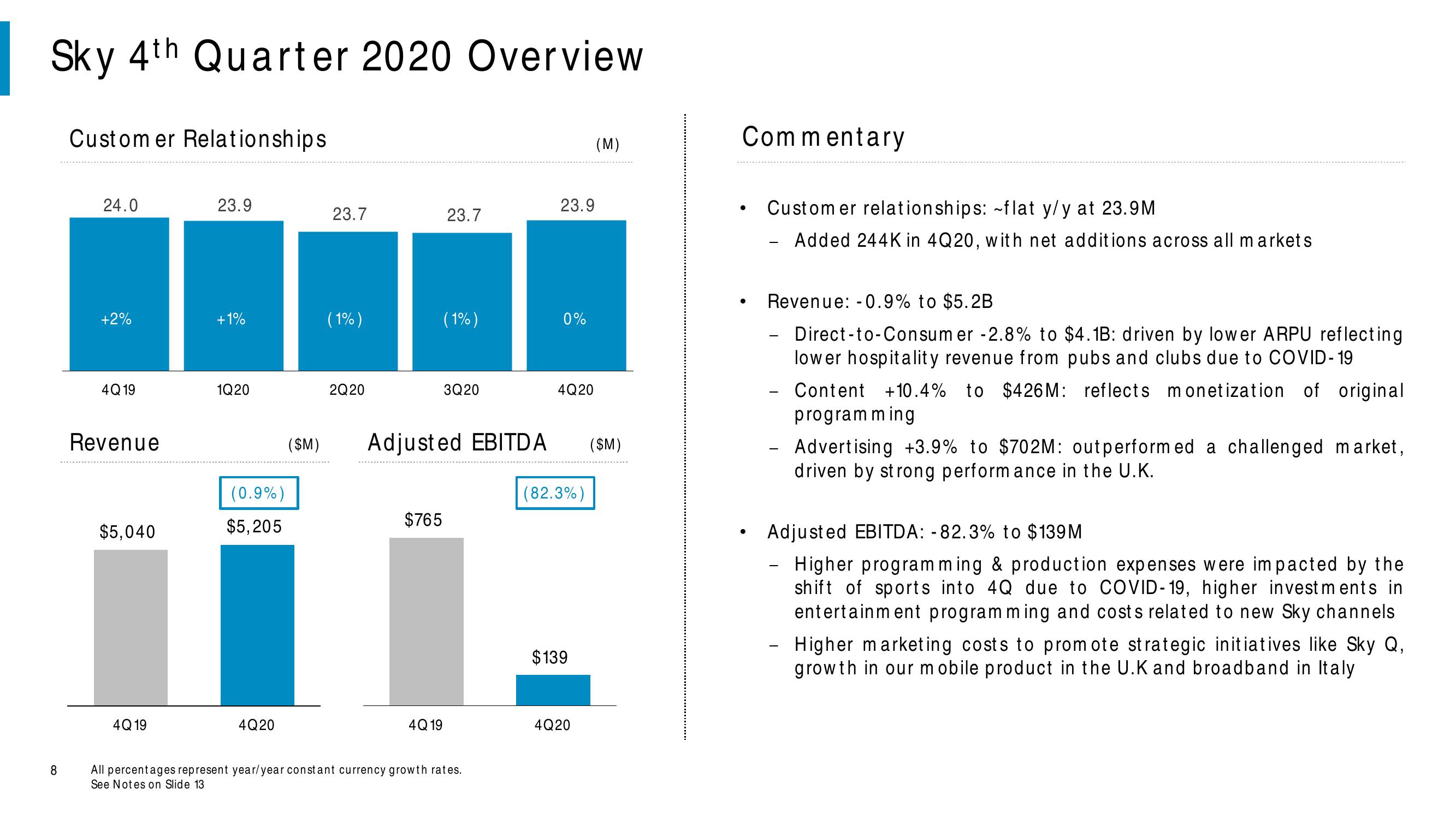

Sky 4th Quarter 2020 Overview

8

Customer Relationships

24.0

+2%

4Q 19

Revenue

$5,040

4Q 19

23.9

+1%

1Q20

(0.9%)

$5,205

4Q20

23.7

(1%)

2Q20

(1%)

23.7

$765

4Q 19

3Q20

All percentages represent year/year constant currency growth rates.

See Notes on Slide 13

23.9

0%

($M) Adjusted EBITDA ($M)

4Q20

(82.3%)

(M)

$139

4Q20

Commentary

●

●

Customer relationships: ~flat y/y at 23.9M

Added 244K in 4Q20, with net additions across all markets

-

Revenue: -0.9% to $5.2B

Direct-to-Consumer -2.8% to $4.1B: driven by lower ARPU reflecting

lower hospitality revenue from pubs and clubs due to COVID-19

Content +10.4% to $426M: reflects monetization of original

programming

Advertising +3.9% to $702M: outperformed a challenged market,

driven by strong performance in the U.K.

-

Adjusted EBITDA: -82.3% to $139M

Higher programming & production expenses were impacted by the

shift of sports into 4Q due to COVID-19, higher investments in

entertainment programming and costs related to new Sky channels

-

- Higher marketing costs to promote strategic initiatives like Sky Q,

growth in our mobile product in the U.K and broadband in ItalyView entire presentation