Atalaya Risk Management Overview

Underwriting & Asset Management

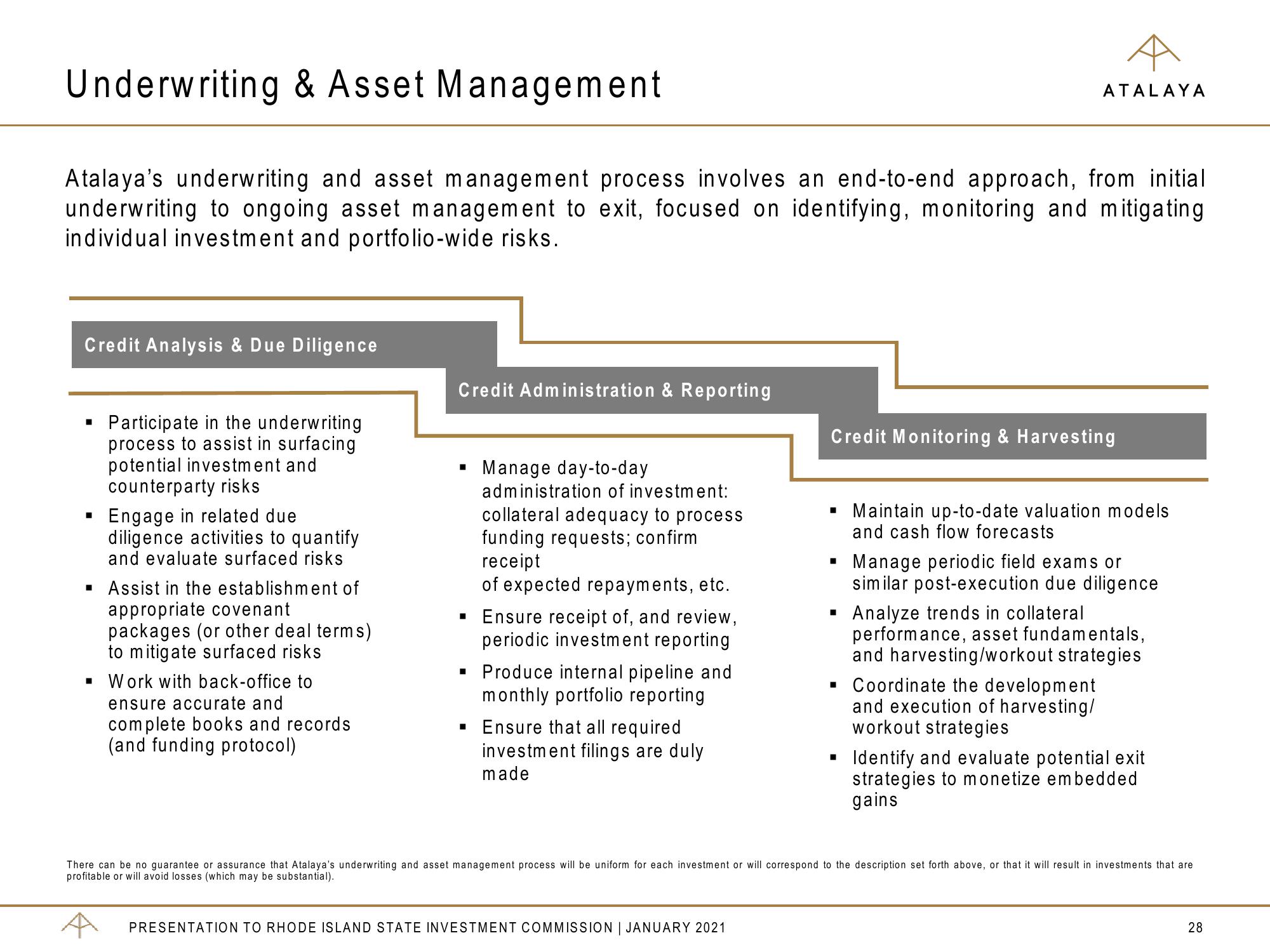

Atalaya's underwriting and asset management process involves an end-to-end approach, from initial

underwriting to ongoing asset management to exit, focused on identifying, monitoring and mitigating

individual investment and portfolio-wide risks.

Credit Analysis & Due Diligence

Participate in the underwriting

process to assist in surfacing

potential investment and

counterparty risks

Engage in related due

diligence activities to quantify

and evaluate surfaced risks

▪ Assist in the establishment of

appropriate covenant

packages (or other deal terms)

to mitigate surfaced risks

▪ Work with back-office to

ensure accurate and

complete books and records

(and funding protocol)

Credit Administration & Reporting

Manage day-to-day

administration of investment:

collateral adequacy to process

funding requests; confirm

receipt

of expected repayments, etc.

▪ Ensure receipt of, and review,

periodic investment reporting

■

▪ Produce internal pipeline and

monthly portfolio reporting

▪ Ensure that all required

investment filings are duly

made

PRESENTATION TO RHODE ISLAND STATE INVESTMENT COMMISSION | JANUARY 2021

Credit Monitoring & Harvesting

I

I

ATALAYA

■

Maintain up-to-date valuation models

and cash flow forecasts

Manage periodic field exams or

similar post-execution due diligence

Analyze trends in collateral

performance, asset fundamentals,

and harvesting/workout strategies

Coordinate the development

and execution of harvesting/

workout strategies

Identify and evaluate potential exit

strategies to monetize embedded

gains

There can be no guarantee or assurance that Atalaya's underwriting and asset management process will be uniform for each investment or will correspond to the description set forth above, or that it will result in investments that are

profitable or will avoid losses (which may be substantial).

28View entire presentation