Nikola Results Presentation Deck

1 5

PAGE

NIKOLA

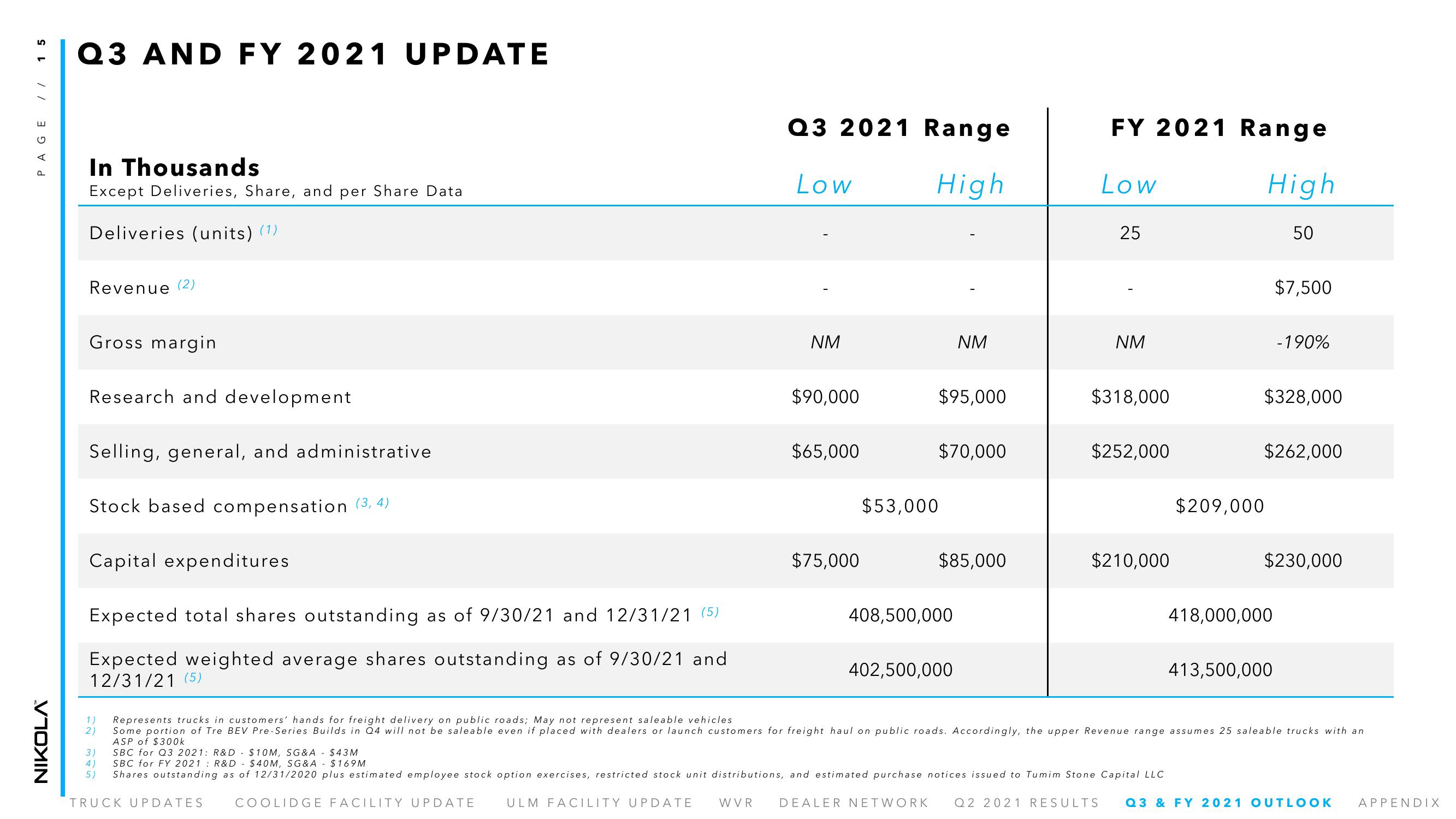

Q3 AND FY 2021 UPDATE

In Thousands

Except Deliveries, Share, and per Share Data

Deliveries (units) (1)

Revenue (2)

Gross margin

Research and development

Selling, general, and administrative

Stock based compensation (3, 4)

Capital expenditures

Expected total shares outstanding as of 9/30/21 and 12/31/21 (5)

Expected weighted average shares outstanding as of 9/30/21 and

12/31/21 (5)

Q3 2021 Range

Low

High

TRUCK UPDATES

NM

COOLIDGE FACILITY UPDATE

$90,000

$65,000

$75,000

$53,000

$95,000

$70,000

NM

$85,000

408,500,000

402,500,000

FY 2021 Range

Low

High

25

NM

$318,000

$252,000

$210,000

4) SBC for FY 2021 R&D - $40M, SG&A - $169M

(5)

Shares outstanding as of 12/31/2020 plus estimated employee stock option exercises, restricted stock unit distributions, and estimated purchase notices issued to Tumim Stone Capital LLC

$209,000

50

$7,500

$328,000

418,000,000

-190%

$262,000

413,500,000

$230,000

1) Represents trucks in customers' hands for freight delivery on public roads; May not represent saleable vehicles

2)

Some portion of Tre BEV Pre-Series Builds in Q4 will not be saleable even if placed with dealers or launch customers for freight haul on public roads. Accordingly, the upper Revenue range assumes 25 saleable trucks with an

ASP of $300k

3) SBC for Q3 2021: R&D - $10M, SG&A - $43M

ULM FACILITY UPDATE WVR DEALER NETWORK Q2 2021 RESULTS Q3 & FY 2021 OUTLOOK APPENDIXView entire presentation