Vale Results Presentation Deck

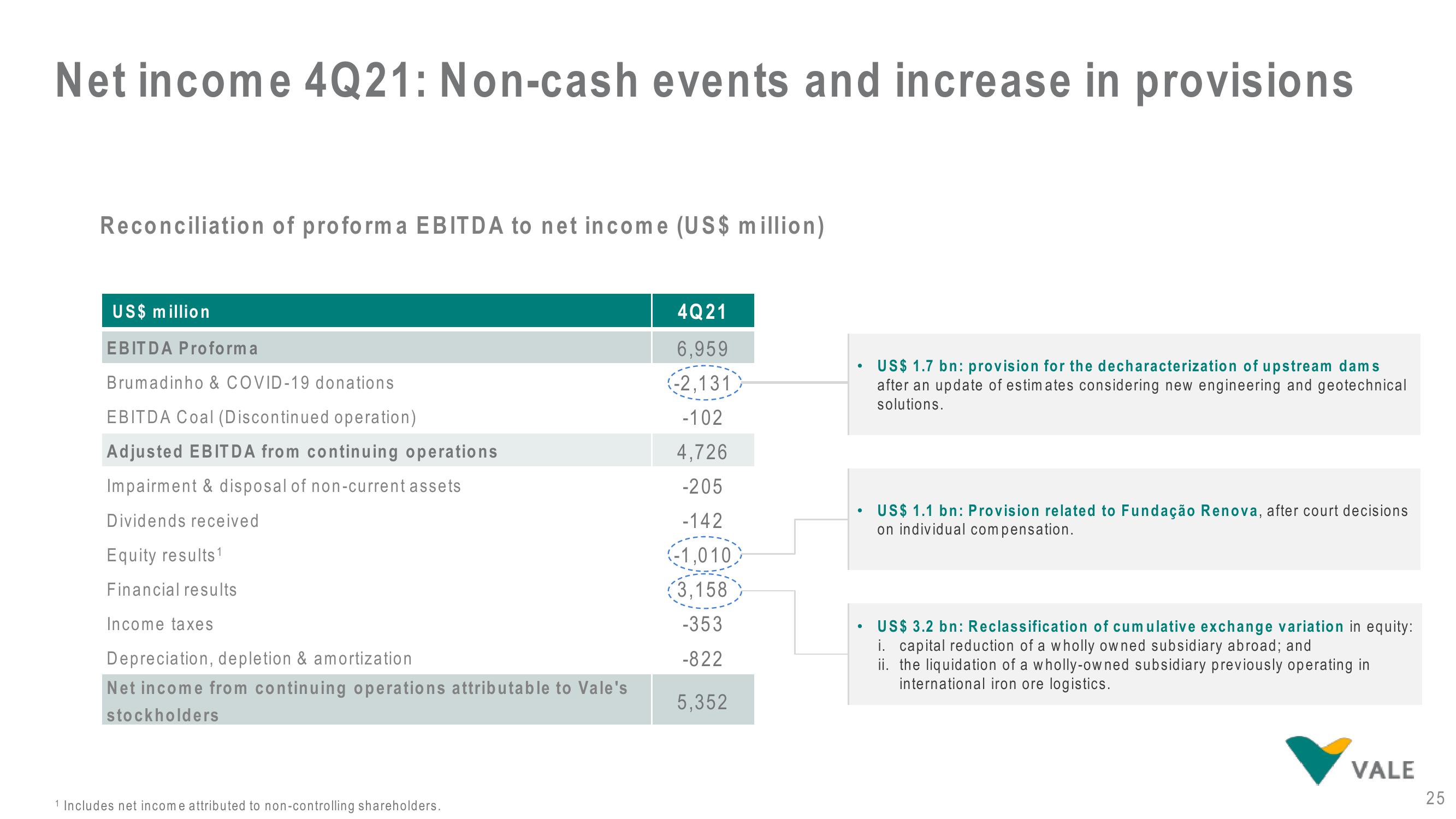

Net income 4Q21: Non-cash events and increase in provisions

Reconciliation of proforma EBITDA to net income (US$ million)

US$ million

EBITDA Proforma

Brumadinho & COVID-19 donations

EBITDA Coal (Discontinued operation)

Adjusted EBITDA from continuing operations

Impairment & disposal of non-current assets

Dividends received

Equity results ¹

Financial results

Income taxes

Depreciation, depletion & amortization

Net income from continuing operations attributable to Vale's

stockholders

1 Includes net income attributed to non-controlling shareholders.

4Q21

6.959

-2,131)

-102

4,726

-205

-142

(-1,010)

(3,158

-353

-822

5,352

●

●

●

US$ 1.7 bn: provision for the decharacterization of upstream dams

after an update of estimates considering new engineering and geotechnical

solutions.

US$ 1.1 bn: Provision related to Fundação Renova, after court decisions

on individual compensation.

US$ 3.2 bn: Reclassification of cumulative exchange variation in equity:

i. capital reduction of a wholly owned subsidiary abroad; and

ii. the liquidation of a wholly-owned subsidiary previously operating in

international iron ore logistics.

VALE

25View entire presentation