Apollo Global Management Investor Day Presentation Deck

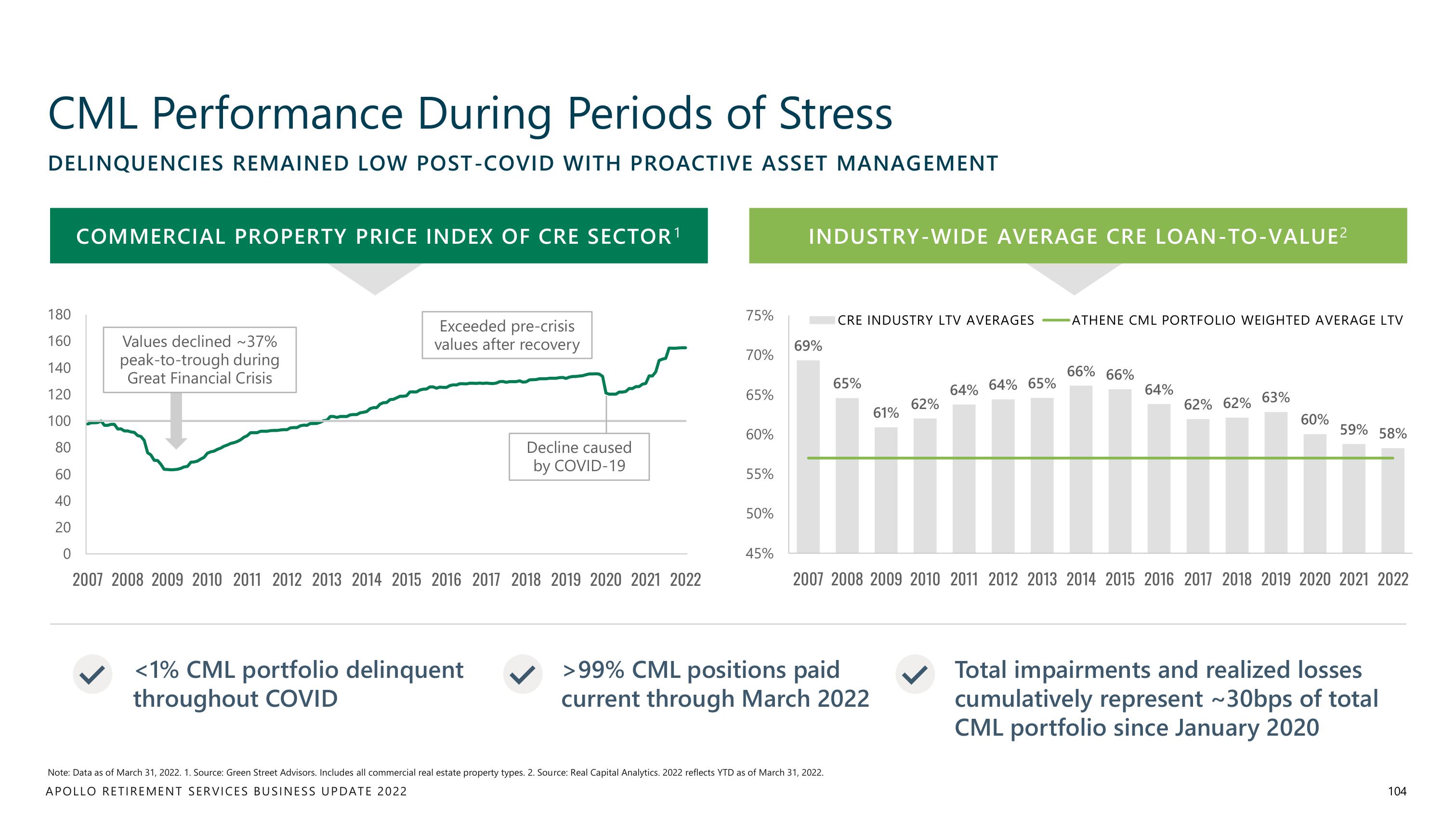

CML Performance During Periods of Stress

DELINQUENCIES REMAINED LOW POST-COVID WITH PROACTIVE ASSET MANAGEMENT

180

160

140

120

100

80

60

40

20

0

COMMERCIAL PROPERTY PRICE INDEX OF CRE SECTOR ¹

Values declined ~37%

peak-to-trough during

Great Financial Crisis

Exceeded pre-crisis

values after recovery

Decline caused

by COVID-19

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

<1% CML portfolio delinquent

throughout COVID

75%

70%

65%

60%

55%

50%

45%

INDUSTRY-WIDE AVERAGE CRE LOAN-TO-VALUE²

69%

CRE INDUSTRY LTV AVERAGES

65%

Note: Data as of March 31, 2022. 1. Source: Green Street Advisors. Includes all commercial real estate property types. 2. Source: Real Capital Analytics. 2022 reflects YTD as of March 31, 2022.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

>99% CML positions paid

current through March 2022

61%

62%

64% 64% 65%

ATHENE CML PORTFOLIO WEIGHTED AVERAGE LTV

66% 66%

64%

62% 62% 63%

60%

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

59% 58%

Total impairments and realized losses

cumulatively represent ~30bps of total

CML portfolio since January 2020

104View entire presentation