NioCorp SPAC Presentation Deck

Transaction Summary

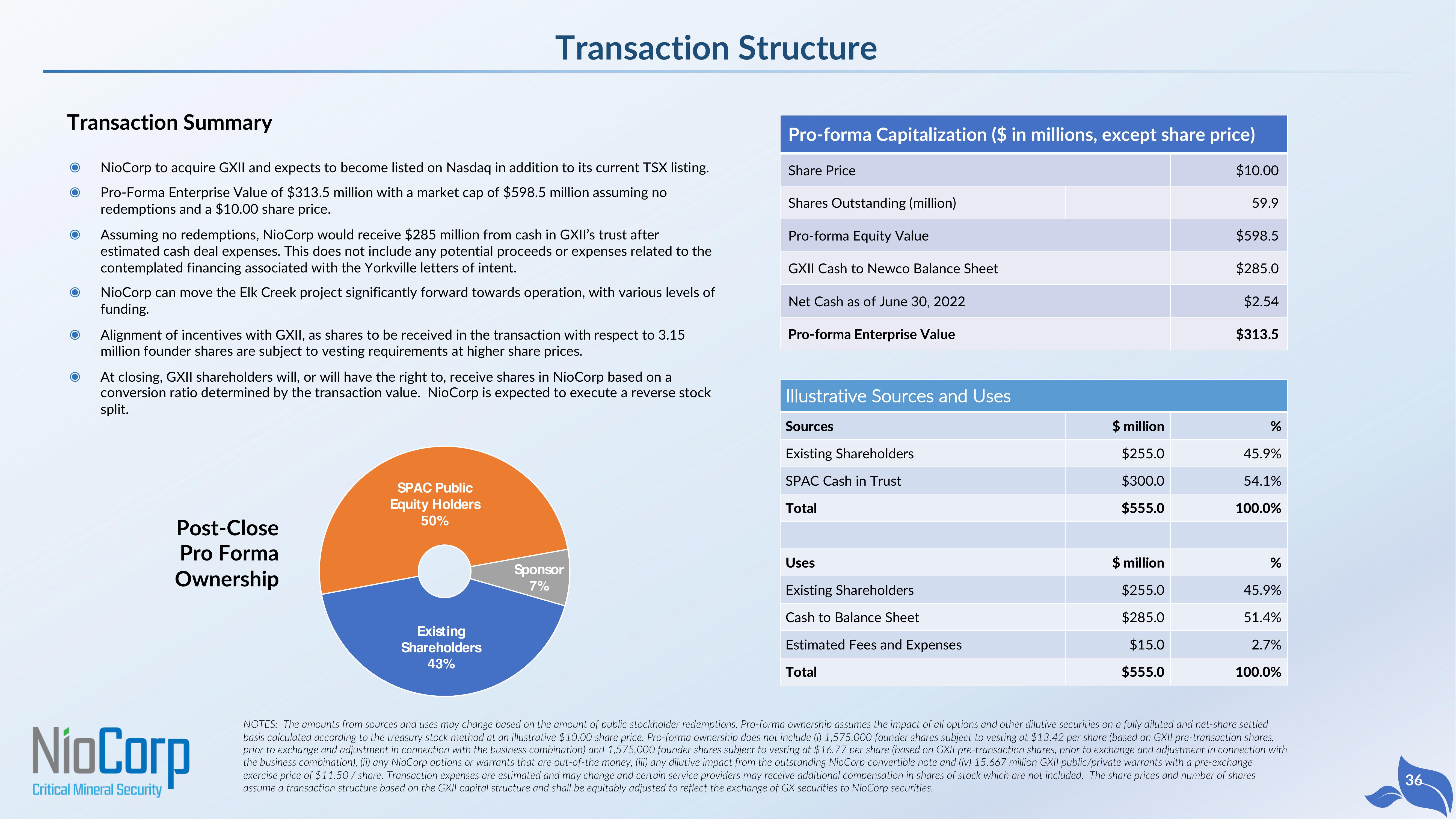

NioCorp to acquire GXII and expects to become listed on Nasdaq in addition to its current TSX listing.

Pro-Forma Enterprise Value of $313.5 million with a market cap of $598.5 million assuming no

redemptions and a $10.00 share price.

Assuming no redemptions, NioCorp would receive $285 million from cash in GXII's trust after

estimated cash deal expenses. This does not include any potential proceeds or expenses related to the

contemplated financing associated with the Yorkville letters of intent.

NioCorp can move the Elk Creek project significantly forward towards operation, with various levels of

funding.

Transaction Structure

Alignment of incentives with GXII, as shares to be received in the transaction with respect to 3.15

million founder shares are subject to vesting requirements at higher share prices.

At closing, GXII shareholders will, or will have the right to, receive shares in NioCorp based on a

conversion ratio determined by the transaction value. NioCorp is expected to execute a reverse stock

split.

Post-Close

Pro Forma

Ownership

NioCorp

Critical Mineral Security

SPAC Public

Equity Holders

50%

Existing

Shareholders

43%

Sponsor

7%

Pro-forma Capitalization ($ in millions, except share price)

Share Price

Shares Outstanding (million)

Pro-forma Equity Value

GXII Cash to Newco Balance Sheet

Net Cash as of June 30, 2022

Pro-forma Enterprise Value

Illustrative Sources and Uses

Sources

Existing Shareholders

SPAC Cash in Trust

Total

Uses

Existing Shareholders

Cash to Balance Sheet

Estimated Fees and Expenses

Total

$ million

$255.0

$300.0

$555.0

$ million

$255.0

$285.0

$15.0

$555.0

$10.00

59.9

$598.5

$285.0

$2.54

$313.5

%

45.9%

54.1%

100.0%

%

45.9%

51.4%

2.7%

100.0%

NOTES: The amounts from sources and uses may change based on the amount of public stockholder redemptions. Pro-forma ownership assumes the impact of all options and other dilutive securities on a fully diluted and net-share settled

basis calculated according to the treasury stock method at an illustrative $10.00 share price. Pro-forma ownership does not include (i) 1,575,000 founder shares subject to vesting at $13.42 per share (based on GXII pre-transaction shares,

prior to exchange and adjustment in connection with the business combination) and 1,575,000 founder shares subject to vesting at $16.77 per share (based on GXII pre-transaction shares, prior to exchange and adjustment in connection with

the business combination), (ii) any NioCorp options or warrants that are out-of-the money, (iii) any dilutive impact from the outstanding NioCorp convertible note and (iv) 15.667 million GXII public/private warrants with a pre-exchange

exercise price of $11.50/share. Transaction expenses are estimated and may change and certain service providers may receive additional compensation in shares of stock which are not included. The share prices and number of shares

assume a transaction structure based on the GXII capital structure and shall be equitably adjusted to reflect the exchange of GX securities to NioCorp securities.

36View entire presentation