Silicon Valley Bank Results Presentation Deck

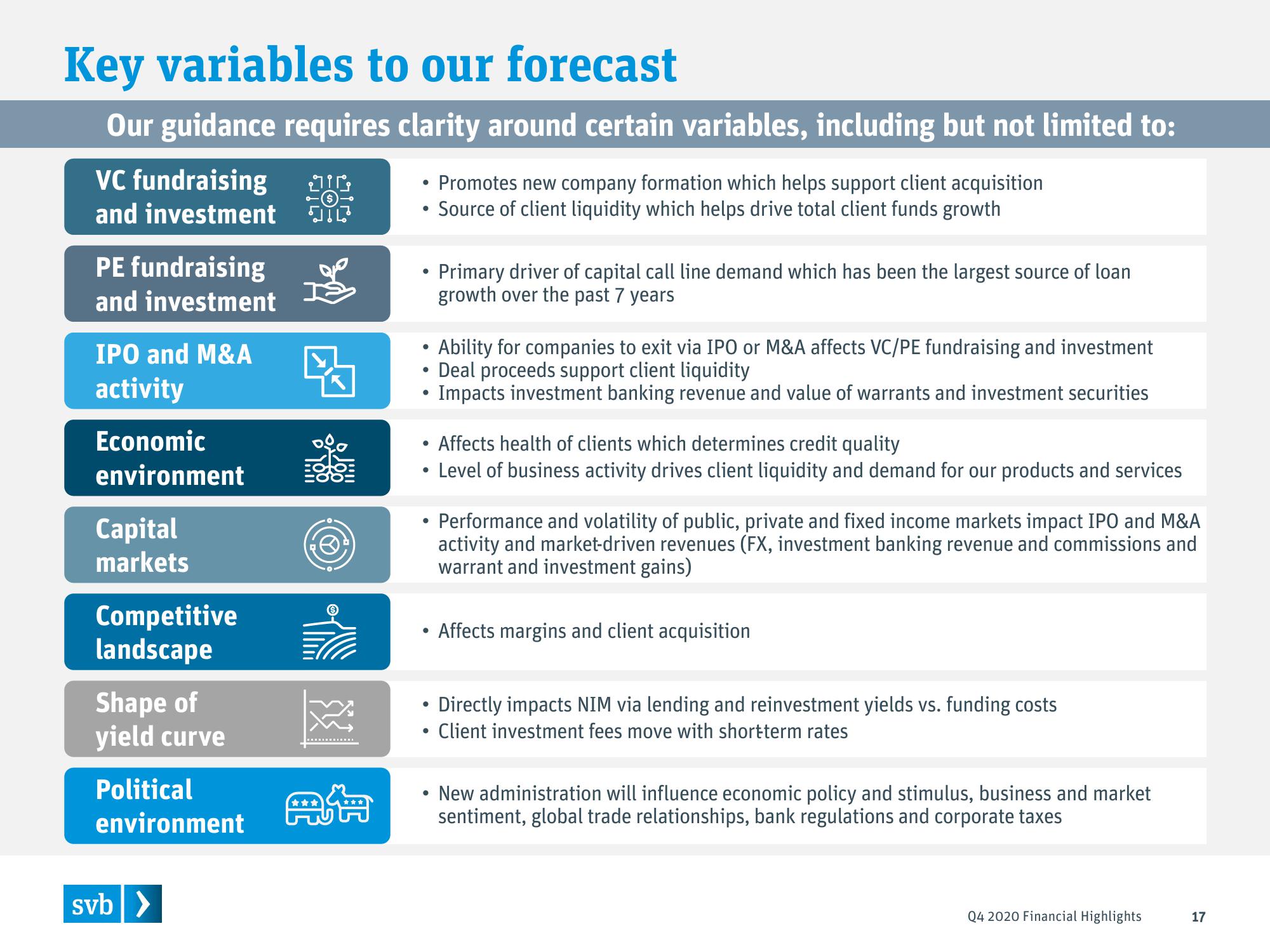

Key variables to our forecast

Our guidance requires clarity around certain variables, including but not limited to:

VC fundraising

ir

and investment i

PE fundraising

and investment

IPO and M&A

activity

Economic

environment

Capital

markets

Competitive

landscape

Shape of

yield curve

Political

environment

svb >

gal

X

ACH

●

●

●

●

●

●

●

Promotes new company formation which helps support client acquisition

Source of client liquidity which helps drive total client funds growth

Primary driver of capital call line demand which has been the largest source of loan

growth over the past 7 years

Ability for companies to exit via IPO or M&A affects VC/PE fundraising and investment

Deal proceeds support client liquidity

Impacts investment banking revenue and value of warrants and investment securities

Affects health of clients which determines credit quality

Level of business activity drives client liquidity and demand for our products and services

Performance and volatility of public, private and fixed income markets impact IPO and M&A

activity and market-driven revenues (FX, investment banking revenue and commissions and

warrant and investment gains)

Affects margins and client acquisition

Directly impacts NIM via lending and reinvestment yields vs. funding costs

Client investment fees move with shortterm rates

New administration will influence economic policy and stimulus, business and market

sentiment, global trade relationships, bank regulations and corporate taxes

Q4 2020 Financial Highlights

17View entire presentation