Momentus SPAC Presentation Deck

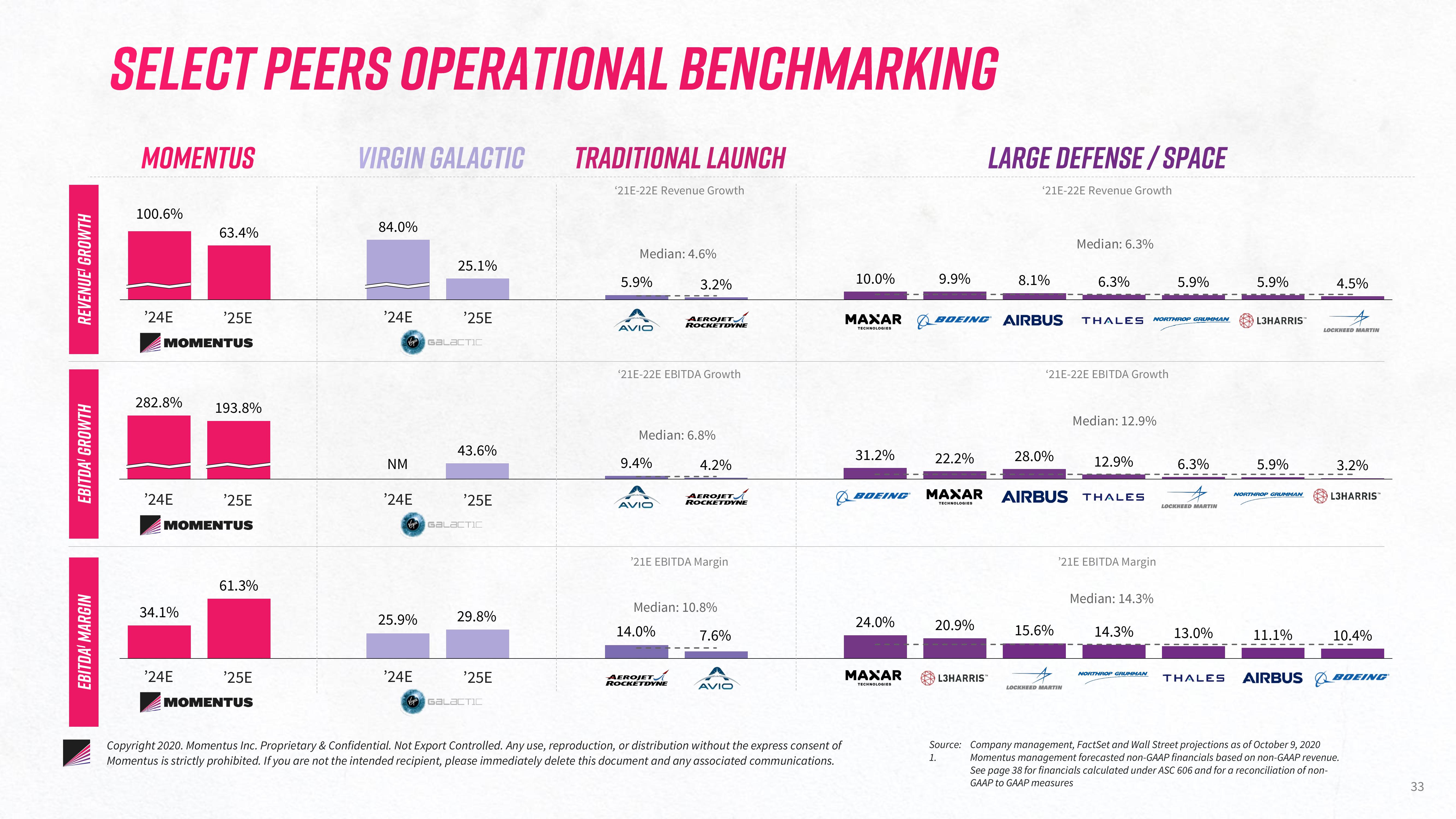

REVENUE GROWTH

EBITDA' GROWTH

EBITDA' MARGIN

SELECT PEERS OPERATIONAL BENCHMARKING

MOMENTUS

100.6%

'24E

282.8%

MOMENTUS

'24E

63.4%

34.1%

'25E

'24E

193.8%

MOMENTUS

'25E

61.3%

'25E

MOMENTUS

VIRGIN GALACTIC TRADITIONAL LAUNCH

84.0%

'24E

NM

'24E

25.9%

'24E

25.1%

'25E

GALACTIC

43.6%

'25E

GALACTIC

29.8%

'25E

GALACTIC

'21E-22E Revenue Growth

Median: 4.6%

5.9%

AVIO

'21E-22E EBITDA Growth

9.4%

Median: 6.8%

AVIO

3.2%

AEROJET

ROCKETDYNE

14.0%

AEROJET

ROCKETDYNE

4.2%

¹21E EBITDA Margin

AEROJET

ROCKETDYNE

Median: 10.8%

7.6%

AVIO

Copyright 2020. Momentus Inc. Proprietary & Confidential. Not Export Controlled. Any use, reproduction, or distribution without the express consent of

Momentus is strictly prohibited. If you are not the intended recipient, please immediately delete this document and any associated communications.

10.0%

31.2%

BOEING

MAXAR BOEING AIRBUS

TECHNOLOGIES

24.0%

9.9%

MAXAR

TECHNOLOGIES

22.2%

MAXAR

TECHNOLOGIES

LARGE DEFENSE/SPACE

'21E-22E Revenue Growth

20.9%

8.1%

L3HARRIS™

28.0%

Median: 6.3%

'21E-22E EBITDA Growth

15.6%

6.3%

LOCKHEED MARTIN

THALES NORTHROP GRUMMAN

Median: 12.9%

AIRBUS THALES

12.9%

'21E EBITDA Margin

Median: 14.3%

14.3%

5.9%

NORTHROP GRUMMAN

6.3%

LOCKHEED MARTIN

13.0%

5.9%

L3HARRIS™

5.9%

NORTHROP GRUMMAN

11.1%

4.5%

LOCKHEED MARTIN

3.2%

L3HARRIS

10.4%

THALES AIRBUS BOEING

1.

Source: Company management, FactSet and Wall Street projections as of October 9, 2020

Momentus management forecasted non-GAAP financials based on non-GAAP revenue.

See page 38 for financials calculated under ASC 606 and for a reconciliation of non-

GAAP to GAAP measures

33View entire presentation