Advent SPAC Presentation Deck

Pro Forma Sources, Uses & Equity Ownership

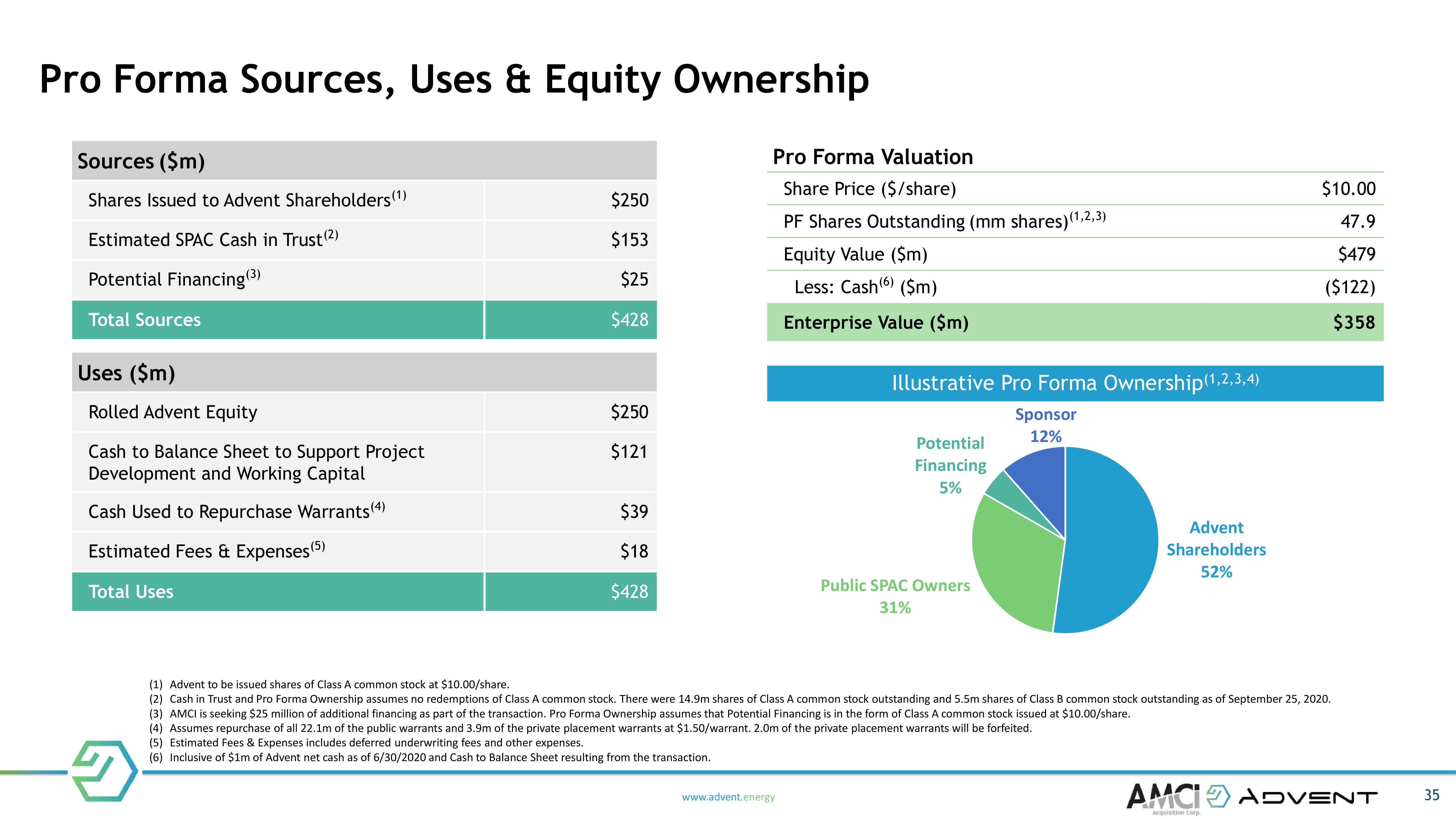

Sources ($m)

Shares Issued to Advent Shareholders (1)

Estimated SPAC Cash in Trust (2)

Potential Financing(³)

Total Sources

Uses ($m)

Rolled Advent Equity

Cash to Balance Sheet to Support Project

Development and Working Capital

Cash Used to Repurchase Warrants (4)

Estimated Fees & Expenses (5)

Total Uses

$250

$153

$25

$428

$250

$121

$39

$18

$428

Pro Forma Valuation

Share Price ($/share)

PF Shares Outstanding (mm shares) (1,2,3)

Equity Value ($m)

Less: Cash (6) ($m)

Enterprise Value ($m)

Illustrative Pro Forma Ownership(1,2,3,4)

Sponsor

12%

Potential

Financing

5%

www.advent.energy

Public SPAC Owners

31%

(4) Assumes repurchase of all 22.1m of the public warrants and 3.9m of the private placement warrants at $1.50/warrant. 2.0m of the private placement warrants will be forfeited.

(5) Estimated Fees & Expenses includes deferred underwriting fees and other expenses.

(6) Inclusive of $1m of Advent net cash as of 6/30/2020 and Cash to Balance Sheet resulting from the transaction.

Advent

Shareholders

52%

(1) Advent to be issued shares of Class A common stock at $10.00/share.

(2) Cash in Trust and Pro Forma Ownership assumes no redemptions of Class A common stock. There were 14.9m shares of Class A common stock outstanding and 5.5m shares of Class B common stock outstanding as of September 25, 2020.

(3) AMCI is seeking $25 million of additional financing as part of the transaction. Pro Forma Ownership assumes that Potential Financing is in the form of Class A common stock issued at $10.00/share.

$10.00

47.9

$479

($122)

$358

AMCI ADVENT

Acquisition Corp.

35View entire presentation