Q2 Quarter 2023

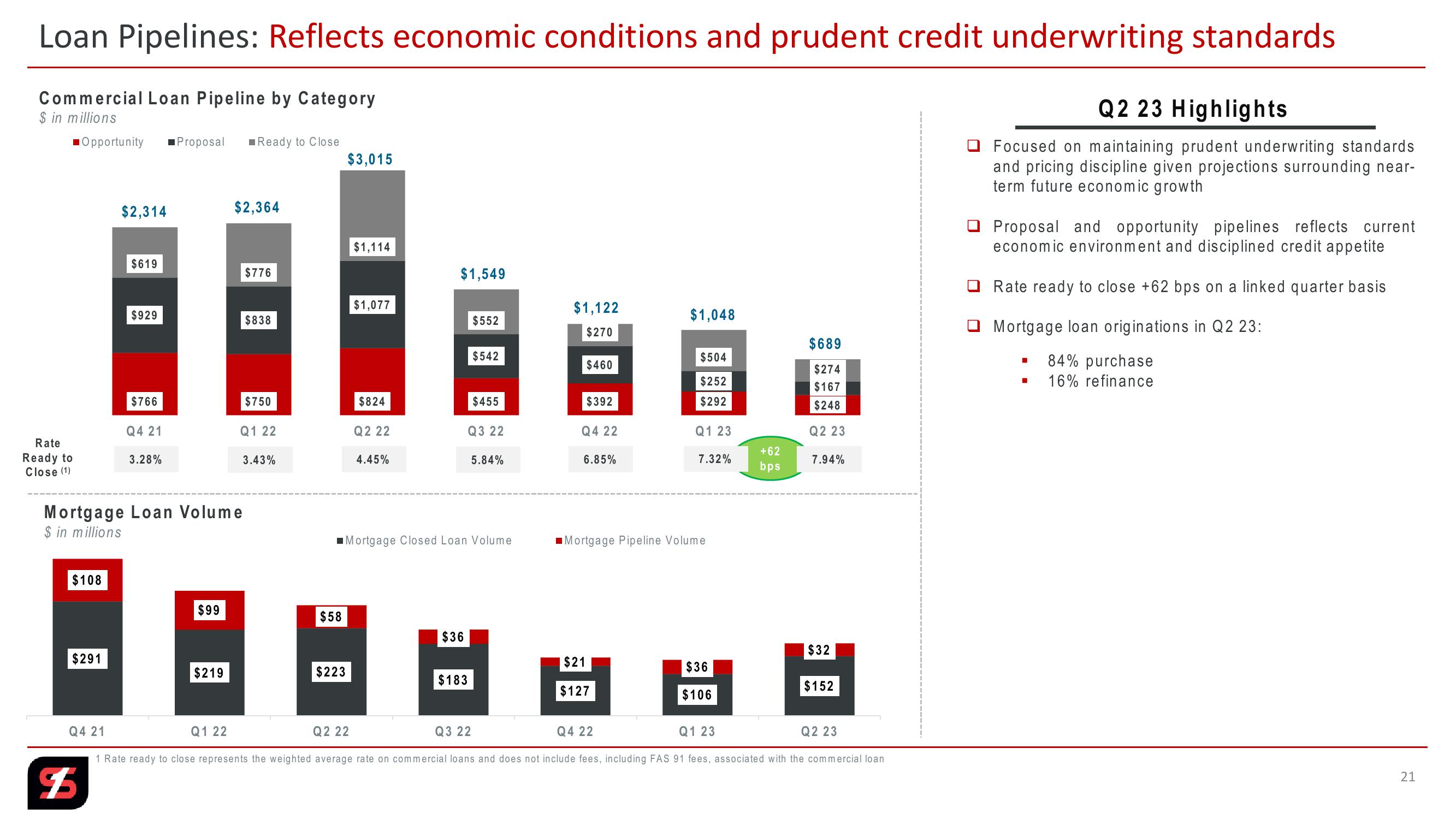

Loan Pipelines: Reflects economic conditions and prudent credit underwriting standards

Commercial Loan Pipeline by Category

$ in millions

■Opportunity ■Proposal Ready to Close

$3,015

Q2 23 Highlights

Focused on maintaining prudent underwriting standards

and pricing discipline given projections surrounding near-

term future economic growth

Proposal and opportunity pipelines reflects current

economic environment and disciplined credit appetite

Rate ready to close +62 bps on a linked quarter basis

Mortgage loan originations in Q2 23:

$2,314

$2,364

$1,114

$619

$776

$1,549

$1,077

$1,122

$929

$838

$552

$1,048

$270

$689

$542

$504

■

$460

$274

84% purchase

$252

16% refinance

$167

$766

$750

$824

$455

$392

$292

$248

Q4 21

Q1 22

Q2 22

Q3 22

Q4 22

Q1 23

Q2 23

Rate

+62

Ready to

3.28%

3.43%

4.45%

5.84%

6.85%

7.32%

7.94%

bps

Close (1)

Mortgage Loan Volume

$ in millions

$

■Mortgage Closed Loan Volume

■Mortgage Pipeline Volume

$108

$99

$58

$36

$32

$291

$21

$219

$223

$36

$183

$127

$152

$106

Q4 21

Q1 22

Q2 22

Q3 22

Q4 22

Q1 23

Q2 23

1 Rate ready to close represents the weighted average rate on commercial loans and does not include fees, including FAS 91 fees, associated with the commercial loan

21View entire presentation